What’s Hampering Retail Leasing?

The latest report from JLL identifies the main factor that's slowing activity today.

Despite e-commerce, and despite COVID, the ongoing revival of the retail real estate sector has continued, to an extent where retail sales have risen for six straight months, and it’s a limited supply of space in desirable locations—not a lack of demand—that’s constraining retail leasing.

Overall, net retail absorption was down roughly 10 percent in the third quarter.

Meanwhile, multichannel retailing remains strong. About 57 percent of U.S. holiday shoppers expect to avail themselves of two or more channels.

These are some of the observations in the new U.S. Retail Outlook Q3 2023, from JLL. The report also delves into significant shifts among tenants and owners.

READ ALSO: Emerging Trends for CRE in 2024 and Beyond

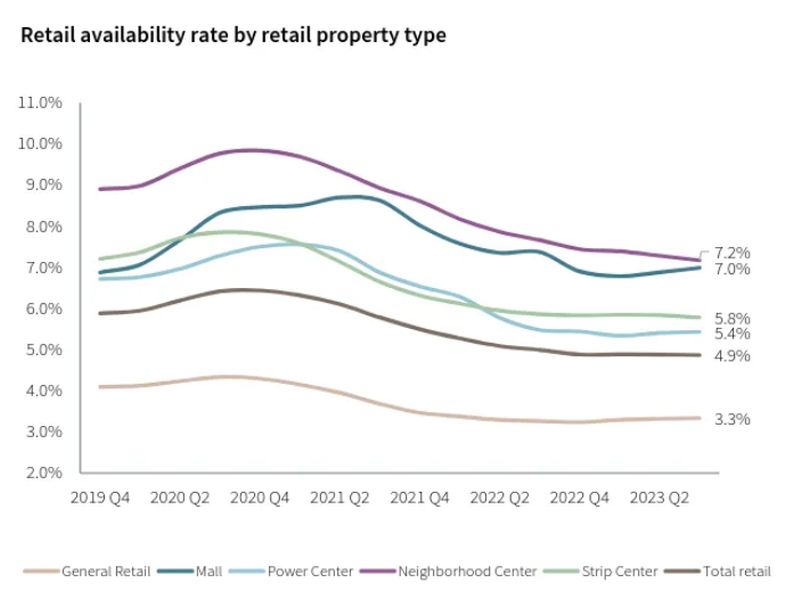

The lack of suitable space results from a dearth of new construction, alongside the demolition of about 145 million square feet of retail space over the past five years. At this point, JLL notes, “The availability rate is nearly 200 basis points below its historical average of 6.8 percent.”

Driven partly, but not entirely, by inflation, retail sales have grown by 3.8 percent year-over-year.

While the picture is improving, it’s rosier for some than for others. Food and beverage tenants, quick-service restaurants in particular, were responsible for nearly 20 percent of leasing over the past year, and fitness and experiential tenants continue to expand, especially in big-box spaces.

On the other side, JLL reports, “Some traditional mall tenants have announced plans to relocate some of their mall stores to open-air neighborhood and community centers with higher foot traffic.”

Mall vacancy is the worst it has been in 15 years. Class B and C malls have taken the hardest hits, but Class A malls have fared only a bit better.

And as has been amply reported, store closures by retailers from JCPenney (242 stores) to GNC (1,200 stores) have been a strain across the mall sector.

Seeking fresh air

In parallel to straight-up closures, several major chains that have traditionally preferred mall locations are shifting to open-air neighborhood and community centers.

Among these are Foot Locker (closing more than 400 mall locations and opening 300 off-mall locations), Bath & Body Works and Macy’s. The latter, according to JLL, “plans to open 30 smaller stores roughly one-fifth the size of its traditional stores in strip centers over the next two years. The convenience and higher traffic of these open-air centers boost store performance.”

Tenants that appear to favor malls currently include apparel and accessories stores, fitness tenants, health/medical tenants, and experiential tenants (the report singles out Round1 and Picklemall).

You must be logged in to post a comment.