Where to Find the Bright Side of Office

Opportunities continue to arise in these urban core markets, the latest Cushman & Wakefield research shows.

Major U.S. cities are a long way from dead—and in fact their downtown office markets present numerous opportunities, according to a new report from Cushman & Wakefield, titled The Bright Side of Office: Opportunities in the Urban Core.

Going back to 2020, wrote David Smith, head of Americas Insights at Cushman & Wakefield, the company recognized that increased remote work would create sustained impacts on occupier demand and that the nature of office would need to evolve as a result. Cushman & Wakefield also anticipated that some portion of existing office stock would be obsolete, that recovery would take some time and that owners should be realistic about the outlook for 2024.

In its more than 100 pages, the report takes some deep dives into four “bright spots” seen in many CBD office markets: the halt in substantial urban out-migration, declining deliveries of new office space, the fact that the effects of remote and hybrid work have largely already played out, and a general rebound in office-using employment.

READ ALSO: Office Trends in 2024: How Much Will the Sector Change?

Naturally, these bright spots differ from city to city, so we’ll zero in on seven of the report’s 11 markets—Atlanta, Chicago, Dallas, Houston, Los Angeles, New York and San Francisco—to offer a glimpse into the investment opportunities each of these present.

Atlanta

As in most of the highlighted cities, Atlanta’s core office market benefits from multiple diverse factors. In Atlanta’s case, those include major universities Emory and Georgia Tech, more than a dozen Fortune 500 headquarters, and relative affordability.

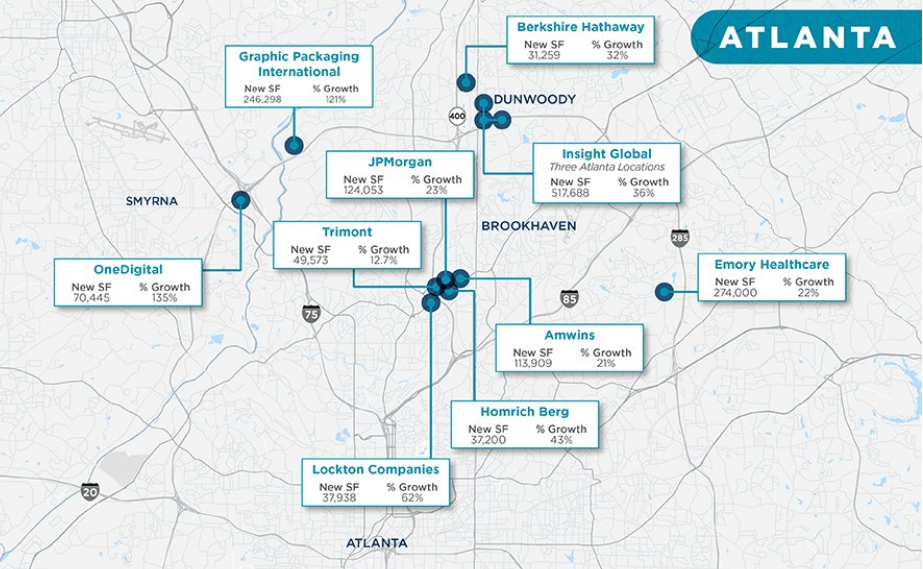

Despite corporate right-sizing, the report notes at least 10 sizable office tenants that have grown their footprints across metro Atlanta in the past two years.

