Vaccine to Trigger Q3 CRE Recovery: Report

With an economic turnaround expected to begin around mid-2021, commercial real estate should enter recovery too, but some sectors will look quite different.

Most of the country’s industrial markets will be in a recovery or expansion mode this year, while only a handful of metros will see their office markets expand, according to Integra Realty Resources’ Viewpoint 2021 publication.

But until the reset of the economy—expected to occur at the midyear point—the firm remains cautiously optimistic about the overall state of commercial real estate.

READ ALSO: Net Lease Cap Rates Close 2020 at Record Lows

“Overall, we’re still waiting to see the full fallout from the pandemic across the commercial real estate sector,” Anthony Graziano, CEO of Integra Realty Resources, told Commercial Property Executive. “As my late partner Michael Cannon used to say, ‘The market goes where the money flows.’ Transaction volume was way down last year, so we haven’t really seen the pricing adjustments that are yet to occur. But with the vaccine rollout continuing and everyone getting back to the physical office, hopefully by the third quarter, the outlook looks promising for the latter part of the year.”

Office transitioning

In the roughly 5 billion-square-foot U.S. office sector, fourth-quarter 2020 market conditions yielded two notable findings, one of which was the flight to quality as opposed to a flight-to-cost advantage across regions and asset classes. The second significant conclusion was the movement of the investment community to the sidelines, which rendered it nearly impossible to glean data on asset pricing from the limited transaction activity. In terms of office occupancy levels, no market has gone unscathed, although the East and West regions have proven more successful, with average CBD occupancy rates remaining below the national average of 16.46 percent. The South however, suffered the greatest increases, with Class A assets recording a year-over-year vacancy rate increase of 396 basis points and Class B properties experiencing a 544 basis-point jump year-over-year.

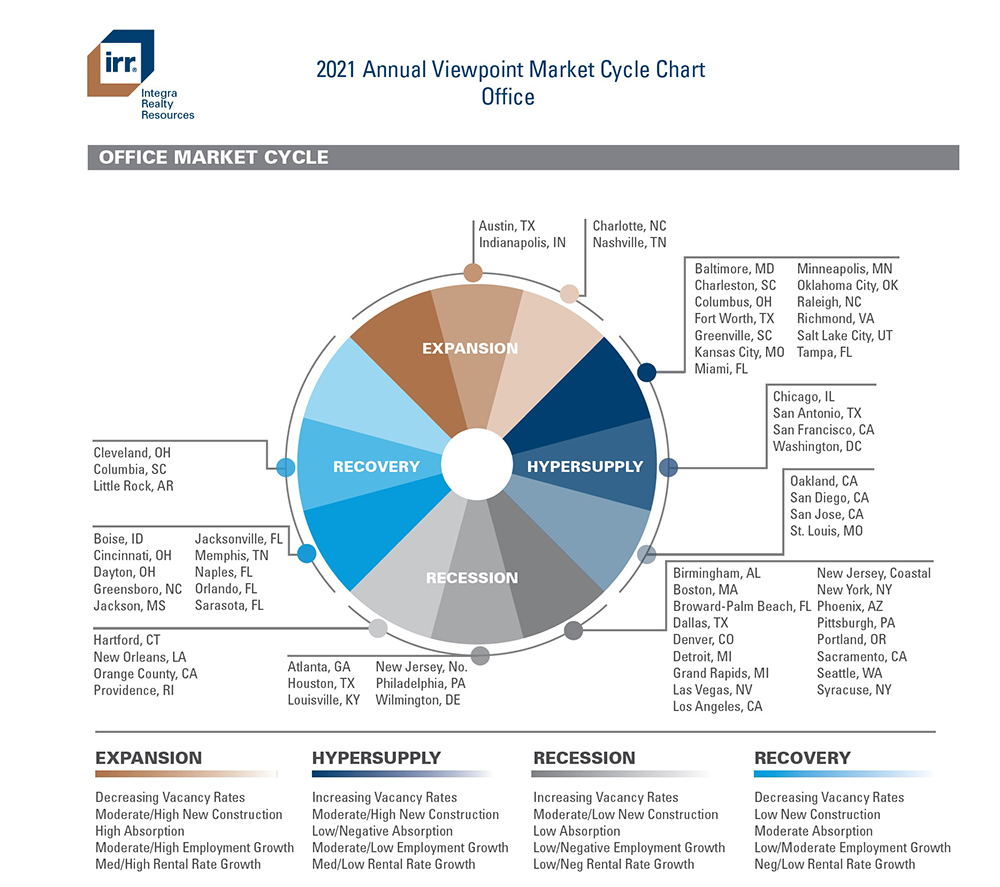

Looking at IRR’s Office Cycle Chart for 2021, the upper-left quadrant of the pie—where strong markets with good immediate prospects are represented—is blank. Austin, Charlotte, N.C., Indianapolis and Nashville, Tenn., are the only markets in the desirable “expansion” category, while a whopping 27 markets are relegated to the “recession” category, with an additional 21 markets destined for near-term deterioration in the “hypersupply” category.

The office sector will have to evolve to survive, according to IRR, changing its physical, operational and financial aspects instead of returning to the formal norm. Offices will be reconfigured to accommodate the requisite 6-foot spacing between workstations for social distancing. Operationally, some companies will choose to keep employees working remotely or on a hybrid schedule, while others will determine that in-office work is more productive. “Once the recovery accelerates in the latter part of 2021, we’ll also see a flight to quality with newer, Class A space recovering faster as we’ve seen in the past. Class C or less well-located B-class offices will likely be conversion or redevelopment candidates due to the long wait times and higher cost of renovation necessary to make these properties competitive in markets with weaker demand,” Graziano said.

