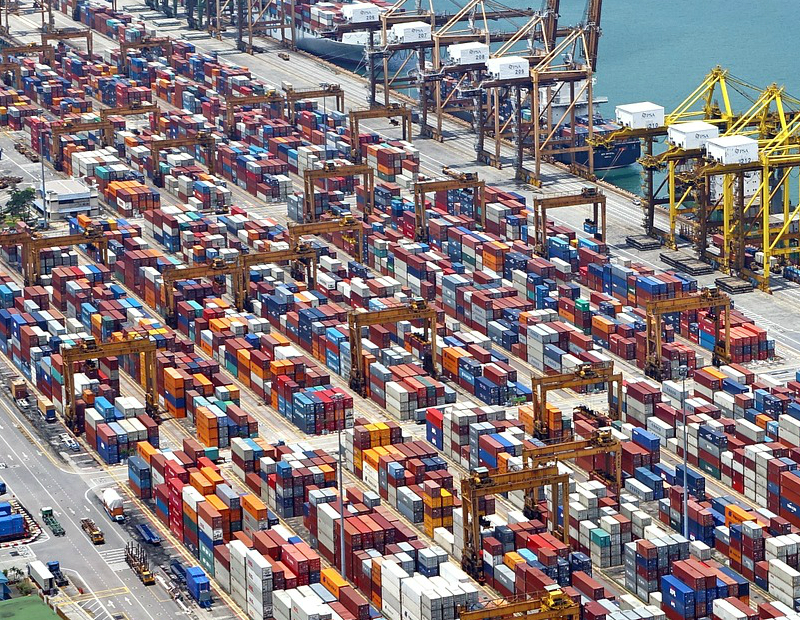

What’s Next for Logistics Property?

A new Prologis report examines how anticipated changes in the components of supply chain costs could impact the sector.

By Barbra Murray

Global logistics real estate company Prologis completes a three-part series on supply chains with the release of Innovation, Disruption and the Value of Time: The Next 10 Years in Logistics Real Estate. The paper explores the manner in which forecasted changes in the multiple levels of supply chain costs will affect the logistics/industrial real estate sector.

Global logistics real estate company Prologis completes a three-part series on supply chains with the release of Innovation, Disruption and the Value of Time: The Next 10 Years in Logistics Real Estate. The paper explores the manner in which forecasted changes in the multiple levels of supply chain costs will affect the logistics/industrial real estate sector.

As noted in the report, “The future of supply chains requires a focus on greater efficiency driven by technology.”

Expected changes in cost

Transportation is the leading cost in supply chains, and technologies such as alternative fuels and autonomous vehicles will play a role in mitigating price instability and could also yield significant decreases in costs within the next 20 years. Labor is another major supply chain expense; however, robotics, automation and other innovations will lessen the cost. “Automation will shift the nature of human work in logistics facilities, requiring higher skill levels. It will also translate to supply chain savings in the medium- and long-term. Those savings will open up locations—specifically infill—that may not have been viable options due to high wages. At the same time, the risk that robotics and automation will reduce the need for logistics real estate is low,” per the report. Examining the numbers, each 1 percent savings in transportation and labor costs equates to 15 to 20 percent of logistics real estate rent.

Another considerable expense for supply chains is the inventory carry cost. Between the Internet of Things, Big Data, and modern mathematical techniques, retailers and suppliers have the tools distribute inventory with greater efficiency. Notably, these efficiencies aren’t expected to dampen the logistics real estate sector, as they’ll be kept in check by increased consumer demands for more product options and faster delivery.

Changes in retail models will also have a role in the evolution of supply chain costs. Presently brick-and-mortar retailers spend 15- to 20-times more on retail square footage than logistics space, but the prominent and ever-increasing presence of e-commerce will push retailers to allocate more funds to logistics real estate.

The future of supply chain costs may turn on technology, but the technology must be embraced to be effective. According to the Prologis paper, “Users of logistics real estate may find these technologies unfeasible today; yet, adoption will accelerate with technological maturation and the growing need to overcome logistics challenges.”

Technological progress, however, can have its hiccups. “Future-proofed portfolios” must take into consideration the unknowns—including regulation and the pace of technological adoption—in addition to the “unknown-unknowns.”

You must be logged in to post a comment.