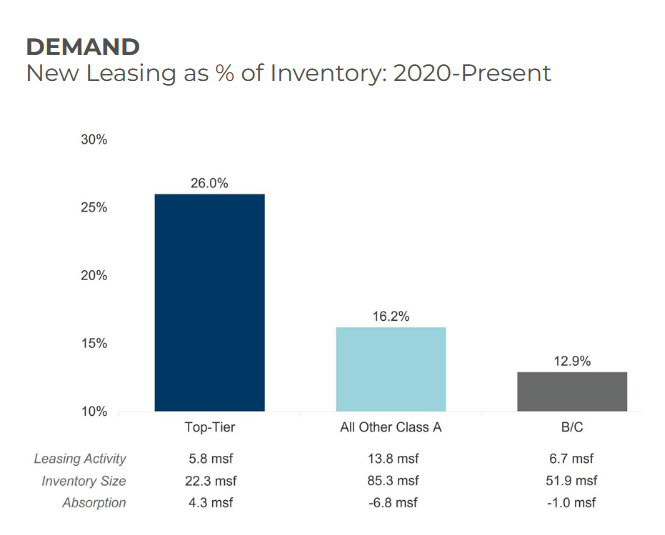

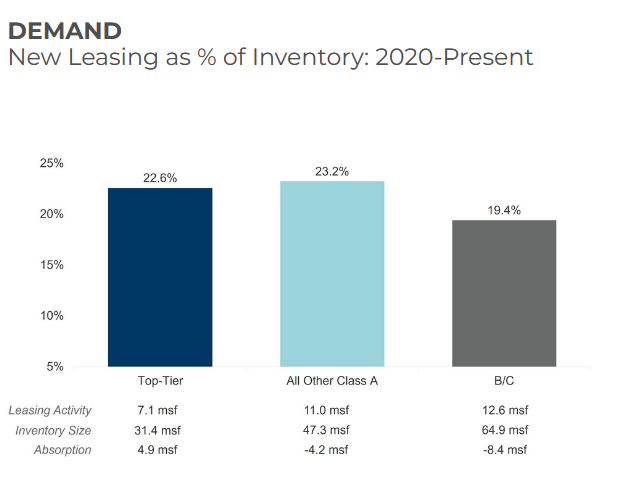

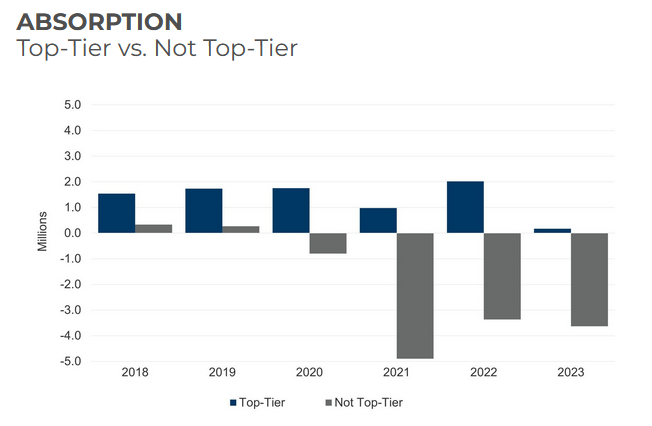

A flight-to-quality trend is clear in leasing figures cited by Cushman & Wakefield: The topmost rank of buildings saw 4.3 million square feet of net absorption from 2020 to 2023, while other Class A and Class B/C buildings registered negative absorption over the same period. Vacancy figures show a parallel trend.

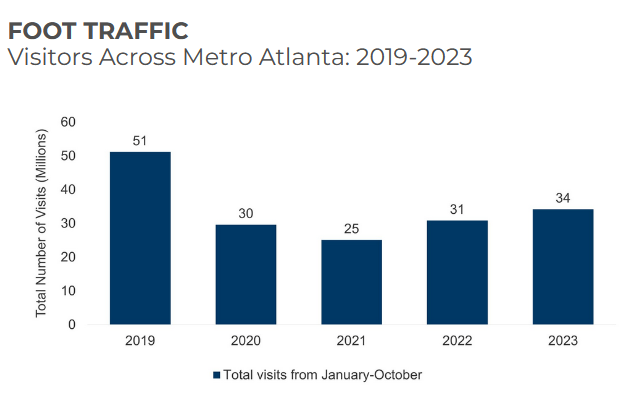

Cushman & Wakefield research on the return-to-office indicates that this pattern has gained traction since 2021, but has not yet brought foot traffic back up to 2019 levels.

