What’s Driving CRE Securitization

An update on the key trends shaping conduits, CLOs and other strategies.

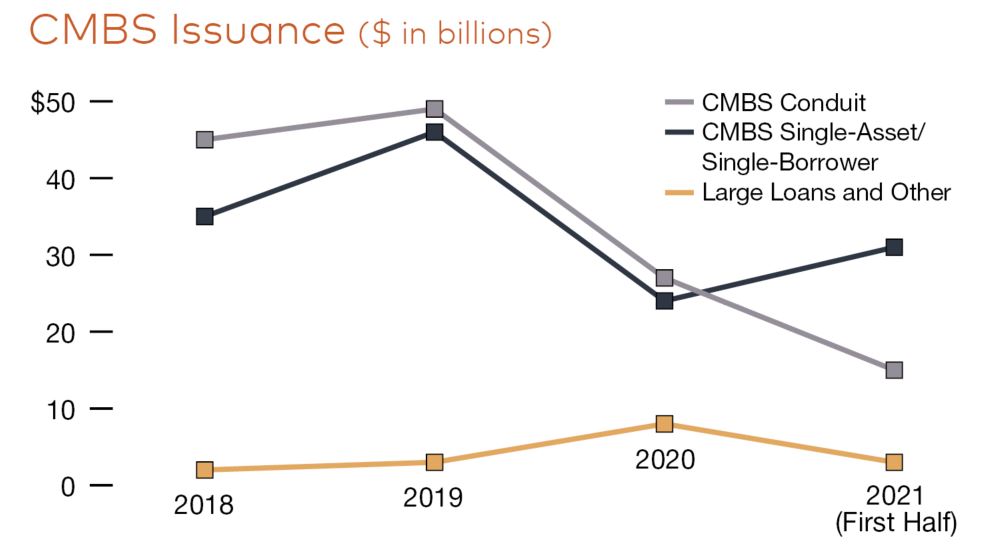

Despite the recovery, changing preferences among borrowers, lenders and bond buyers are reshaping commercial real estate securitizations. Commercial real estate collateral loan obligations and single-asset single-borrower securities are dominating securitization deals. Meanwhile, traditional conduit issuances, which typically include a wide variety of property types and have historically driven activity, are falling behind.

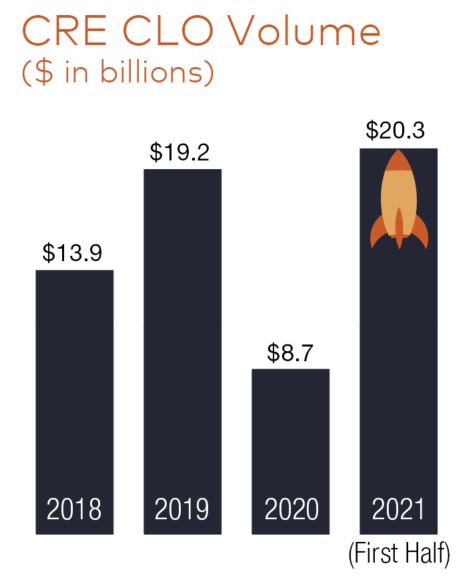

Private commercial property debt issuances totaled $69 billion in the first half of 2021, surpassing the amount issued in 2020 by $1 billion, according to the CRE Finance Council. But SASB and CLO deals accounted for $31 billion and $20 billion, respectively, while conduit and other CMBS issuances made up $18 billion, the organization noted.

To be sure, SASB issuances have been a growing slice of the market for the last few years, largely because they are collateralized by a single trophy property or a portfolio of high-quality assets favored by bond buyers.

But the increase in CLOs represents a new trend. Issuance increased to $19.2 billion in 2019 from $1 billion in 2012, according to CREFC. Panelists at a recent conference suggested that CRE CLO volume could total $35 billion this year and surpass that in 2022, reports Deryk Meherik, a senior vice president and manager in the structured finance group at Moody’s.

“We’re extremely busy this year—we’ve been engaged to rate more than double the amount of CRE CLO deals we did in 2019, which was a robust year in the post-financial crisis era,” he said. “It could be a growing sector for the foresBut the increase in CLOs represents a new trend. Issuance increased to $19.2 billion in 2019 from $1 billion in 2012, according to CREFC. Panelists at a recent conference suggested that CRE CLO volume could total $35 billion this year and surpass that in 2022, reported Deryk Meherik, a senior vice president & manager in the structured finance group at Moody’s.eeable future.”

Conduit challenges

Meanwhile, the drop in conduit CMBS dollar volume stems from the uncertainty over what’s in store for the asset categories that have historically made up the bulk of the securitizations—hospitality, retail and, to some degree, office assets. The CMBS delinquency rates have dropped about 10 percentage points in the lodging sector and 4 percentage points for retail properties over the last 12 months, but they still remain high at 12 percent and 10.4 percent, respectively, according to Trepp.

