Where the Smart Money Is Investing in CRE

Should investors stay on the sidelines?

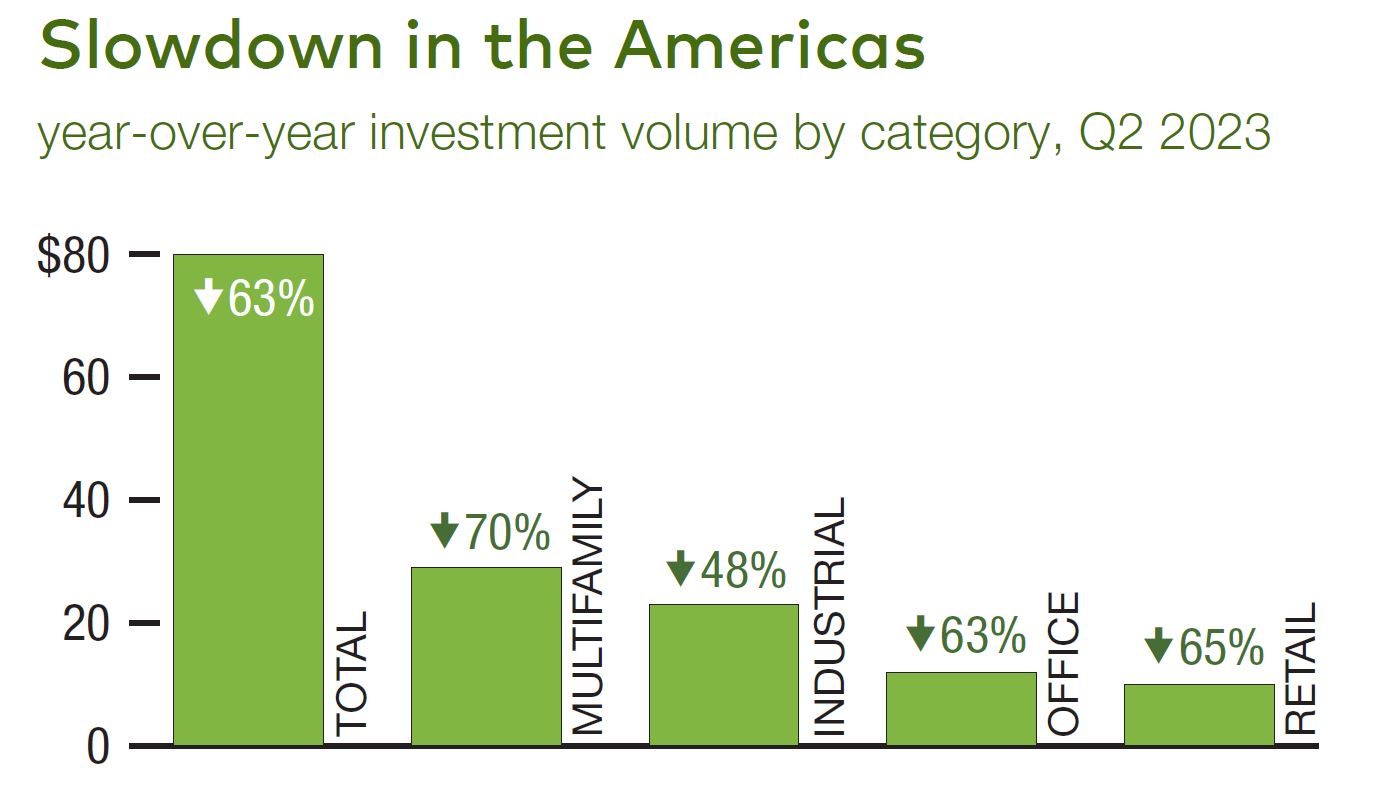

Investors face an unusually complex and contradictory picture as 2023 enters the home stretch. The outlook for capital markets continues to be sobering. Overall investment volume in the Americas fell to $80 billion during the second quarter, a 63 percent decline, according to CBRE. That encompasses 63 percent for the office sector, 65 percent for retail and 48 percent for industrial, which showed the smallest decline among the property categories.

