What the GOP’s Border-Adjustment Tax Means for REITs

While its tough to say where the proposal is headed, lawmakers agree the taxing system for REITs could look very different in the future. Here’s a snapshot of REIT sectors that could feel an impact—adverse or beneficial—according to BDO's Matthew Becker, Tanya Thomas and Paul Heiselmann.

By Tanya Thomas, Paul Heiselmann and Matthew Becker, BDO USA

The House Republicans’ tax blueprint, A Better Way: Our Vision for a Confident America, contains a border-adjustment tax (BAT) proposal that would change the way corporations are taxed. While the plan would cut the corporate tax rate from 35 percent to 20 percent, it also suggests transforming the nation’s tax regime from a worldwide approach to a destination-basis tax system with border adjustments.

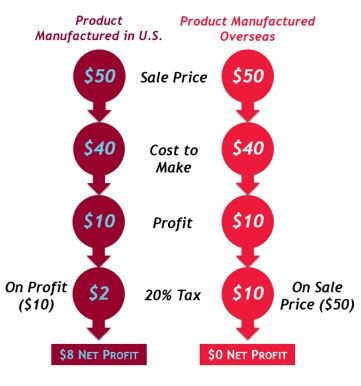

This means sales of imported goods would be fully taxable, while the sales of exported products would be exempt from tax. The costs of goods, services and intangibles purchased from foreign parties and sold to U.S. customers would not be deductible from taxable income, as they currently are.

The BAT’s enactment is far from certain. While it aims broadly to increase the economic viability of domestic production and exports, outcomes would be nuanced, as some products will remain better suited for production outside the U.S. Nonetheless, the plan is under close watch by many industries, and investors should be versed in the implications should it come to fruition. Here’s a snapshot of REIT sectors that could feel an impact—adverse or beneficial.

Retail

Losing the deduction for costs of imported goods could cause the tax of imported item sales to exceed the profit margin. With retail margins squeezed already, demand for retail space could go down over time, impacting rents and therefore retail REITs’ revenue. There are, however, mitigating factors that make the impact less straightforward. In the shorter term, retailers might embrace the “buy American” concept the BAT is designed to promote by changing suppliers or shifting to domestic production to ensure a tax deduction. Or they may raise selling prices to offset increased costs. Over the longer term, the proposal is designed to boost domestic manufacturing and assembly jobs, stimulating consumer spending and demand, which would partially or fully offset the impact.

Industrial

If enacted, the BAT proposal’s aim to stimulate demand for domestic goods would boost demand for industrial real estate. Factory, warehouse and distribution center properties, particularly those located around existing manufacturing hubs in the Midwest, South and Rust Belt, would be primed to benefit from increased production and warehousing activity over time. Seeking Alpha suggests coastal industrial warehouses could benefit less than those in other areas, as a decrease in import volume at ports could offset some or all the potential increased export volume.

Hospitality

Many expect the enactment of BAT would have a swift impact on exchange rates, strengthening the U.S. dollar. This would impact the purchasing power of other currencies and could slow international tourism in the U.S. Hotel occupancy could dip as a result, impacting hotels’ abilities to charge premium prices for in-demand rooms, which could, over time, trouble hotel REITs.

Agriculture and Farmland

Tax-free exports of row crops like soybeans and corn would enable agricultural companies to sell those staples at lower prices, making them more attractive in foreign markets. After several years of bumper crops, row crop farmers have been struggling to maintain profitability, according to Seeking Alpha. Farmland leases tend to be shorter, so REITs in this sector could see a more immediate jump in performance if the BAT is enacted.

The Future for BAT and REITs

No matter the sector, the question remains of whether the BAT would violate the World Trade Organization’s (WTO) non-discrimination rules on equal treatment of imported and domestic goods. Without the actual wording of the proposed legislation to review, it is impossible to say at this point whether the BAT is WTO-consistent. Broadly speaking, WTO rules permit border adjustments on indirect, consumption-based taxes (i.e., customs duties or VAT) but not on direct, income-based taxes. The treatment of taxes that fall somewhere in the middle is less clear.

While it’s tough to say where this proposal is headed, there has been—and there’s sure to be more—discussion and debate around the future of tax reform above and beyond the GOP’s initial proposal and what that might mean for the real estate industry. As tax reforms come into greater clarity and move from speculation to concrete legislation, lawmakers agree the taxing system for REITs could look very different in the future.

Tanya Thomas is a tax managing director with BDO, and may be reached at tthomas@bdo.com. Paul Heiselmann is the national managing partner of Specialized Tax Services with BDO, and may be reached at pheiselmann@bdo.com. Matthew Becker is a partner in BDO’s national Tax practice, and may be reached at mkbecker@bdo.com.

You must be logged in to post a comment.