When the Fed Gives You Lemons…

Dekel Capital's Shlomi Ronen on why flexibility and opportunity will be the watchwords in this year's high-rate environment.

As the old saying goes, “when life gives you lemons, make lemonade.” And, of late, it definitely feels like the CRE industry has received its fair share of lemons. The post-pandemic slow return to office, the Fed’s historic increase of short-term rates, tight labor markets, the persistently high material costs, and the recent banking crisis have all created headwinds for CRE investors and developers.

While forcing investors to pivot their business plans to mitigate market risk, all these events also led to opportunities that we have not seen in the CRE market for many years.

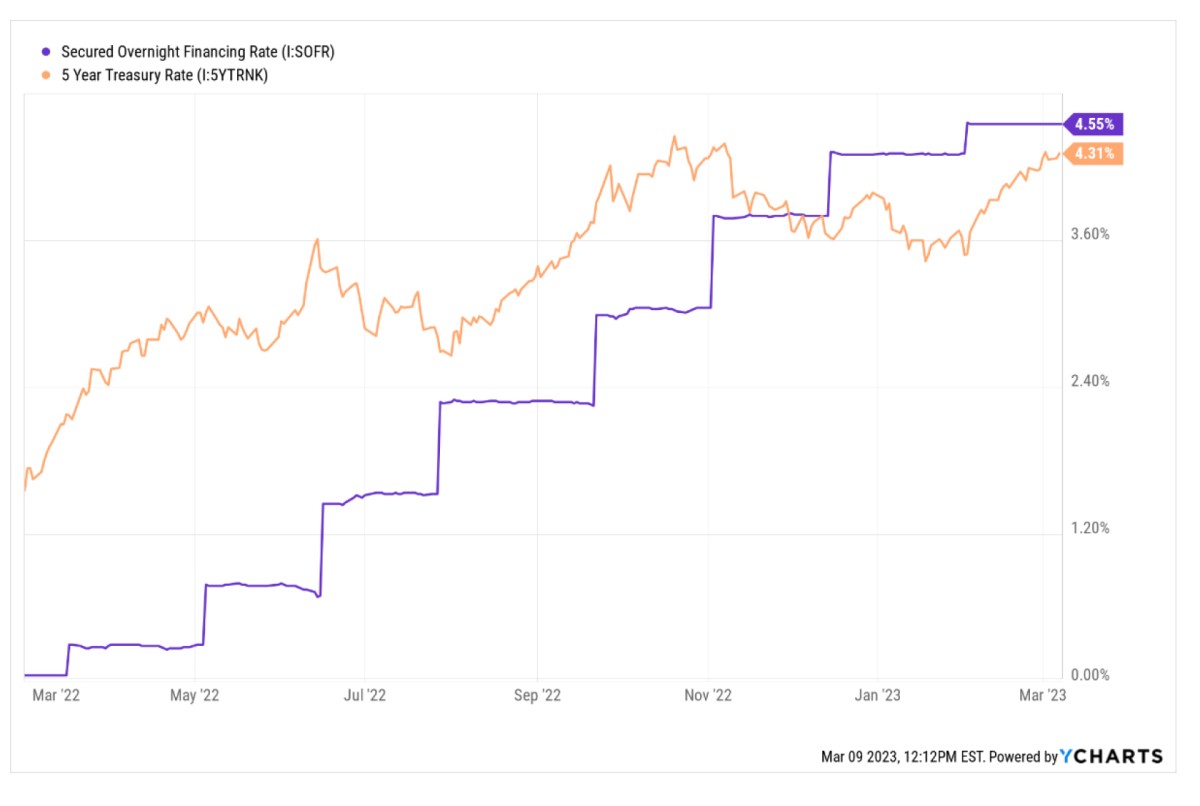

From a risk management standpoint, we have been advising borrowers to refinance their floating-rate loans with a five-year fixed-rate loan. Several factors make this strategy attractive. Long- term indices have remained lower as investor expectation for long-term economic growth remain muted. The spread between SOFR and the five-year note (see chart below) reached nearly 1 percent in recent months.

In addition, credit spreads from Agency, CMBS and Life Company lenders have remained stable, ranging around 2 percent on fixed-rate financing for multifamily. (Life Company lenders have been a good source of capital for these loans as they tend to have the greatest amount of flexibility around prepayment structures while providing full term interest-only pricing around these 2 percent spreads.

Second, based on recent testimony by Fed Chairman Powell it seems as though we are entering into a persistently high (by recent history) short-term rate environment. As such, borrowers with bridge loans maturing in the coming 12-24 months are likely going to find themselves having to buy new expensive interest rate caps (if they didn’t purchase full term interest rate caps at loan origination) or extending their loans and buying caps. Interest rate caps have become expensive as the uncertainty over the scope and scale of fed funds increases and as the cap providers have had to make payments on caps that they have sold prior to the rate hikes.

Opportunities exist on the acquisition side in today’s market as the capital markets, especially equity investors, are focused on investments that are either in distress or have an element of distress such as a 50 percent leased commercial property that may be a covered land play for an alternative use. While we are not yet seeing a large volume of distressed, non-performing, note sales in the market, Lenders are pruning their balance sheets and are either selling notes outright or partnering with investors to execute on a business plan to help them achieve par value for their loan. So far this year, we are seeing these opportunities in office, senior housing, and construction loans.

Opportunities exist on the acquisition side in today’s market as the capital markets, especially equity investors, are focused on investments that are either in distress or have an element of distress such as a 50 percent leased commercial property that may be a covered land play for an alternative use. While we are not yet seeing a large volume of distressed, non-performing, note sales in the market, Lenders are pruning their balance sheets and are either selling notes outright or partnering with investors to execute on a business plan to help them achieve par value for their loan. So far this year, we are seeing these opportunities in office, senior housing, and construction loans.

Lastly, from a capital provider standpoint and potentially an alternative investment strategy, mezzanine and preferred equity are in great demand as lenders have been constraining leverage and sponsors are needing to make capital calls in order fill the capital stack. The opportunities and risks are varied but the risk-adjusted returns seem compelling relative to last-dollar equity returns.

As we are now settled into the New Year and themes are starting to emerge, the key to a successful 2023 will be flexibility and looking forward. Mitigating risk and exposure in current investments and focusing on opportunities that the market presents will help us all make lemonade this year.

Shlomi Ronen is managing principal, Dekel Capital.

You must be logged in to post a comment.