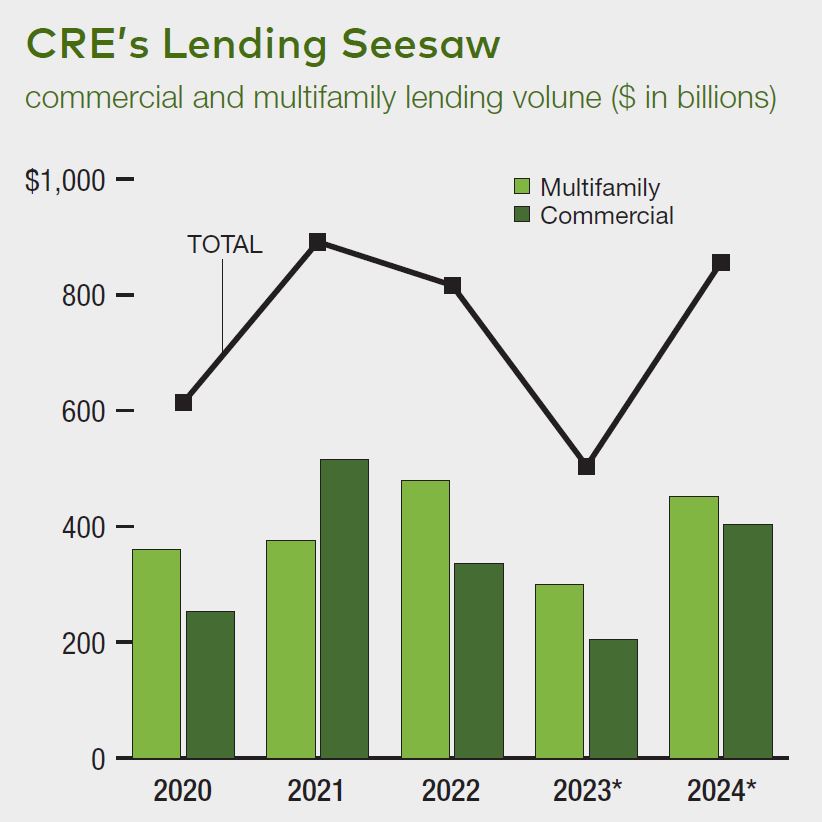

At the heart of the challenging conditions is the continuing difficulty in the capital markets, which shows few signs of easing this year. Lending volume for commercial and multifamily properties is projected to drop 38 percent in 2023 to $504 billion, the Mortgage Bankers Association estimated in early August. The much-discussed combination of interest rate volatility, lack of clarity regarding values and worries about some asset categories’ fundamentals adds up to an impasse in deals and lending, noted Jamie Woodwell, MBA’s head of commercial real estate research.

The timing of the recovery, experts say, will hinge largely on the Federal Reserve’s action on interest rates. The central bank is expected to hike rates several more times in 2023. Current trends and market sentiment suggest the economy could enter a recession if the Federal Reserve doesn’t intervene to tap the bond market more aggressively, said Rajeev Hota, associate director for commercial lending at Acuity Knowledge Partners, a New York City-based research firm.

Downturn dilemma

Another potential wild card for investment, closely tied to the impact of interest rates, is the prospect of a recession. The Fed itself no longer expects one, as Jerome Powell, the Fed’s chair, stated when announcing a 25 basis-point increase in late July. While the economy has outperformed expectations on the strengths of a strong job market and steady consumer spending, the persistence of an inverted yield curve—a reliable predicter of economic downturns—suggests that a recession in 2024 cannot be ruled out.

The pace of investment will correspond closely to trends in interest rates, and will depend on the spread between the risk-free rate and the return, predicted Rob Finlay, CEO and founder of Charlotte, N.C.-based Thirty Capital. The fact that the market is currently off balance makes it difficult to forecast the pace of investment “until pricing parity is established,” he said. In this climate, Finlay prefers suburban office and industrial. “Select retail might also be a good investment, although it’s largely-asset specific,” he added.