Return-to-office trends: Visitors across metro Atlanta between 2019 and 2023. Chart by Placer.ai, courtesy of Cushman & Wakefield

Chicago

Chicago’s extensive public transit system helps make the city truly a live-work-play environment—and to attract recent college graduates from across the Midwest. Moreover, Chicago retains its position as the top metro in the U.S. for corporate relocations and site selection, according to an annual study conducted by Site Selection Magazine.

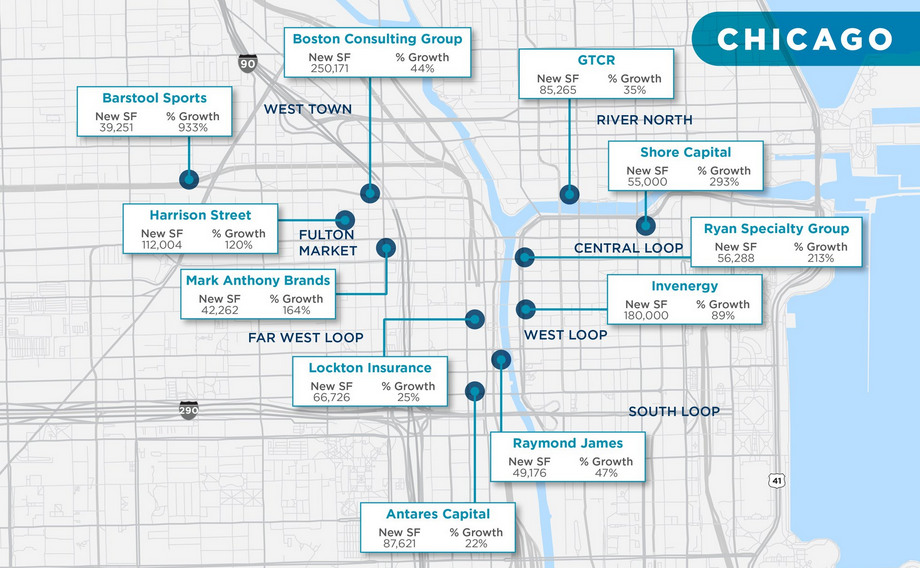

Employment trends in office-using sectors are mixed, but generally above the pre-pandemic high. Cushman & Wakefield spotlights nearly a dozen major tenants that collectively increased their downtown footprints by more than 800,000 square feet since 2022.

The flight to quality is clear. Even as overall vacancy rose, the most-desirable spaces saw vacancy 320 basis points below the Class A average and 630 basis points below the office market overall, as of the fourth quarter of 2023.

Trophy CBD buildings totaled about 34 percent (3.7 million square feet) of new leasing activity, which has boosted rent growth. Cushman & Wakefield reports that overall gross asking rental rates for these assets increased 6.2 percent since year-end 2020.

Return-to-office seems to depend on the tenant. The report notes that large tenants in Class A buildings (50,000 square feet or more) that require employees to work in the office two to five days a week are seeing about a 50 percent higher attendance level than the average for Class A space.

