Where Industrial Real Estate Opportunity Knocks

Strategies for navigating investment and development in the high-powered logistics sector in 2021.

“If you build it, they will come.” Spoken by Kevin Costner 30 years ago in the “Field of Dreams” movie, those famous words hold true for the industrial sector today. The effects of COVID-19 have generated skyrocketing demand and surging supply for an asset category that was already a top performer. In this fast-changing field, a variety of trends point to the locations, product types and niches that will be the most promising for investors and developers over the next several years.

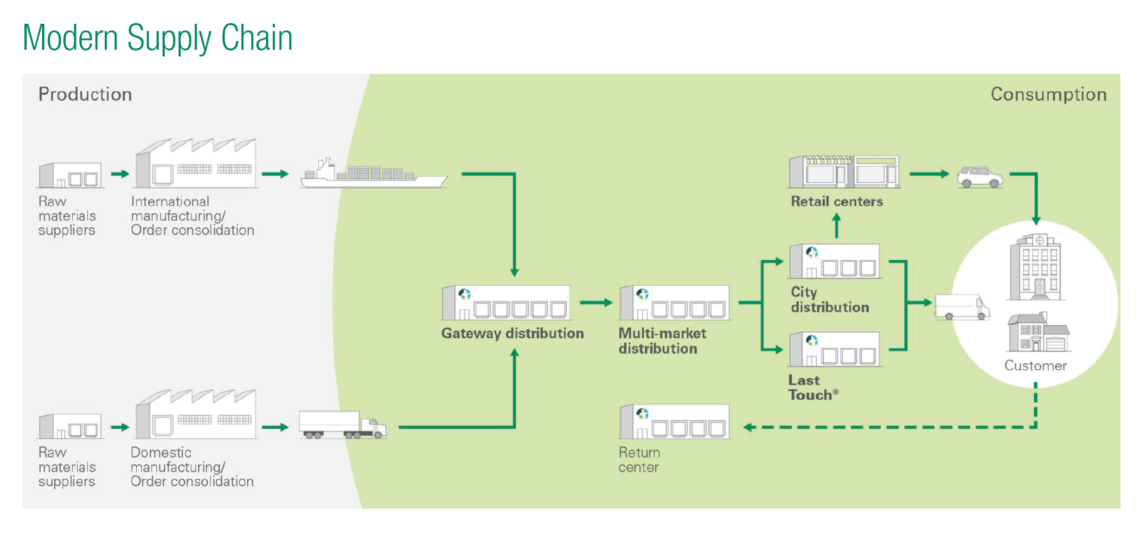

Accelerated e-commerce adoption and increased inventories of goods have the potential to generate upward of 400 million square feet of additional demand for logistics space over the next two to three years. Growth in direct-to-consumer delivery volumes and rapid replenishment needs will continue to put pressure on all phases of the supply chain, which will likely see an increase in demand for last-touch and city distribution facilities, explained Melinda McLaughlin, vice president of research at Prologis.

As online shopping grows with the American consumer population, demand for large fulfillment centers all the way down to smaller last-mile facilities is growing. “In 2019, 11 percent of all retail sales were online, but now we’re on a journey toward 30 percent, spiking to where we expected this to be five years down the line,” said Craig Meyer, president of JLL Industrial for the Americas.

A paradigm shift in shopping habits is creating a need for more facilities that are closer to the customer. Although larger markets like California, New York and Atlanta continue to shine, demand is also increasing for facilities that can efficiently deploy product in secondary and tertiary markets.

According to Digital Commerce 360, online sales totaled $602 billion in 2019. Sales could hit $1.5 trillion by 2025, JLL estimated. That additional $900 billion in sales would equate to a demand for more than 1 billion square feet of industrial real estate over the next five years. E-commerce has been the No. 1 performer in the industrial sector for three consecutive quarters, driving 71.3 million square feet in leases as of the third quarter of 2020, according to JLL.

