WeWork Taps Brookfield’s Mathrani as CEO

The veteran retail executive and former GGP leader will step into his new role on Feb. 18.

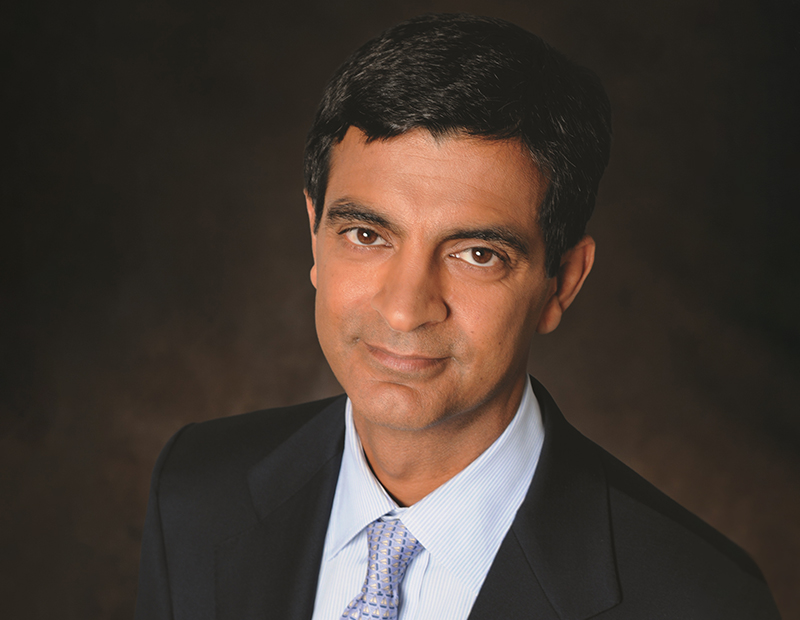

WeWork is turning to one of retail real estate’s top executives as its next CEO. The shared-space provider confirmed on Sunday that Sandeep Mathrani, who most recently headed Brookfield Properties’ retail division, will join WeWork on Feb. 18.

In a statement announcing the appointment, WeWork’s executive chairman, Marcelo Claure, cited Mathrani’s extensive turnaround experience. He was instrumental in the revival of General Growth Properties. Part of the group that recapitalized GGP in 2010, he served as CEO from January 2011 to August 2018 and led the company out of the largest bankruptcy in the history of the real estate industry.

In 2018, Mathrani’s stewardship culminated in GGP’s $15 billion acquisition by Brookfield Properties. By 2019, occupancy at the portfolio had reached 96 percent during a challenging time for retail owners. Mathrani’s accomplishments earned him recognition as CPE’s 2019 Retail Executive of the Year. The award is voted by the CPE 100, an invited group of industry leaders.

Speculation about Mathrani’s next move began swirling in early January, when his imminent departure was reported by the Commercial Observer.

Before joining GGP in 2010, Mathrani was president of Vornado Realty Trust’s retail division and oversaw the REIT’s office portfolio in India. That followed nearly a decade at Forest City Ratner, where he oversaw the company’s retail expansion in New York City.

The statement announcing the appointment detailed steps taken by WeWork since the departure in September of CEO & co-founder Adam Neumann in the wake of a scuttled IPO. Neumann’s successors as co-CEOs were Artie Minson, previously WeWork’s president & COO, and Sebastian Gunningham, who had been the firm’s vice chairman.

Those steps include the development of a five-year strategic plan for growth and transformation; a five year financial plan that targets profitability on an adjusted EBITDA basis by 2021 and a positive free cash flow the following year; a solid liquidity position; and structural changes to its operating model and organizational changes intended to ensure execution and accountability.

You must be logged in to post a comment.