US Real Estate Markets Top Global Investor Choices: AFIRE

New favorites are emerging as international buyers plan bigger allocations this year.

Illustration courtesy of Gerd Altmann via Pixabay

Investors globally remain keen on the U.S. commercial real estate market. Three in four plan to increase their volume of activity this year, and one in four expect to boost it significantly. Looking beyond 2022, eight in 10 investors expect to increase their U.S. exposure over the next three to five years.

Those are topline results of the annual investor survey conducted by the Association for Foreign Investment in Real Estate. AFIRE drew on input from its broad-based membership of some 175 organizations in 23 countries, representing $3 trillion in assets under management. CBRE and Holland Partner Group served as underwriters of the survey, conducted in February by AFIRE along with the PwC LLP research team.

“I’ve noticed that the most successful among us—both within and beyond the global real estate investment community—can acknowledge uncertainty and still feel out the way ahead,” Gunnar Branson, CEO of AFIRE, wrote in a letter prefacing the report. “They listen to others to find out what they’ve seen, and, through this, they avoid the pitfalls of assuming that something will work simply because that’s how things worked in the past.”

New Favorites

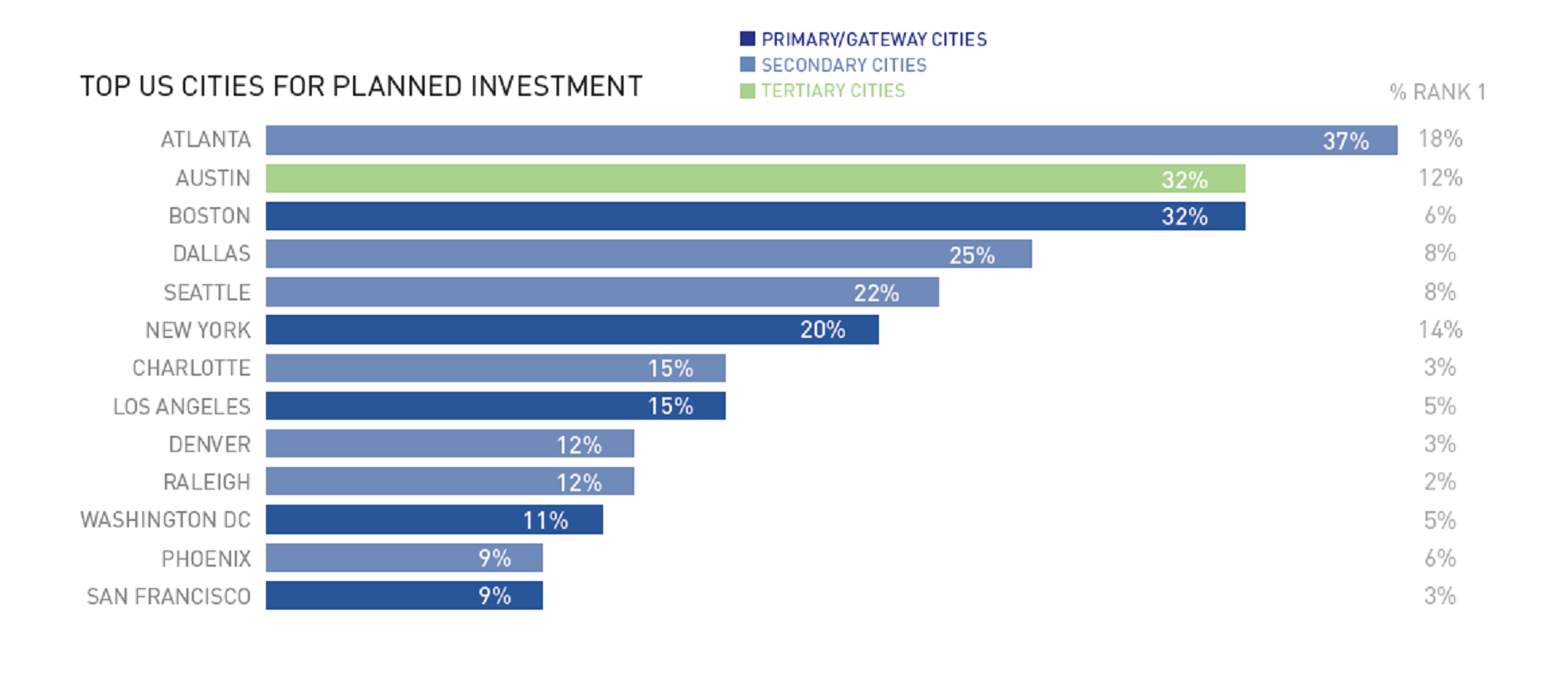

In a sign of changing strategies, the survey shows that tier-one markets like New York City and Los Angeles no longer consistently top institutional investors’ lists. Secondary and tertiary cities have risen to the highest point on investors’ radar. Atlanta, a secondary city, was the top U.S. choice among respondents, with 37 percent selecting the city; the tertiary market of Austin was selected by 32 percent, tying primary market Boston for the number-two spot.

Top U.S. cities for planned allocations by international investors. Chart courtesy of AFIRE.

In a telling result, U.S. markets also took eight of the top 10 spots among global markets. Austin took first place among investors, named by 28 percent, followed by Atlanta with 26 percent. Close behind in third and fourth place were Boston and Dallas, which each received 23 percent of the vote. Other U.S. markets in the top 10 were New York City, Dallas, Los Angeles and Denver. London and Berlin were the only non-U.S. markets to make the top 10.

Regarding asset categories, over the next three to five years, investors in U.S. real estate will continue to focus on first on multifamily, cited by 90 percent. However, the life science sector is high on the list as well, with 77 percent planning to increase their exposure. Almost as many respondents, 75 percent, intend to expand their exposure in the industrial sector. Not all sectors are in good favor with the investment community. Twenty-five percent of survey participants indicated that they plan to reduce their participation in the office sector over the next three to five years.

Lingering Effects

While investors’ outlook for the U.S. market remains on its years-long optimistic track, it is different from past forecasts due to the long arm of the pandemic.

“Eighty-one percent of the respondents believe that the pandemic has permanently altered culture and live-work preferences,” Branson told Commercial Property Executive. “There has been a lot of discussion over the last two years about the potential impact of changes in how and where we work thanks to the pandemic.

“Some are predicting a return to normal, others the complete transformation of the CBD. There’s no way to know at this point if either extreme will be true; however, with a clear majority accepting ‘permanent’ change, it is clear that investors aren’t expecting a ‘return to normal.’ Their investment focus on secondary markets, on alternative asset classes, and on waiting to see what happens in office is a change from years past.”

The global survey saw a sizeable year-over-year jump in investors’ sentiment toward ESG criteria, with 81 percent of respondents indicating that the standards would be very important over the next five years, compared to 69 percent in the 2021 survey. Of the ESG priorities, 90 percent of participants placed the highest value on carbon footprint reduction measures, with 89 percent citing actionable climate change strategies as a top priority.

“A new question this year was whether they would be willing to accept a lower rate return if the investment had a beneficial impact on the society or environment. Fifty-five percent said yes,” Branson told CPE. “The global institutional investor community is very serious about ESG, especially Europe.”

You must be logged in to post a comment.