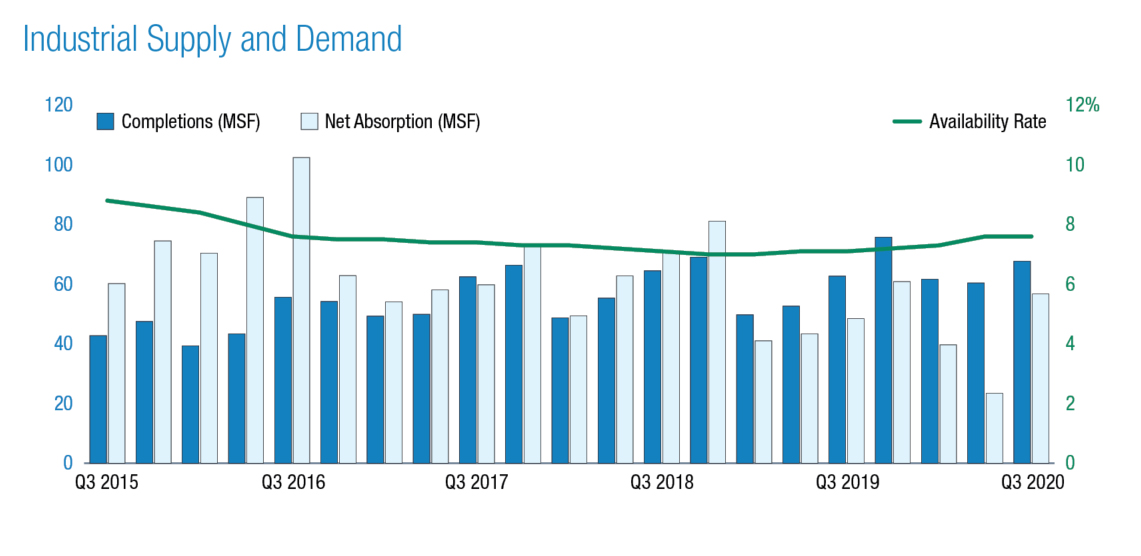

“A big leasing year is going to put added pressure on supply in 2021,” noted Meyer. “Think about the lead time it takes to build a property. We’re looking at some time ahead where there will be shortages in certain markets.”

In-Demand opportunities

Chicago-based Karis Cold Storage purchased this 42,000-square-foot cold storage building at 5115 S. Millard in Chicago’s Brighton Park neighborhood for $7.5 million. Image courtesy of Karis Cold Storage

The market is performing so well across all geographic markets and product sizes that the majority of investors are looking to buy any kind of industrial asset, said James Breeze, senior director & global head of industrial and logistics research at CBRE. That said, some particularly attractive products are emerging, including modern, fully occupied big-box facilities at least 200,000 square feet in size; and assets that are 50,000 square feet or less, in markets with dense population centers. “These markets tend to not have land for development and have robust demand, especially from final-mile occupiers, meaning rents are increasing at a significant pace,” Breeze noted.

Although much recent development and investment activity has centered on larger facilities, smaller product provides significant opportunities. Assets of 25,000 square feet or less offer the country’s lowest vacancy rate and strongest rent growth.

Core industrial markets such as the Inland Empire, New York/New Jersey, Dallas-Fort Worth, Atlanta and Chicago; those located near logistics hubs like seaports, inland ports and major cargo airports; and interior Southwest markets like Phoenix, Las Vegas and Salt Lake City are in particularly high demand from end users and investors.

In addition to desirable locations, specific features are in demand, including higher clear heights, larger truck courts, more parking and additional power. Markets with growing populations and training programs in modern distribution will be sought after, as will areas that can supply skilled labor.

According to a third-quarter CBRE report, industrial supply grew 1.9 percent year-over-year to 14.6 billion square feet and had a 7.6 percent overall availability rate, well below the long-term average. Completions rose 12 percent and net absorption increased 142.4 percent.

Repurposing potential?

With a range of features and locations, properties can have widely different purposes. The demand of industrial far outweighs the supply, which raises questions about the advisability of redeveloping other property types to meet the need. That depends on the availability of land, what type of product is needed and what you’re starting with.

The question comes up often in regard to the retail sector due to its large number of struggling properties and wide range of formats: freestanding buildings; neighborhood, community and strip centers; and regional malls. Each industrial project has unique requirements based on the site, market needs and local regulations, noted Matthew Walaszek, associate director of industrial and logistics research at CBRE. “It’s going to accelerate,” he said of retail-to-industrial conversions. “However, it will remain a relatively small portion of the market.”

Prologis estimates that if 5 million to 10 million square feet of retail space becomes available for redevelopment annually, it would add between 50 million and 100 million square feet over the next decade. That would amount to less than 1 percent of the 10 billion-square-foot inventory in the Top 25 U.S. markets. Issues such as restrictive zoning and physical site limitations are the biggest obstacles to making the conversion of retail properties to industrial facilities a larger opportunity, said McLaughlin.

