When Will Convention and Group Travel Demand Return?

RevPAR in dense urban markets remains more than 80 percent below 2019 levels, according to CBRE Hotels Research.

Safety concerns and corporate travel bans will prevent the lodging industry from making a post-pandemic recovery until at least 2023, according to the latest report from CBRE Hotels Research.

READ ALSO: Hotel Development Pipeline to Slow: HVS

The Future for the Lodging Industry: When Will Convention and Group Demand Come Back report also notes it will take until 2024 to 2026 for upper-tier hotels to reach the nominal RevPAR levels of 2019.

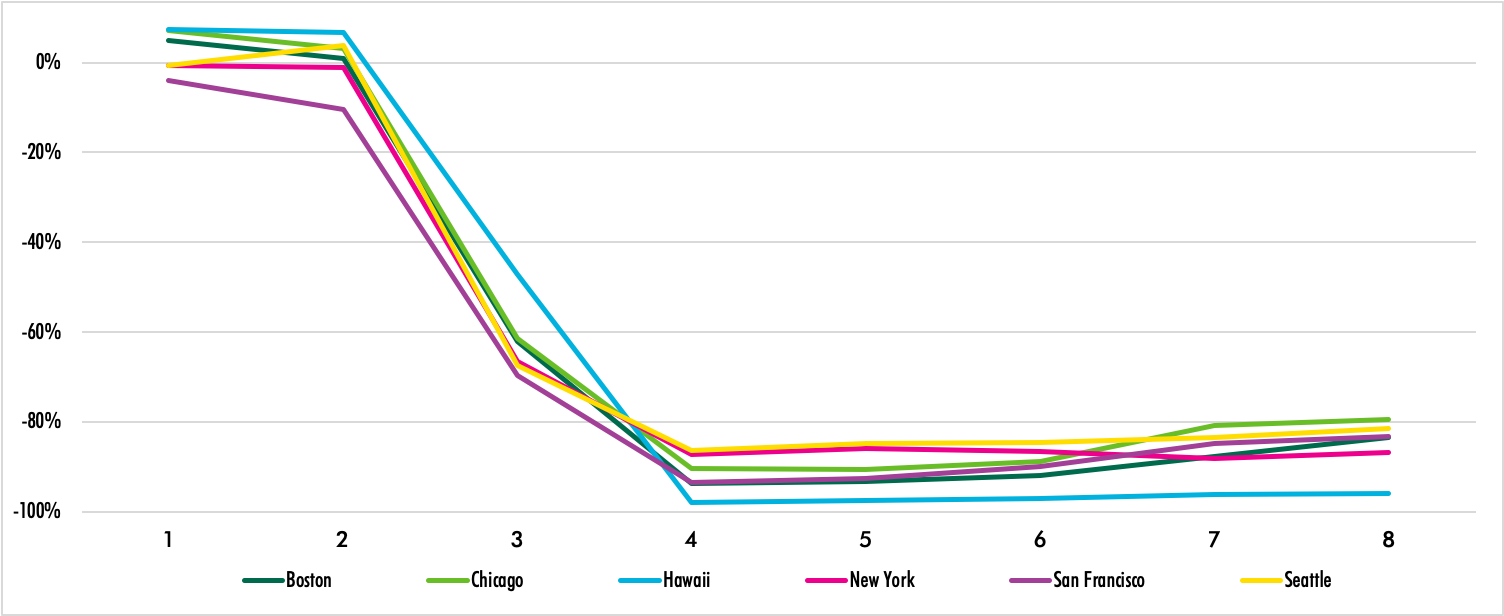

The return of group and business travel is a major factor in the recovery of the hotel industry. The report states the RevPAR in dense urban markets remains more than 80 percent below 2019 levels. The return of corporate demand will be a key driver of recovery in those markets. In 2019, corporate demand made up almost 50 percent of the demand for upper-tier markets that year.

There is also economic evidence that business travel is good for the corporate bottom line too. An Oxford Economics study found for every $1 invested in business travel, firms get $12.50 in incremental revenue. The same research found eliminating business travel reduces profits by 17 percent in the first year. And executives and business travelers estimated 28 percent of their business would be lost without in-person meetings.

While virtual meetings have become commonplace during the COVID-19 crisis, CBRE predicts “once travel starts up again the competitive nature of the business and sales will spur in person-meetings again.”

Anticipating the workforce will remain more remote, the CBRE report states those workers will be demanding more opportunities to connect with people at conferences and conventions. That desire for face-to-face communications will be another factor driving business travel after the crisis has passed, according to the authors of the report, Jamie Lane, senior research director of economics and forecasting; Jack Corgel, managing director at CBRE Hotels Research, and Bram Gallagher, senior economist with CBRE Econometric Advisors.

