What’s Driving the Manufacturing Revival?

A handful of high-tech industries are behind the growth, particularly in the Midwest and Sun Belt, the latest Savills report finds.

The manufacturing resurgence in the U.S. over about the past three years is perhaps remarkable for its diversity. It arises from multiple causes and is strongest in multiple states across the nation, according to a new manufacturing report from Savills.

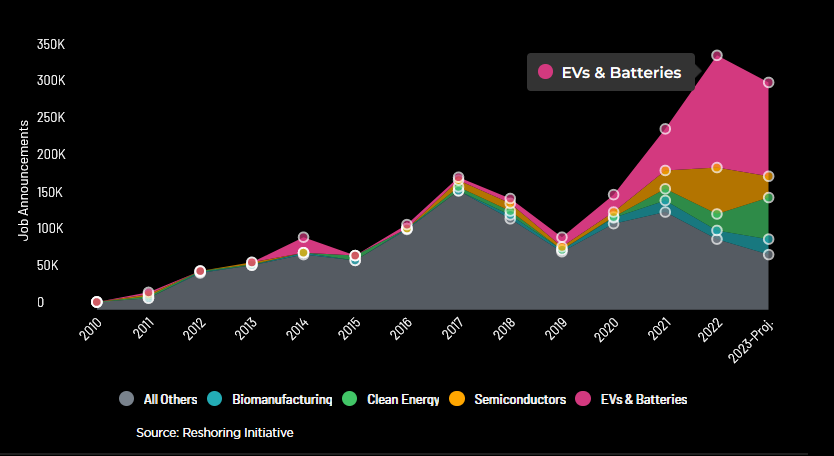

It also rests on a diverse handful of high-tech industries that have generated two-thirds of new manufacturing jobs, primarily electric vehicles and their batteries, semiconductors, clean energy and biomanufacturing.

This inaugural report tallies some powerful numbers from America’s manufacturing expansion. For example, between January 2021 and October 2023, in excess of 845,000 new manufacturing jobs were announced, which was more than double the figure from the preceding three years. Just eight states in the Midwest and Sun Belt created nearly half (47 percent) of new manufacturing jobs: Arizona, Georgia, Michigan, North Carolina, Tennessee, Ohio, South Carolina and Texas.

U.S. manufacturing job announcements by industry vertical. Chart courtesy of Savills Research & Data Services

Twenty hot metros in those eight states account for more than 6.0 billion square feet of industrial property, or about 37 percent of the nation’s inventory. And there’s an additional 282 million square feet currently under development.

That’s a snapshot of the “how much” and the “where.” The “why” consists of diverse factors that include transportation and other infrastructure, pools of skilled labor, public incentives and adequate availability of land.

READ ALSO: EV Boom Reshapes US Industrial Landscape

To zero in on one factor that Savills highlights, the report states: “This revival is propelled by a significant injection of public incentives, including federal allocations from the Inflation Reduction Act, the CHIPS and Science Act and the Bipartisan Infrastructure Law, which supported $628 billion in capital investments in manufacturing since the start of 2021.”

Data dashboards

The report includes interactive dashboards with data and commentary on the drivers of site selection in each of the eight leading states, exploring what specifically is attracting manufacturers. In Arizona, for example, the availability of land and skilled labor have overcome concerns about water supplies to pull in more than $20 billion in commitments from semiconductor makers like Intel and Taiwan Semiconductor.

In Georgia, there’s a very different story. Driven by reshoring initiatives and foreign direct investment that have created nearly 60,000 new jobs, the state is seeing oversize projects in the electric vehicle and battery sectors. Extensive transportation infrastructure, including rail systems and ports, has also been important in the Peach State.

You must be logged in to post a comment.