What Opportunity Funds Do When There Is No Distress

With troubled real estate in short supply, what’s an opportunistic investor to do?

Anticipated widespread distress has yet to materialize as plentiful capital, real estate equity markets and measures to forestall foreclosures have created a healthier-than-expected market.

More than a year ago, opportunistic investors started assembling funds to take advantage what they anticipated would be widespread distress as a result of the pandemic and forced lockdowns that have affected office, hospitality and retail properties. But to a large degree, those expectations remain unfulfilled as a confluence of factors have helped prop up commercial real estate asking prices.

“If you look at both debt and equity-oriented strategies here in the U.S. and around the world, there is a significant amount of dry powder sitting in opportunistic-style funds,” said Tim Bodner, a partner with PwC and leader of its real estate deals practice. “But it’s apparent that the level of distressed opportunities is far lower than what most people thought would be the case.”

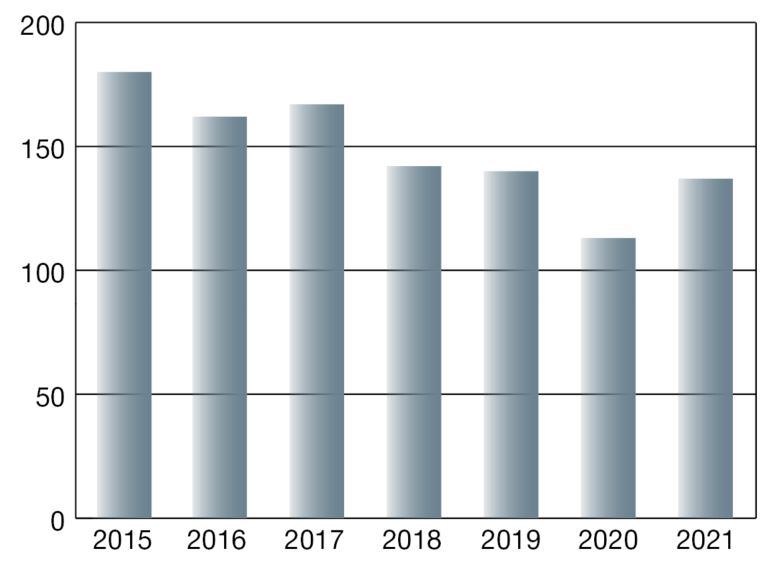

A record 565 comingled real estate funds were actively fundraising early this year seeking $490 billion, according to an annual review by Real Estate Alert, a Green Street publication. Of that total, 137 opportunity funds were seeking $162 billion, Real Estate Alert noted, up from 113 funds that raised $114 billion in 2020. The publication also estimated that funds across all strategies had uninvested equity totaling a 10-year high of $242 billion.

Real estate values in general have rebounded strongly over the last several months as many lenders have worked with borrowers to try and outlast consequences of the pandemic and lockdowns. NAREIT’s index of equity REITs had generated a total year-to-date return of 23.4 percent as of early July. That bested the S&P 500 index, which has hit numerous all-time highs this year, by nearly 7 percentage points over the same period.

“We’re at a strange point where deals weren’t happening at all because of Covid, and then it started to loosen up, and now I think we’re seeing more transactions today,” said Terri Adler, chair of the real estate department for the Duval & Stachenfeld law firm in New York. “But we’re not seeing prices plunging or fire sales.”

Life science real estate developer IQHQ recently broke ground on Fenway Center, a $1 billion, 960,000-square-foot project in Boston that will feature 10,000 square feet of retail.

Evolving Market

Bodner and Adler are quick to note exceptions, especially in the retail and hospitality space, which have experienced bankruptcies and other struggles. Meanwhile, questions about what the future of work looks like and how it will impact space requirements continue to cloud office investment decisions.

Some distressed office transactions have occurred, such as the recent $120.5 million auction of the substantially vacant 400,000-square-foot 1350 Eye St. NW property in Washington, D.C., after an $182.5 million loan default. In June, 3 percent of office properties backed by commercial mortgage-backed securities had entered special servicing, up 30 basis points over the last six months, according to Trepp.

