WeWork Leases 45% of Flex Office Space in Major Markets

A report from Savills and Workthere details the state of the sector in New York City, Los Angeles, Chicago and other key metros.

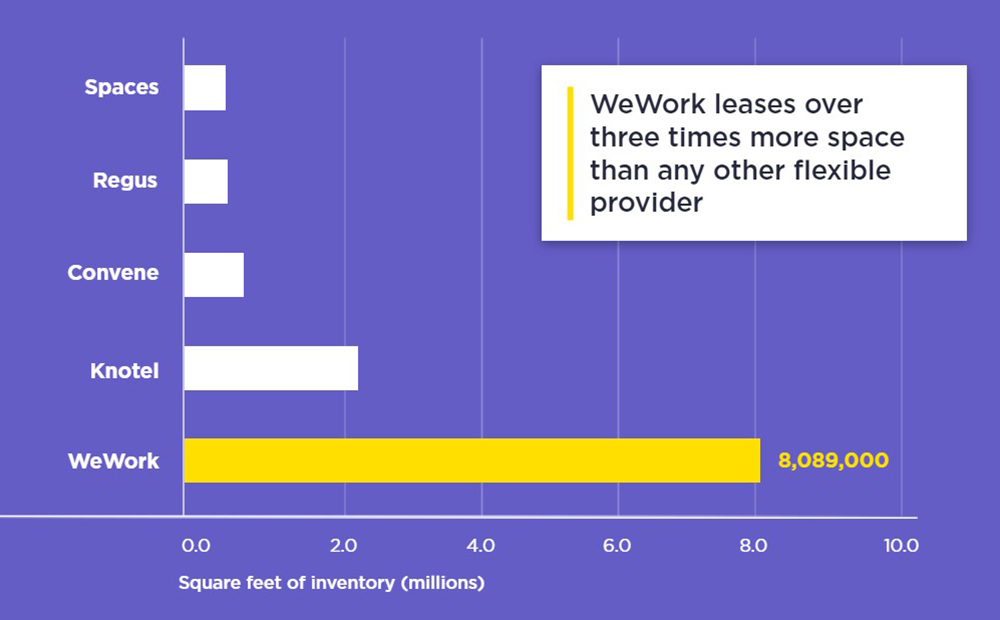

WeWork still dominates the flexible and shared office sector in major U.S. markets, including New York City, where it leases more than 8 million square feet—more than three times the space of any other flexible provider. Other flexible office providers are also growing in a sector that a new Savills and Workthere report says is “here to stay.”

“The Flex Machine,” an interactive report, highlights the state of the flexible office sector in eight markets—New York City, Los Angeles, Chicago, Houston, Atlanta, San Francisco, Washington, D.C., and Orange County, Calif. WeWork leased 45 percent of the flex space across those markets profiled, despite the company’s highly publicized stumbles of last year.

READ ALSO: Niche Operators Change the Face of US Coworking

“We haven’t seen any kind of shedding of space. WeWork is still the dominant player in all the markets we’re profiling,” Sarah Dreyer, vice president & head of Americas research at Savills, told Commercial Property Executive.

However, Dreyer noted that there was a drop in leasing between the second and third quarters of 2019. WeWork founder Adam Neumann resigned as CEO last September under pressure from shareholders of parent firm The We Co., after it had pulled its planned IPO a week earlier and delayed it indefinitely. While other flex office providers were leasing space during the fourth quarter, Dreyer said they were not taking blocks of space as large as WeWork had been, so “it doesn’t swing the numbers as much.”

Local player dominates Houston

Manhattan-based WeWork reigns supreme in the New York City and Los Angeles markets, leasing more than three times as much space as any competitor. The company’s 8.1 million-square-foot platform in the Big Apple forms part of a 14 million-square-foot flex office market—equating to roughly 3 percent of the overall office market.

Los Angeles had the second-largest WeWork presence, coming in at about 2 million square feet out of the market’s nearly 5 million square feet of flex office space, or 2.3 percent of the overall office market. Nearby Orange County, though, registered only 470,000 square feet of WeWork leases out of 1.6 million square feet of flex office space.

The company has a lower profile in Houston, where locally based provider Workstyle accounts for the largest market share. The brand launched in 2013 by Boxer Property has more than 1 million square feet leased out of a total of roughly 3 million square feet across the market.

WeWork leases only 245,000 square feet of space in Houston, according to Savills. IWG-owned serviced office brand Regus had 868,000 square feet of space leased in the Texas city.

Other rivals including IWG brand Spaces, Knotel, Industrious and Convene have seen strong growth. Dreyer noted that these and other operators will be moving ahead with their expansion plans, albeit with smaller footprints than WeWork. She also expects to see more local providers and more building owners offering their own flexible space platforms, continuing a rising trend.

Flexible office space will continue to expand because it’s “part of the corporate real estate strategy now,” Dreyer said.

You must be logged in to post a comment.