USAA Completes $305M Acquisition of FCC Headquarters

The deal marks the largest single-asset office sale in Washington, D.C., this year.

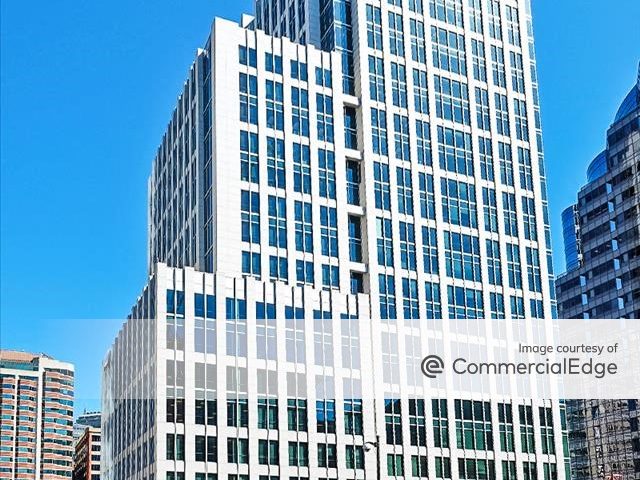

USAA Real Estate has closed on the year’s largest single-asset office transaction in Washington, D.C., CommercialEdge data shows. Acting through an affiliate, the global investor paid $305 million to MetLife Real Estate Investment for the Federal Communications Commission’s new headquarters, in D.C.’s NoMa submarket.

New York Life Real Estate Investors provided acquisition financing for USAA. The building became subject to a nine-year, fixed-rate loan in the amount of $188.4 million. Brokers from Cushman & Wakefield’s D.C. Capital Markets team arranged the sale and financing.

Sentinel Square III offers 540,000 square feet of Class A office space and is part of a 1.3 million-square-foot project developed by Trammell Crow Co. and its partners between 2010 and 2019. The FCC agreed to prelease 473,000 square feet at the mid-rise tower back in 2017, when it was still under construction.

That same month, Trammell Crow Co., Cottonwood Partners and an affiliate of Crow Holdings Capital Real Estate closed the sale of Sentinel Square III to a joint venture formed of institutional investors advised and managed by MetLife Investment Management. The FCC moved into the building in October 2020. In 2019, the government agency had 1,454 federal employees.

Sentinel Square III sits on a 1.5-acre lot at 45 N.E. L St., the last phase of the three-building development. According to the developer, the 11-story building’s design was modified to suit the FCC’s needs. The ground floor features nearly 12-foot-high ceilings for its hearing and conference rooms. Workers also have access to common amenity areas, a penthouse and three levels of underground parking, which offer a ratio of 0.6 spaces per 1,000 square feet. The building was designed to meet LEED Silver certification. Clark Construction Group was the general contractor and SmithGroupJJR provided architectural services.

The Sentinel Square development comprises three buildings bounded by L, K and First streets. Its location facilitates access to Union Station, amenities along the H Street Corridor, Chinatown and downtown Washington, D.C., via public transit or major thoroughfares.

USAA Real Estate currently owns more than 5.3 million square feet of office space in the Washington, D.C., and suburban Maryland market. The acquisition comes on the heels of last year’s restructuring, in which the real estate arm of USAA bought back a controlling interest.

Substantial price tag

At roughly $565 per square foot, the sale of Sentinel Square III represents one of the priciest office deals recorded this year, CommercialEdge data shows. It is also the largest single-asset sale recorded this year in the market, exceeding Boyd Watterson Asset Management’s $201.8 million acquisition of an office building from ASB Real Estate Investments back in April.

Office investment activity in Washington, D.C., was slower this year, generating $2.7 billion through November, according to CommercialEdge. Sales volume decreased by 16.9 percent year-over-year, with prices also dropping. The average per-square-foot rate reached $286 in November, 8.3 percent lower than last year’s $312 average.

You must be logged in to post a comment.