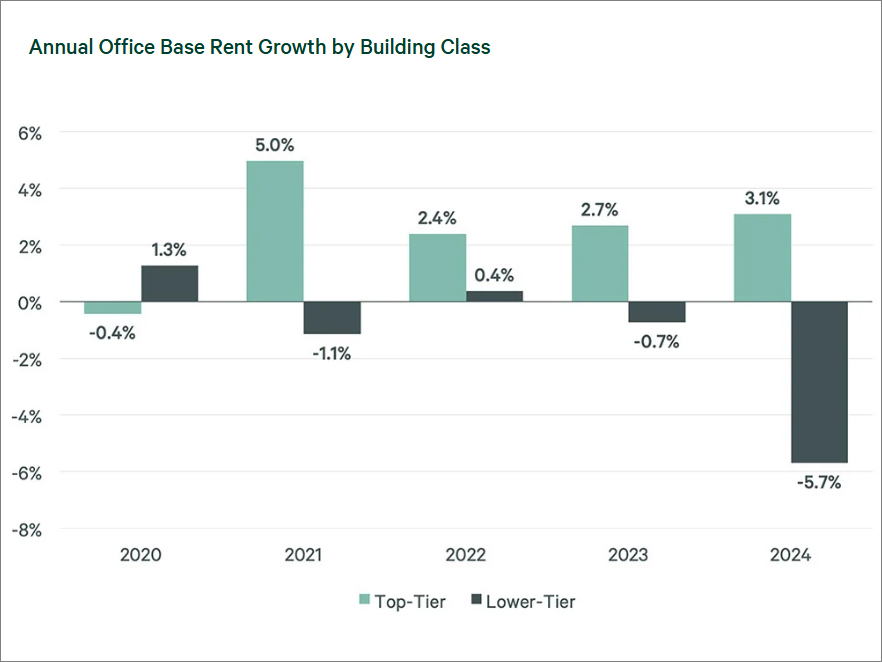

The office delinquency rate has seen some month-to-month volatility over that period but has been hovering around 2 percent. The office sector faces tail risk, however, given the likelihood that office users will slash space over the next several years, said Manus Clancy, senior managing director & leader of Trepp’s applied data, research and pricing department.

“Right now, financing is available for office assets, and valuations have held up,” he said. “The only immediate concerns are where there are tenants of size with near-term expirations.”

More broadly, CMBS financing is available for retail and lodging properties with strong locations and sponsorship, but those property categories are not appearing in conduit CMBS deals nearly to the extent that they were before COVID. “Two-thirds of the asset classes that make up conduits are on the sidelines,” said Michael Hurley, managing partner & co-chair of the CMBS practice at Cassin & Cassin law firm in New York City. “That leaves warehouses, multifamily and life sciences properties most in demand. But all the capital sources are chasing those—life insurance companies, banks and CLO, conduit and SASB lenders.”

Timely financing

CLOs are particularly suited for the pandemic era, according to Hurley. The securitizations are typically backed by short-term floating-rate loans that are funding property transitions such as repositioning, value-add and stabilization efforts. The health crisis and lockdowns have fueled some of those transitions, whether they are apartment upgrades to accommodate remote work or the conversion of retail space into offices or warehouses.

Flexibility is arguably the biggest benefit. The loans are primarily originated by nontraditional bridge lenders and debt funds, and they come with fewer regulations and restrictions than conventional CMBS or bank financing.

More important, the prospect of taking on debt for 10 years in this environment is often unappealing to borrowers, Clancy said. That’s especially true because conduit lenders have reduced proceeds as underwriting has tightened.

“A lot of borrowers don’t want to get locked into a 10-year loan that has an LTV of around 60 percent,” Clancy explained. As an alternative, those borrowers seek out a two- to three-year CLO loan with a plan to either sell it or wait to secure a 10-year loan with an LTV in the 75 percent range.

“If you don’t think interest rates are going to go up materially, it’s not a bad way to keep your options open,” Clancy said.

Rise of SASB

Multifamily properties dominate the CLO space, securing 47 percent of the roughly $50 billion in issuances, according to CREFC, and offices secure about 27 percent. On the other hand, offices back 33 percent of the $189 billion in outstanding SASB issuances, the most of any property type.

Unlike CLOs, which were a small part of the securitization market until this year, SASB deals have accounted for 30 to 40 percent of CMBS dollar volume since 2017. But this is the first year that SASB dollar volume has outpaced the conduit sector.

“SASB activity has really taken off,” said Robb Paltz, associate managing credit director at Moody’s. “In particular, we’ve seen large sponsors really like the SASB product and utilize it on very large transactions.”

In June, SL Green secured $3 billion fixed-rate financing for its One Vanderbilt tower in Midtown Manhattan. The 10-year loan, which retired construction debt, featured a 2.86 percent interest rate. That month, a Blackstone real estate fund secured $1.63 billion in SASB CMBS floating rate debt for a nine-state, 22.9 million-square-foot industrial portfolio.

Bond buyer demand for debt backed by quality assets has historically fueled tight pricing of SASB deals, Clancy said. But even conduit deals have generated strong demand despite the drop in issuance, added Blair Coulson, a vice president & senior credit officer for new CMBS ratings at Moody’s.

“There is no property type that is off limits in the market,” he said. “But it comes down to ensuring that the risk profile is at a point where there will be investor interest and that the loan structure can play a part in getting borrowers through the forecasted recovery.”

You must be logged in to post a comment.