Dallas

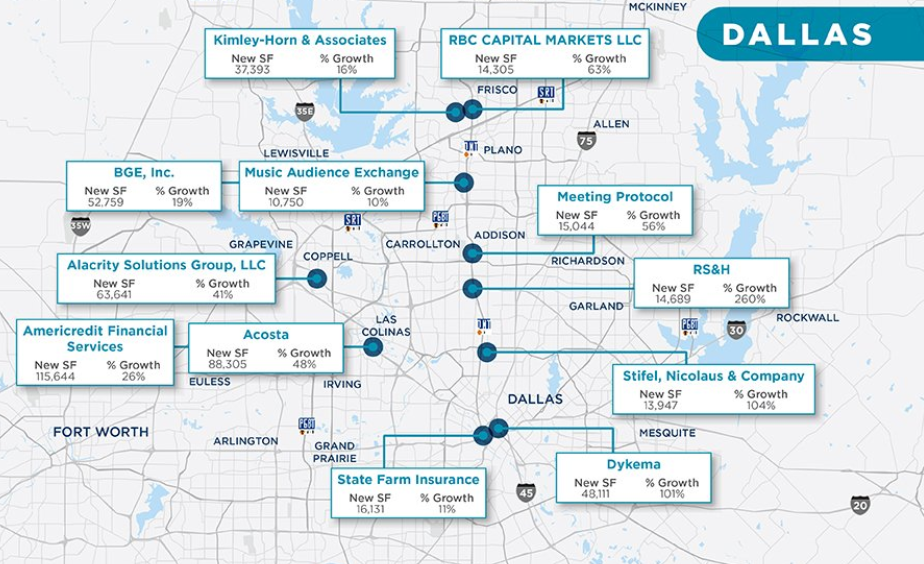

The DFW Metroplex has continued to enjoy nation-leading population and economic growth, despite the pandemic, and office-using jobs have grown 1.3 percent year-over-year in 2023. Sizable office tenant footprint expansions have been numerous, across the finance, insurance, professional, scientific and technical services sectors.

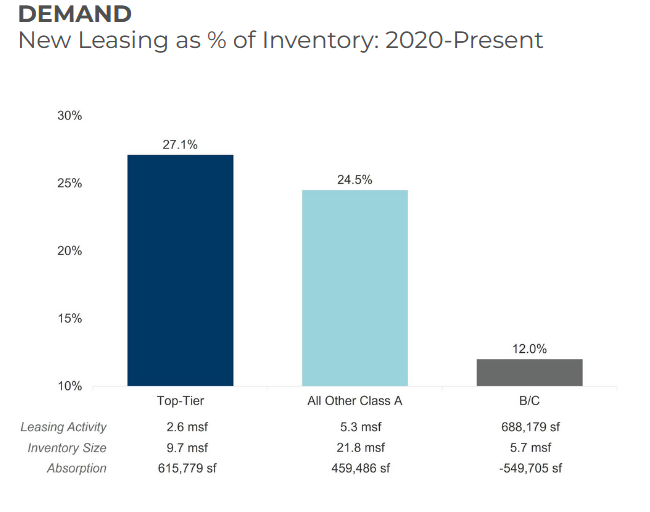

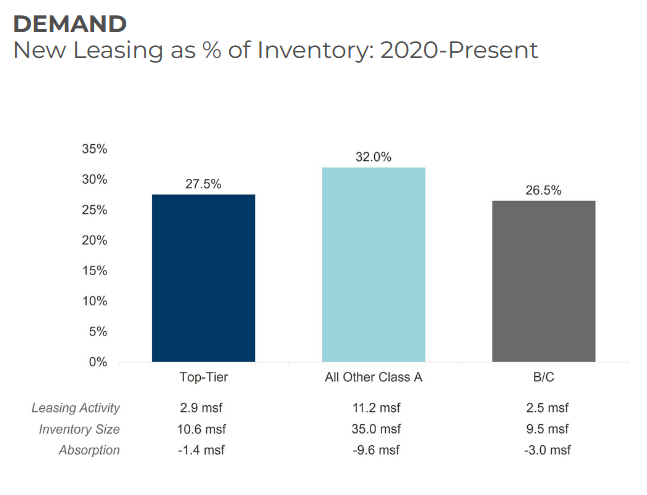

Top-tier properties comprise just over one-third of CBD office product and accounted for 2.6 million square feet of leasing activity since 2020. They command an average gross rent of $36.59 per square foot, as against $32.37 for non–top tier Class A office assets, which account for 44.6 percent of CBD inventory. In addition, CBD properties only had 1.3 million square feet of available sublease space at the end of the fourth quarter of 2023, about one-tenth the available sublease space in the Metroplex as a whole.

Connected to this is the strong role being played by office-to-residential conversions. Just two high-profile projects, involving Energy Plaza and Santander Tower, added 522 residential units to the Dallas CBD.

