Which Asset Classes Stole the Spotlight in 2024?

Key takeaways from the year’s investment trends, according to DLA Piper’s annual survey.

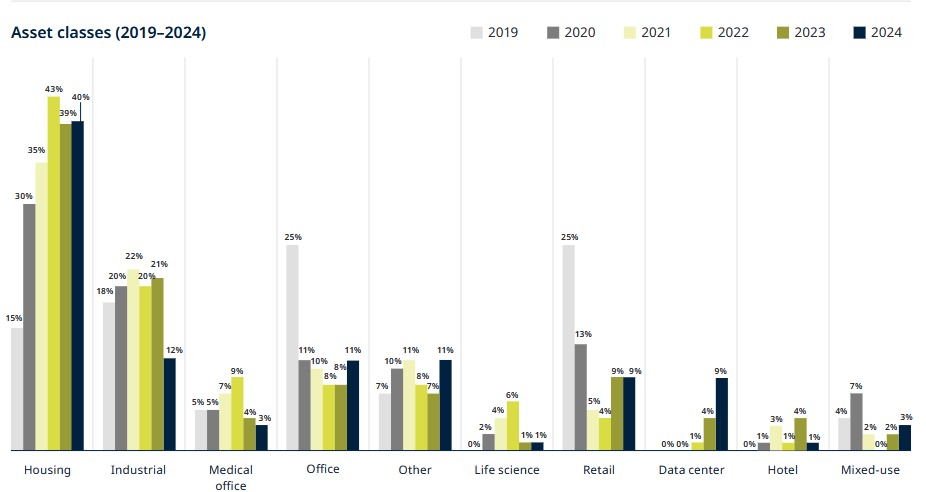

Among commercial property investors, interest in industrial assets declined somewhat in 2024, while a stronger focus on data centers, and even a modest rebound in office, were clear trends during the year, according to the latest DLA Piper real estate report. The most favored property type remained residential.

In preparing the report, the law firm analyzed more than 950 purchase and sale agreements and over 500 property management agreements—data from the volume of transactions that DLA Piper handles in major U.S. markets. Overall, the company noted, deal volume in acquisitions and dispositions, including joint ventures, was robust in 2024, despite the still-elevated cost of capital.

Investors were particularly interested in downtown and metro areas in major markets such as Washington, D.C., New York City and Chicago. Among the states, there was “significant transaction volume” in urban and suburban areas across California and Texas, DLA Piper found.

Among non-residential property types, industrial still represented the highest percentage of 2024 investment deals in the data set analyzed in the report, but just barely at 12 percent, down sharply from 21 percent in 2023 and 20 percent in 2022. Office investment ticked up from 8 percent in 2023 to 11 percent in 2024, showing that the sector isn’t completely kaput.

Investment in retail assets was stable at 9 percent of the total in 2024, the same as the year before, and hotels dropped from 4 percent to 1 percent over the same period, the report found.

The steepest year-over-year rise in investment, however, was in data centers. As recently as 2020 and ’21, none of DLA Piper clients were acquiring data centers, and only 1 percent were in 2022. By 2023, 4 percent of the deals involved data centers, and by 2024 the volume had swelled to 9 percent.

READ ALSO: CBRE Survey Indicates Optimism by Investors

Despite these movements in investor interest, the fact of the matter is that residential properties totaled the most: 40 percent of all the 2024 transactions studied by the report, a figure that hasn’t changed much since the pandemic (though only 15 percent of investors acquired multifamily in 2019).

Financial contingencies up slightly

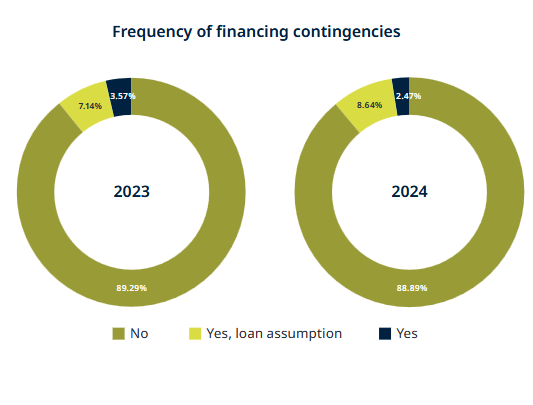

The report also covered financial contingencies among the universe of transactions handled by the company, finding a slight increase in the total percentage of transactions in which financing contingencies were present, up from 10.71 percent in 2023 to 11.11 percent in 2024.

“We saw a more noticeable shift between contingencies for loan assumptions versus contingencies for new loans,” the report explained.

Of the 11.11 percent of transactions where a financing contingency was part of the deal, the percentage of loan assumption contingencies rose from 7.14 to 8.64 percent between 2023 and ’24, while the percentage of new financing contingencies dropped from 3.57 percent to 2.47 percent over the same period.

The report chalked up those movements to the fact that, while interest rates dropped somewhat in 2024, in many cases a buyer can still obtain a better rate by assuming existing financing, which tends to date from the period before the anti-inflation hike in rates.

The report also found that the most common survival period for representations and warranties continued to be 270 days, a period common to 46 percent of the transactions DLA Piper handled in 2024. The number-two most popular survival period was 180 days, which had a 28 percent frequency.

Penalties for breach of representations and warranties didn’t change much between 2023 and ’24, the report noted, especially those deals with purchase prices below $125 million. Larger deals saw more movement to increase average liability caps, especially those of more than $300 million.

Property management trends

Property management fees continued to be toward the middle of the range, the DLA Piper report found, with most coming in between 2 percent and 5 percent of rent, with an increase in fixed fee arrangements.

The clustering of property management fees in the middle range was especially noticeable in the residential sector, where (for example) about two-thirds of fees for apartments came in between 3 percent and 4 percent, with a similar range for student housing and manufactured housing. Senior housing fees were higher, however, three-quarters of which were above 5 percent.

Among non-residential property types, fees were more widely spread. For industrial, 35.9 percent of managers charged 5 percent or more, while the rest charged anything from less than 1 percent to as much as 5 percent. Office and data centers likewise were scattered across the range of fees.

Construction management fees across property types didn’t change much in 2024, the report noted. Most residential management fees are higher than 5 percent, with senior housing an exception at between 2 percent and 3 percent. For industrial, 41.8 percent of construction fees totaled 5 percent or more, but nearly a third of such fees came in between 2 percent and 3 percent.

You must be logged in to post a comment.