Industrial on top

In the industrial sector, the pandemic shed light on the importance of reevaluating supply chain management, as businesses saw the need to enhance “just-in-time” strategies designed to minimize costs, with “just-in-case” measures. More focus has to be placed on inventory along the entire chain—including finished goods in warehouse, inventory in transit, inventory covered by preorders and last-mile accommodations.

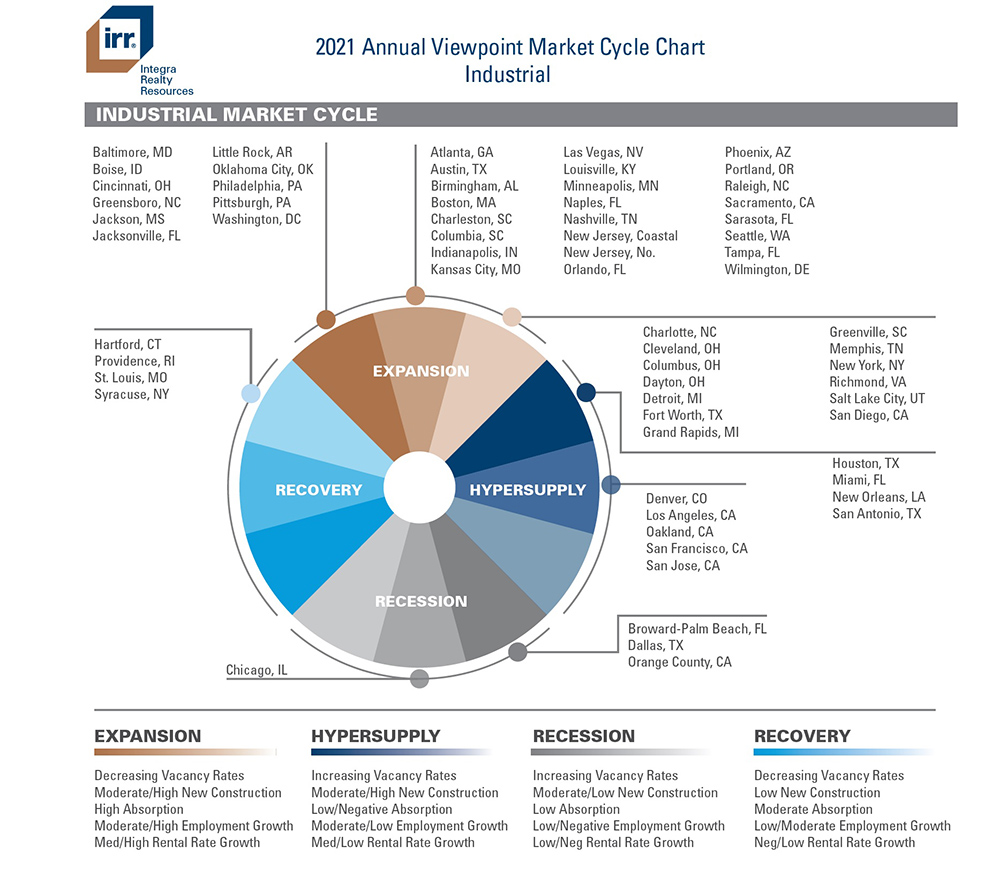

IRR’s Industrial Cycle Chart for 2021 places 90 percent of industrial markets in recovery or expansion. Only four markets—Chicago, Broward/Palm Beach, Fla., Dallas and Orange County, Calif.—are in recession. Still, investors were not highly acquisitive in 2020, plagued by the wait-and-see approach commonly taken in times of economic uncertainty. But the tide is expected to turn in 2021 due to the sector’s solid performance last year and high hopes of economic improvement going forward. “The unprecedented growth we’re seeing in the e-commerce sector has been propping up the industrial real estate sector throughout this pandemic. Industrial assets—especially those that are more modern and well-located nearby major population centers or distribution hubs—are in high demand and will certainly continue to see an uptick in values and transactions this year,” noted Graziano.

Retail rearrangements

Retail continues to be a tale of two sectors, with essential retail thriving and nonessential retail struggling. “It’s going to be a challenging year ahead for the retail real estate sector, which will perhaps see the most dramatic changes of all the sectors,” Graziano said. “Department stores and marginal centers are closing at a faster rate than anticipated. Regional malls face the most significant challenges, with dozens of high-profile, historically safe anchor tenants filing for bankruptcy. We’ll see more bankruptcies or trades at steep discounts in 2021 and beyond. Recent trends in the past decade to convert retail to entertainment destinations face steep challenges ahead as we work through movie theatre closures and changes in entertainment consumption.”

Presently, more than half of the retail markets in the U.S. fall into the recession category. After the pandemic, it is unclear what consumer habits will look like; if shoppers will return to the stores or if the mass adoption of e-commerce will remain the norm. However, IRR does expect consumer behavior to restore some of the market share to physical retail properties.

Light at the end of the tunnel

Overall, with vaccines now a reality, the road is being paved for an eventual economic recovery and a CRE rebound. “The economic reset will still be painful, but the prospect of stemming the tide with a return to stability for most sectors within the year is now a realistic possibility,” Graziano concluded. “Much of the consumer and economic confidence we are currently experiencing is tied to expectations of continued fiscal stimulus and accommodative monetary policy. This, coupled with rising local and municipal costs, will exact a toll on the economy for years to come. For now, let’s rejoice that we’re climbing out of the hole and not just continuing to dig deeper.”

Read the full report by Integra Realty Resources.

You must be logged in to post a comment.