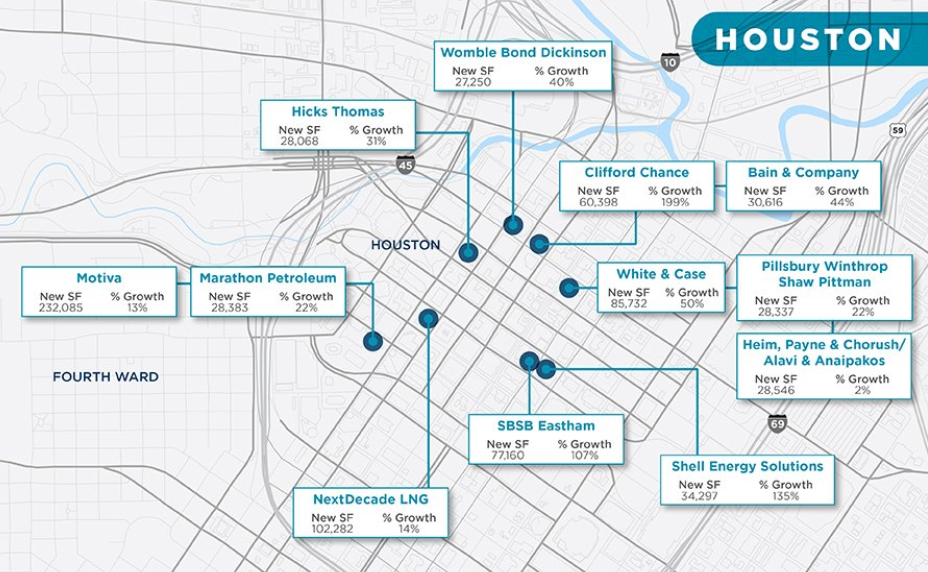

Houston

Already home to a labor force of almost 3.5 million, Houston set a record for job growth in 2021, adding 170,000 jobs, or 5.7 percent year-over-year. Office-using growth has slowed since 2021 (6.5 percent) and 2022 (5.4 percent) to just 2.0 percent in 2023. Energy companies and law firms led the dozen or so top office tenant expansions over the past two years.

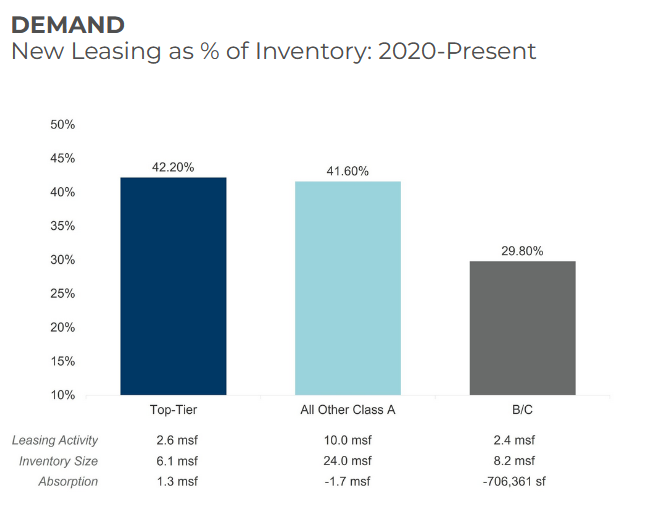

Cushman & Wakefield reports on Houston’s flight to quality that seven buildings considered the top tier (totaling 6.1 million square feet, or about 16 percent of the total inventory) ended the fourth quarter at a total vacancy of 20.2 percent, versus 28.5 percent for the CBD’s Class A market overall.

The report states that the pressure from users demanding high-quality space continues to result in millions of dollars being spent on renovations of older buildings.