Under these circumstances, Hota argues that the Fed should reverse course and strive toward reducing stress in the CRE market. “The current level of reduction and investor stress indicates the economy could take one to two years to return to normalcy,” he said. “CRE investments are expected to recover starting in 2024, but the recovery will be slow due to the change in dynamics, including working from home and telecommuting.”

Seeking smart moves

These complex and often contradictory indicators raise the key question: Where should the smart money go now?

Looking toward the rest of this year, location should be investors’ main focus, contends Justin Basie, president of real estate at Newport Beach, Calif.-based Mark IV Capital. That will represent a departure from recent years, when it was fairly easy to reap returns based on macro-level asset class allocation. Focusing on a specific location within a submarket will be key to obtaining hoped-for results. It’s critical for investors to monitor the pulse of local markets in which they’re investing, as well as the key fundamentals propelling those markets, he said.

Mark IV’s focus on the industrial sector includes the second phase of Victory Logistics District, its 4,300-acre master planned development in Reno, Nev. The firm is also in the planning stages of industrial developments in the Phoenix, Sacramento and Denver areas, and undertaking a 65-acre mixed-use development in Round Rock, Texas. In the meantime, however, Basie also predicts challenges ahead for investors who took on too much leverage, or have floating-rate debt coupled with short-term hold periods.

Also of note, cap rates are showing signs of stabilizing, CBRE’s recent survey indicates, a trend which would offer investors more clarity going into the end of the year.

Some experts urge caution, however. “With the governor of the Fed indicating a couple of hikes in the second half of 2023, we recommend CRE investors wait and watch,” Hota said. “Moreover, rising Treasury rates would only discourage investors from further capital investment. If the Fed halts rate hikes in the second half of 2023 and starts to cut rates, we expect the commercial real estate market to start recovering from early 2024.”

Rewarding patience

Even for the star-crossed office market, opportunity for selective, patient investors is by no means out of the question, especially for new product. And office product that has come online in 2015 and later has consistently outperformed, tallying 112.5 million square feet of positive absorption since the beginning of the pandemic.

Another plus may be that the pipeline of that new product is gradually slowing. At midyear, office construction starts for the preceding 12 months were down 75 percent compared to the five-year average, For the first time in four quarters, office leasing volume witnessed an uptick across the nation, after three straight quarters of decline, according to JLL’s Q2 Office Market Report. Texas and Florida were especially robust contributors, collectively experiencing 40 percent quarter-over-quarter growth. Also of note, the medical office niche continues to outperform the rest of the sector. During the first half of 2023, prices averaged $296 per square foot, nearly $100 more than the national average for all office deals.

“Commercial real estate, specifically office, is going through a transition,” said Adrian Rahimi, chief investment officer for Tricera Capital in Miami. “[It’s] just like retail had a disruption 10 years ago, when Amazon became what it is today. Office will be similar, where you have to have a compelling reason to go back to the office . . . Slowly but surely, office will make a comeback.”

For its part, Tricera Capital is focused on retail and office sector investments. “If you’re still in wealth creation, you’re building up the platform to purchase higher-yielding assets, [such as] office and retail, as the opportunities arise,” said Adrian Rahimi, chief investment officer for Tricera Capital in Miami.

As it has this year, investment will hinge largely on the availability of capital. Next year could be much more favorable if lending rebounds. In 2024, commercial debt origination could nearly double to $404 billion, according to the Mortgage Bankers Association’s most recent projections.

For investors who are waiting out the disruption, better times and clarity may well arrive as early as next year, Rahimi observes: “You’re holding on hoping to refi or recap until the next cycle. You’re looking to hold the assets for another three to five years. Then, the market will be much better. Next year it’s going to get better, 2025 much better and 2026 back where it should be.”

You must be logged in to post a comment.