Vacancy Drives Industrial Pricing Surge

Bolstered by a broader economic recovery in 2021, rents and sale prices will continue to grow, particularly in supply-constrained coastal markets, the latest CommercialEdge report indicates.

The industrial real estate sector continues to shine, CommercialEdge’s March industrial report shows, with low vacancy affecting a surge in both rents and sales prices. The average industrial vacancy nationwide in February was 6.1 percent. Vacancy is likely to compress further, driven in part by the explosive growth of e-commerce but also as a part of a wider economic recovery.

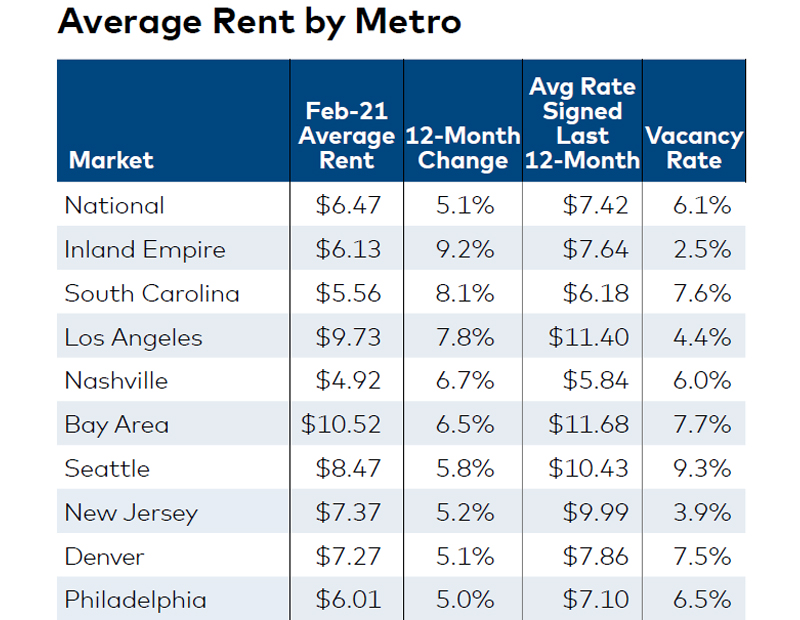

Nationally, industrial rents hit $6.47 per square foot in February, up 5.1 percent year-over-year. New leases signed during this timeframe commanded a 14.7 percent premium, averaging $7.42 per square foot. The strongest rent growth occurred in markets with substantial port activity: The Inland Empire led the nation with 9.2 percent year-over-year growth, followed closely by South Carolina (8.1 percent) and Los Angeles (7.8 percent). Rent increases were milder in the Midwest, with growth ranging between 0.3 percent in St. Louis to 3.1 percent in Chicago.

In January and February, industrial transaction volume hit $4.7 billion, with sales averaging $112 per square foot, a 10 percent increase from the fourth quarter of 2020. Pricing increases are expected to persist, given the lack of availability for new development in high-demand markets.

New supply is on the way, however. Nearly 350 million square feet of industrial projects was under construction at the end of February, with deliveries expected to reach upward of 250 million square feet annually through 2025. That said, development has been focused within inland markets with an abundance of available land. Denver, for example, had 12.7 million square feet underway, accounting for 6.7 percent of completed inventory. On the opposite end of the spectrum, many coastal markets with high demand face significant supply constraints: Los Angeles had 5.7 million square feet under construction, or 0.9 percent of completed inventory, and New Jersey’s 8 million-square-foot pipeline accounted for only 1.7 percent of stock.

Read the full CommercialEdge report.

You must be logged in to post a comment.