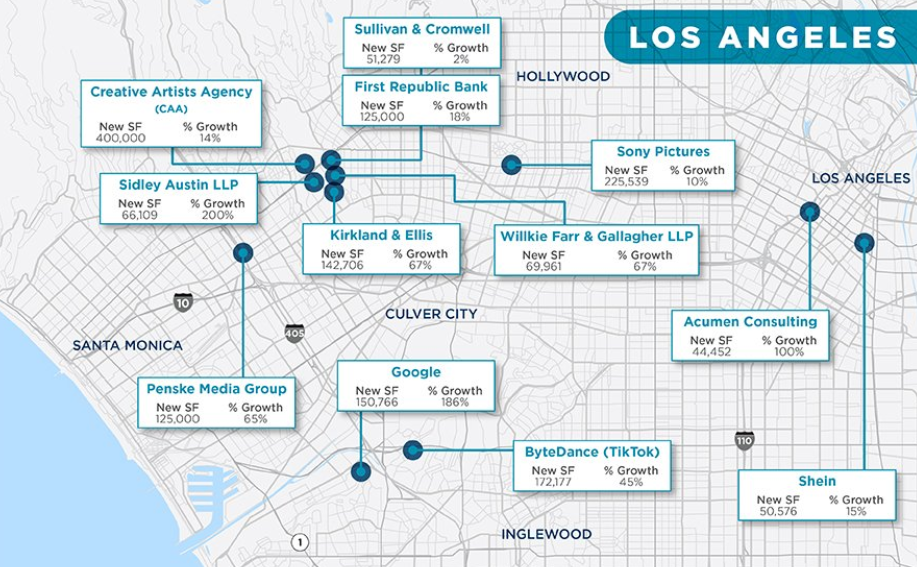

Los Angeles

Metro LA weathered the pandemic well, with office-using employment currently almost equal to pre-pandemic levels, and 15.4 percent higher than in April 2020.

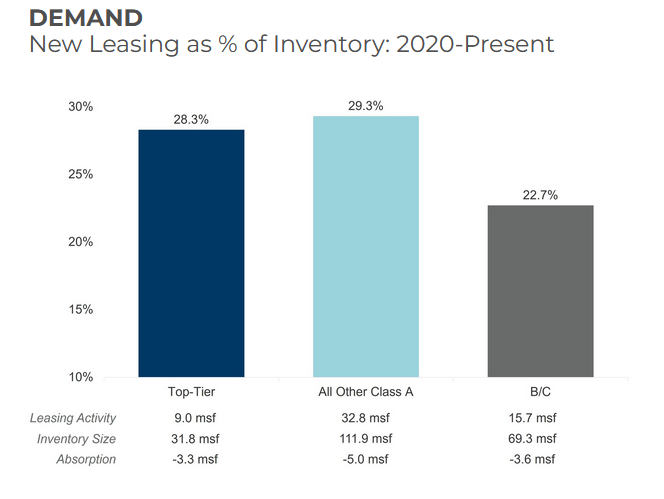

And despite many employers adopting hybrid or remote working approaches, diverse business sectors have driven recent leasing activity, including law firms, financial institutions, and major film and digital entertainment producers. Examples include Creative Artists Agency, Sidley Austin, Kirkland & Ellis, Google, ByteDance (parent company of TikTok) and Sony Pictures.

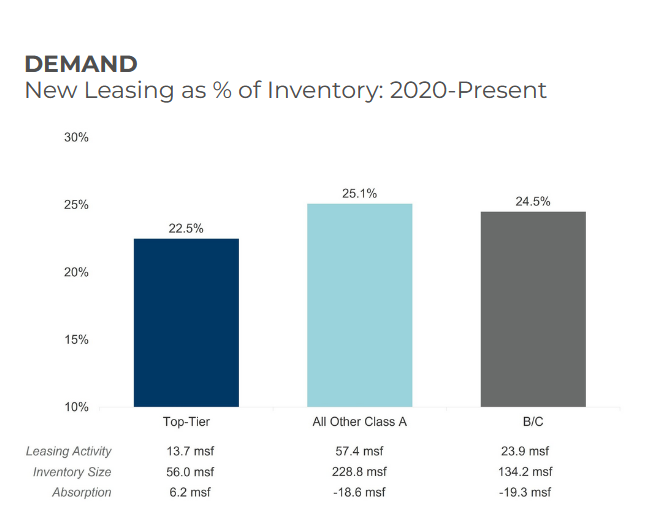

Cushman & Wakefield reports that it is clear how much L.A. occupiers favor high-quality space above all else. Over 28.3 percent and 29.3 percent of top-tier office products and all other Class A assets have leased since 2020, compared to just 22.7 percent of Class B and C properties in the same period.

