Where Are Transactions Moderating?

Supply has remained in check throughout the recovery, and overall fundamentals remain steady, although slowing deal flow may persist for some property types, according to Yardi Matrix's Chris Nebenzahl.

By Chris Nebenzahl

Through the first three quarters of 2018, transaction activity in the office sector continues to slow, as interest rates increase. Supply has remained in check throughout the recovery, and overall office fundamentals remain steady, although slowing transaction activity may persist. The continued presence of 2 percent inflation will likely lead to further increases in interest rates, thus adding additional borrowing costs for commercial real estate investors.

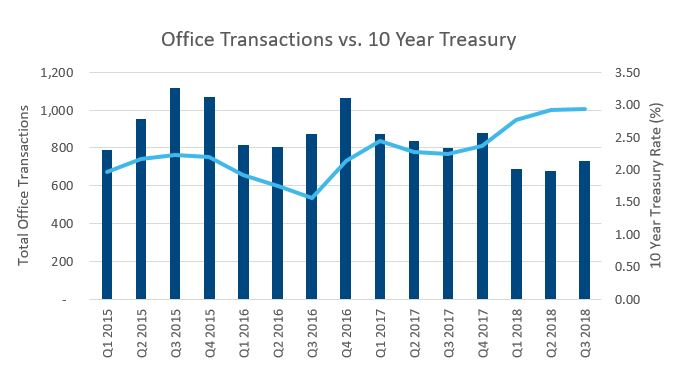

Total office transaction activity has taken measured steps downward in each of the past three years, after averaging close to 1,000 transactions per quarter in 2015. As interest rates began a steady upward climb following the 2016 election, office transactions slowed, averaging roughly 850 per quarter in 2017, and 700 per quarter through Sept. 30, 2018, according to data from Yardi Matrix.

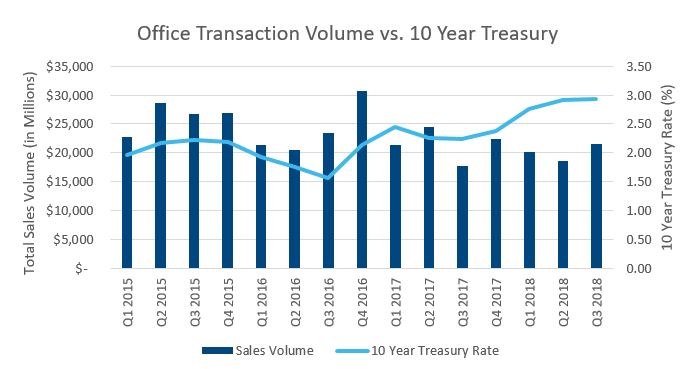

While total dollar volume has exhibited a more volatile pattern over the past few years, the downward trend remains. Low-hanging fruit that was available in the early years of the recovery has disappeared, and investors have been forced to reassess their return expectations in light of higher borrowing costs. After reaching a recent high of more than $30 billion in the fourth quarter of 2016, transaction volumes have fallen, averaging just over $20 billion in the past seven quarters.

Cooling transaction activity has been seen across location classes. Nationwide, central business district (CBD) and urban office transactions fell 12 percent in the first three quarters of 2018 compared to the first three quarters of 2017. There were 18 percent fewer suburban transactions over the same time period. Dollar volume for CBD and urban transactions has been stable this year, compared to last year, however, 2018 is expected to finish well below 2015 and 2016 levels.

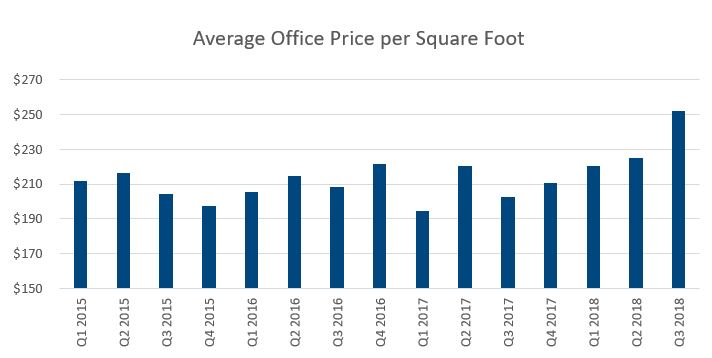

Despite slowing transaction activity, property values have sustained themselves over the past four years, and shown signs of growth in recent quarters. After oscillating around $200 per square foot, the national average price per square foot has increased each quarter since the third quarter of 2017, growing from $203 per square foot to $252 per square foot in the third quarter of 2018.

Demand for office space is elevated as office using employment has outpaced projections. Absorption has been strong and steady throughout the current cycle, despite changing trends such as coworking and declining square footage per employee. Job growth is poised to continue its upward movement, at least for the next 12 to 18 months, which should bring with it sustained healthy demand for office properties.

Multifamily transaction activity has also been volatile but has yet to exhibit significant signs of deceleration. Household formation is growing, and despite roughly 300,000 units being delivered each of the past three years, the overall housing shortage continues to sustain apartment demand.

Thus far in 2018, apartment transactions have averaged more than 1,000 per quarter, a slight decline from previous years, but a strong fourth quarter, which has been the highest quarter for transactions in recent years, would put 2018 in line, if not higher, than 2017. From a dollar volume perspective, 2018 is on pace to eclipse $100 billion, topping 2017 and similar to the average of the past three years.

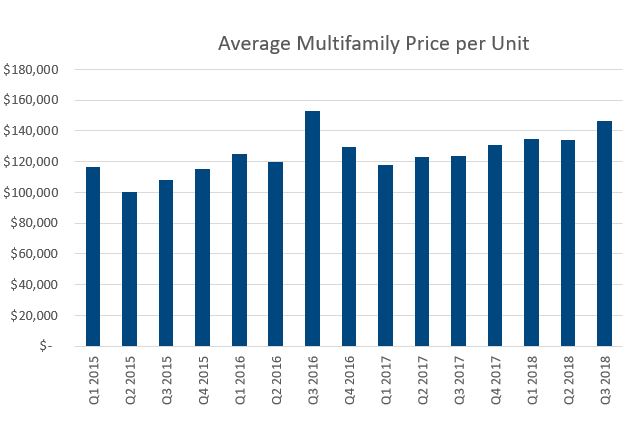

The strong demand for housing has pushed average prices steadily higher over the past four years. The average price per unit neared $150,000 in the third quarter of 2018, and with the exception of the third quarter of 2016, saw the highest quarterly average price per unit. Even as interest rates and borrowing costs rise, multifamily investment remains attractive for many types of investors. Expect transaction values to continue to increase as new, high-end supply delivers, and continued rent growth in workforce and mid-range housing drives net operating income growth.

Commercial real estate transactions are getting harder to pencil as rates increase, and return expectations soften. Despite significant capital available, investors must now take a more refined approach to find the right deal. Transaction activity has moderated across office and multifamily remains stable, but going forward, investors will need to take a sharpshooters approach to find the right deal.

You must be logged in to post a comment.