While the water may appear largely calm at the moment, “episodic” stress is beginning to ripple across the property markets as lenders look to resolve troubled loans, said Douglas Weill, managing partner of Hodes & Weill, a global capital advisory firm based in New York.

“We are starting to hear about some interesting opportunities from investment managers that may be coming to the surface,” he said. “I think there’s a debt-driven strategy where assets were in the middle of development or repositioning when the shutdowns hit. It’s those assets that are now being forced to the market for recapitalization.”

Bridging the Gap

Indeed, Columbia Pacific Advisors, an alternative investment manager based in Seattle, recently launched a real estate recovery fund that is making opportunistic bridge loans to owners who are trying to stabilize or reposition properties that have seen values deteriorate.

The sponsor so far has raised some $120 million, said Billy Meyer, managing director of real estate lending for Columbia Pacific. Typically, it makes loans of more than $10 million, and it anticipates generating an internal rate of return-driven yield of 18 percent to 20 percent.

The fund targets all property types, but in particular it has set its sights on office properties, he said. It recently made a bridge loan to an office asset in Northern New Jersey and is considering similar financings for two other office buildings in Newark and Seattle. The strategy largely centers on identifying superior assets in markets and ensuring that the submarket fundamentals, sponsor and business plan are all geared toward growth, he added.

“We’re seeing a lot of demand for these loans where office owners need a bridge to stabilization,” he said. “They may be close to signing new tenants or the asset may be in a location where they’re very confident that they’ll be able to sign new leases.”

NexPoint Strategic Opportunities Fund, an investor in IQHQ, is working with IQHQ executive Alan Gold to identify additional life science opportunities, particularly sale-leasebacks of manufacturing facilities.

Suburban Thinking

Opportunistic investor BH Properties is also focused on office properties, specifically acquiring smaller, low-rise suburban assets, said Andrew Van Tuyle, senior managing director of investments for the Los Angeles-based firm. Companies are demanding such settings because they can occupy the assets alone or with a minimal number of co-tenants, which limits exposure to others in common areas and elevators, he explained.

“We’ve started to see a little bit of that as companies look for ways to make their employees feel comfortable coming back to work,” Van Tuyle said. “We think we’re going to see a lot more as lease terms expire over the next 18 months to four years.”

To position itself for the trend, BH Properties recently purchased the half-empty Freeway Corporate Park, a two-building, 128,266-square-foot office property in Santa Ana, Calif. The $21 million purchase price represented a $3 million discount to what seller TA Realty paid for the building in 2015, according CommercialEdge data.

Betting on Life Science

NexPoint Real Estate Advisors, an alternative investment manager based in Dallas, is taking a more cautious approach to office properties. Instead, it has been building up a portfolio of single-family residential, apartments and self storage assets, and it has begun to more aggressively pursue life-science research and manufacturing facilities, said Brian Mitts, chief financial officer of the NexPoint.

NexPoint currently owns about 1.8 million shares of life sciences real estate developer IQHQ in its $800 million closed-end NexPoint Strategic Opportunities Fund, which is in the process of converting to a publicly traded REIT. But NexPoint is also working with IQHQ executive and medical property veteran Alan Gold to identify additional life science opportunities, Mitts said. The goal is to build a life science investment platform similar to its $1.1 billion NexPoint Storage Partners business, he added.

Given the fact that Covid-19 exposed the lack of domestic pharmaceutical production in the U.S., the partnership is seeking life-science manufacturing sale lease-back opportunities in particular amid a growing emphasis on onshoring versus offshoring, Mitts explained.

“A lot of these companies don’t want to own or be responsible for real estate,” he added. “They just want to free up cash so that they can manufacture their drug. There’s a value differential of maybe 10 percent to 20 percent between what we buy it for and what the deal will be worth on a 20-year lease plus options to extend and rent escalators.”

You must be logged in to post a comment.