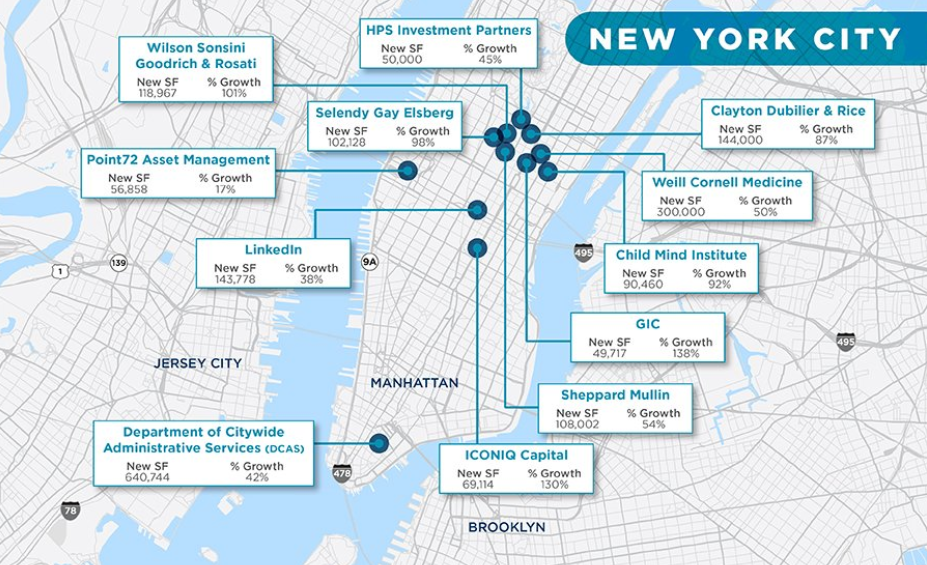

New York City

As the nation’s capital for Fortune 500 headquarters, along with its population of 8.3 million and an unsurpassed cultural scene, it’s fitting that New York City as of this past August had recovered all jobs lost to the pandemic. Office-using jobs had recovered even earlier, by February 2022, and hit an all-time high of 2.8 million jobs by that December.

No surprise, large office tenant expansions have largely been by law firms and financial firms, along with tech and health-care tenants.

The desire to coax employees back into the office has been a strong factor behind the flight to quality in the New York City office market. Crucial factors here have been high levels of amenities and access to public transit and not necessarily new construction.

Still, new construction and renovations have also played roles. The former was the only building class to see positive absorption in 2022 and 2023, for a total of 8.6 million square feet. Even as early as 2020, average vacancy for top-tier properties was stable (13 percent currently), while overall market vacancy climbed to 21.9 percent currently.

San Francisco

San Francisco’s labor market suffered badly from the pandemic, and “the city is still feeling the aftershocks,” Cushman & Wakefield reports. The city’s job total did finally pass the pre-pandemic record high by May 2023, however, and office-using employment for the MSA had rebounded by October 2021. Cuts by tech companies more recently have trimmed the total modestly.

Leaders among large tenant expansions have been law firms and tech companies, the latter often driven by interest in generative AI.

Many office employers want top-quality spaces to help pull workers back into the office, and in some cases the pricing has shifted in their favor.

Trophy buildings command the office market’s highest rent rates and enjoy its lowest average vacancy, of 15.8 percent currently, which is 17.4 percent lower than in the rest of the overall CBD market.

Nonetheless, a 6.4 million-square-foot influx of new office space in the past five years—plus a surfeit of sublease space—have pushed full-service gross rents down from $104.21 at the end of 2020 to $90.37 currently.

Another notable trend is that generative AI has emerged as a significant bright spot for the San Francisco office market throughout 2023. Out of a total of 1,056 public and private generative AI companies in the U.S., 44 percent are in the Bay Area, with 25 percent in San Francisco. Last year, companies based in San Francisco and the Bay Area landed 67 percent and 78 percent of VC funding, respectively, for global AI. In San Francisco alone, that has translated into 1.1 million square feet of office leasing activity in 2023.

You must be logged in to post a comment.