State of the U.S. hotel market

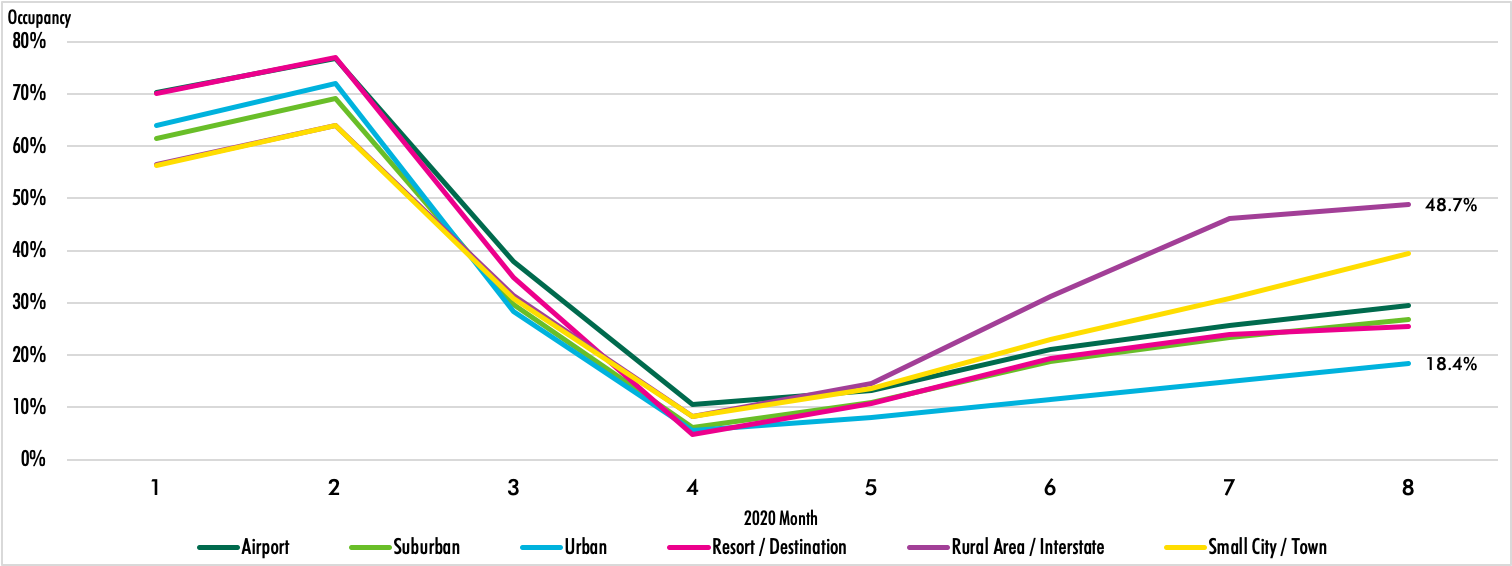

Following the abrupt shutdown in March, there was a spike in hotel demand in April and May as the country slowly began to reopen. The study authors said they expected to see some small group meetings return soon after, but once coronavirus cases began increasing over the summer, demand slowed again and it became clear there would be no corporate travel demand in the fall.

Urban markets have been hit particularly hard. More than half of New York City hotel guestrooms are still closed and RevPAR in markets like New York City, San Francisco, Chicago and Washington, D.C., remain more than 80 percent below 2019 levels. That number has held steady since April, the report states. The urban markets are also experiencing 15 percent occupancy and a nearly 35 percent decline in year-over-year ADR change.

Meanwhile, drive-to leisure and resort locations have begun to slowly recover, particularly on weekends. Air travel also seems to be happening more frequently on weekends, but overall it is down 70 percent compared to 2019.

The report said fear and frugality are inhibiting all forms of travel. CBRE cites a July survey from Freeman and the Atlanta Convention & Visitors Bureau that found safety concerns are the main reason businesspeople aren’t traveling, with 90 percent of respondents saying safety factors will have the most influence on when they attend in-person business events again. Other concerns were: availability of a vaccine (more than 50 percent); safety practices in place for travel and at the event (40 percent); availability of a COVID-19 treatment drug (36 percent); no new coronavirus cases where event is held (20 percent); and no new cases of COVID-19 where the respondent lived (6 percent).

Economic factors also played an important role for 72 percent of the respondents. Company travel bans were cited by 31 percent. Other considerations included: hotels reopening (27 percent); consumer spending increasing (26 percent); and airlines reporting increased demand (19 percent).

Read the full report by CBRE Hotels Research.

You must be logged in to post a comment.