Why 2023 Might Be an Ideal Time to Consider This Untapped CRE Opportunity: Farmland

Last year brought a wave of unnerving economic developments across the U.S.

In response to record-high inflation, the Fed raised interest rates at one of the fastest paces in modern history, with continued hikes on the horizon. Heightened market volatility, meanwhile, sent stocks and bonds to their lowest levels since 2008, each ending the year with negative double-digit returns. As traditional asset classes continue to feel the weight of these economic headwinds, real estate remains a viable option.

In response to record-high inflation, the Fed raised interest rates at one of the fastest paces in modern history, with continued hikes on the horizon. Heightened market volatility, meanwhile, sent stocks and bonds to their lowest levels since 2008, each ending the year with negative double-digit returns. As traditional asset classes continue to feel the weight of these economic headwinds, real estate remains a viable option.

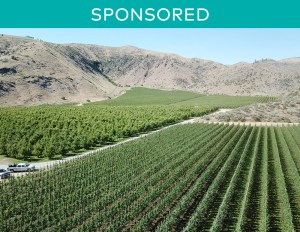

For CRE investors looking to diversify their portfolios further into the real estate market, there’s one untapped and newly accessible opportunity you might be unfamiliar with: farmland.

Ending 2022 with net positive returns of nearly 10%, farmland outpaced many major asset classes, including stocks and bonds, which both ended the year in negative double-digits – and commercial real estate, which posted moderate returns of 5.5%.

Why Farmland?

While farmland might share the same characteristics as more common sectors, like residential or industrial, farmland has delivered higher average annual total returns over the last 30 years – and with much less volatility.

Let’s take a deeper look at how farmland and commercial real estate overlap and where this untapped asset might fit within your real estate portfolio.

- Investment Returns

Real estate returns have been historically strong over the last several decades; since 1992, the NCREIF Property Index posted an average annual return of roughly 8.39%. Despite retail and office segments grappling with pandemic-induced headwinds, the NCREIF Index posted total returns of 6.15% in 2021, its highest annual return in 15 years.

Like traditional real estate, farmland returns are generated through rental payments and appreciation. Farmland investors have the added benefit of receiving recurring payments from the farm operations themselves. Since 1992, the NCREIF Farmland Index has averaged an annual total return of 10.71%, outperforming, not only outperforming real estate, but also the S&P 500, US Bonds, and publicly-traded REITs during this time.

This performance is due, in part, to upward-trending land values; as long as there’s a demand for food, there’s no reason for arable land to depreciate. And this demand is only expected to grow. By 2050, the demands on agriculture are expected to be 50 to 70% higher than they are today.

While other asset classes were still struggling to recover from the impact of the pandemic, US cropland values reached record highs in 2022, topping $5,050. Meanwhile, as mortgage rates continued to climb, the U.S. housing market dropped sharply in 2022, plunging more than $2.3 trillion.

- Portfolio Stability

Like traditional real estate, farmland investments are not often exposed to the same fluctuations that might impact public markets. This stability is driven by the demand for food and shelter, which tends to remain relatively inelastic throughout the economic cycle.

While farmland and real estate may not deliver the same sky-high returns that stocks might in a good year, they tend to have much lower volatility. Between 1992 and 2022, the volatility of the S&P 500 was 17.42%; in comparison, the volatility of privately owned real estate was 7.62% while farmland’s volatility was just 6.64%, according to data from the NCREIF Real Estate and Farmland indices.

However, neither real estate nor farmland investments are risk-free. Commercial real estate values, for example, took a hit at the onset of the pandemic. As a result, institutional investors sought to withdraw more than $20 billion from core real estate funds like JPMorgan and Morgan Stanley last year.

- Diversification

Because of their tendency to move independently of the markets, both real estate and farmland returns have historically low correlations with conventional assets, making each a compelling addition to a well-diversified portfolio. In 2022, for example, the S&P 500 ended the year down more than 19% while the Bloomberg U.S. Aggregate Bond Index dropped 13%. Comparatively, the NCREIF Real Estate and Farmland indices were up 5.5% and 9.6% year to date, respectively.

- Hedge Against Inflation

Historically, both farmland and real estate returns have benefited from rising inflation. Returns for these assets tend to move in lockstep with rising prices; rental rates, for example, may increase, as will the cost of food at the grocery store. Driven by strong commodity prices that began in 2020, farmland’s correlation to the Consumer Price Index (CPI) has been 0.97; real estate’s correlation with the CPI is 0.25.

An Allocation to Farmland

While institutions have been eyeing farmland for decades, individual investors can now get in on the action thanks to farmland investment manager FarmTogether.

FarmTogether enables individual investors to grow their portfolios with institutional-quality farmland opportunities across the US – without requiring any farming know-how. With more than $1.2B of collective capital deployed, FarmTogether’s expert investment team takes care of it all, from sourcing and due diligence to the operations of the farm.

Interested in diversifying your real estate portfolio to include farmland, but not sure where to start? FarmTogether offers a variety of channels designed to fit a range of investor needs. Their flagship crowdfunding product enables fractional farmland ownership for qualified investors starting at a low minimum of $15k. For those seeking a more hands-off approach, their Sustainable Farmland Fund offers diversified exposure to a portfolio of institutional-grade farmland through a single allocation. The firm also offers Bespoke deals for investors seeking fully customizable capital structures and risk-return profiles, and supports 1031 exchanges.

Visit FarmTogether.com for more information.

You must be logged in to post a comment.