Venture One Buys Chicago-Area Industrial Portfolio

Lake Forest Bank & Trust provided $30.4 million in acquisition financing.

VK Industrial VI LP, an acquisition fund managed by Venture One Real Estate and Kovitz Investment Group, has purchased a 785,181-square-foot, two-building industrial portfolio in St. Charles, Ill., for $50.2 million, according to public records. The buyer took out a $30.4 million acquisition loan from Lake Forest Bank & Trust.

Cushman & Wakefield represented the seller, identified by CommercialEdge information as RR Donnelley.

Last year, Venture One acquired a two-building portfolio in Waukegan, Ill., through the same industrial fund. These properties are some 40 miles from the newly acquired facilities.

The newest additions to Venture One’s portfolio

The 504,152-square-foot warehouse at 609 S. Kirk Road changed hands for $31.7 million. Constructed in 1988, the partially air-conditioned facility features 30-foot clear heights, 45 dock-high loading doors and three drive-in doors. The 24-acre property is less than 2 miles from DuPage Regional Airport and 44 miles from downtown Chicago.

The 281,029-square-foot building at 1750 Wallace Ave. sold for $18.5 million. The warehouse came online in 1990 featuring 15 dock loading doors, one drive-in door and clear heights ranging from 21 to 31 feet. Some 80,000 square feet are air-conditioned. The distribution center is 1 mile from the other facility.

Cushman & Wakefield Vice Chairs Mike Tenteris, Jim Carpenter and Adam Tyler, together with Executive Managing Director Scott Goldman and Executive Director David Friedland, negotiated on behalf of the seller. Carpenter was recently part of the team that brokered the transaction of three industrial parks in Phoenix and Silicon Valley.

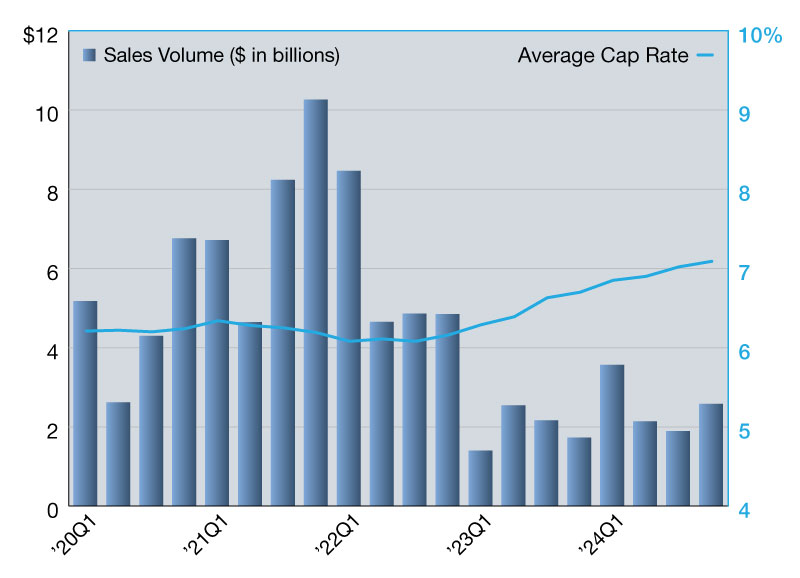

The Windy City’s mixed signals

Industrial sales in Chicago totaled $2 billion through the first eleven months of last year, the latest CommercialEdge industrial report shows. However, the $89 average price per square foot, while being 3.7 percent higher year-over-year, was also considerably lower than the $130 national average.

In one of these transactions, Hines acquired a 1.1 million-square-foot industrial campus in Melrose Park, Ill. AEW Capital Management sold the two-building asset.

You must be logged in to post a comment.