Running hot and cold

One of the fastest-growing influences shaping industrial demand today is the influx of online grocery shopping. The pandemic has led consumers down this path much faster than the industrial market expected. Before 2020, online transactions typically made up only 3 percent to 4 percent of all food sales. By mid-March, 40 million first-time customers were buying groceries online, according to JLL. That is one of the trends having a strong impact on cold storage. Until now, the niche had shown relatively little growth in demand or development in recent years. But all that is changing fast. JLL now estimates demand will contribute to as much as 100 million square feet of new facilities by 2025.

The strongest markets are found in areas of rapid population growth, reported Brian Niven, chief investment & development officer at Karis Cold Storage. One new driver is the need to handle hundreds of millions of doses of COVID-19 vaccines. “Everything will be sourced and manufactured in the U.S. and these vaccines need to be stored in a temperature-controlled space,” Niven noted.

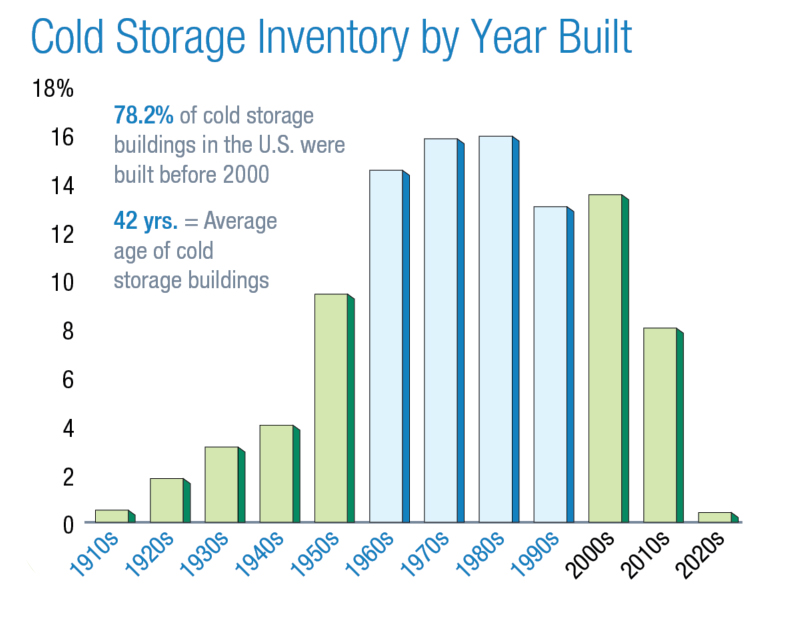

The demand for this type of product is most often found adjacent to large population centers near ports of entry, but because there has been little new construction over the last few decades, that supply is falling short. Seventy-eight percent of cold storage inventory was built before 2000. These older buildings are characterized by inefficient structures and older systems that lack the functionality needed by today’s end user.

Cost has been a major reason for the shortage. Construction of a cold storage asset can average $130 to $180 per square foot, compared to $70-$90 for a conventional dry warehouse. Factors that drive up costs include cooler and freezer space and customization.

For cold storage facilities, repurposing existing facilities generally isn’t an option. Tenants are looking for flexibility, and product and pallet sizes vary widely. When old warehouses are converted to cold storage space, the loss of ceiling height results in limited pallet-racking capability. Temperatures must be carefully monitored and can require adjustment at any time. Due to these highly specialized needs, adapting an existing facility is impractical.

Despite these issues, historical vacancies remain below 10 percent and inventory will reach 250 million square feet, representing 1.8 percent of the U.S. logistics inventory, according to the JLL report “Cold storage in the post-COVID-19 economy.”

“People are waking up to cold storage as being a viable part of the industrial real estate space. It’s an infrastructure asset, no different than a power plant,” said Niven. “It’s needed in all of our markets. Most people don’t take out the time to think of how these products go from farm to table, crossing through all these facilities.”

To Niven’s point, there is still plenty of uncharted territory ahead. From giant cold storage facilities to small last-mile distribution centers and everything in between, demand for industrial product shows no sign of slowing down anytime soon. That brings us full circle back to the principle that “if you build it, they will come.” And as clients expand and consumer preferences evolve, making the most of opportunities calls for adjusting to rapidly changing conditions.

You must be logged in to post a comment.