Why AI Firms Are Taking a Measured Approach to Office Leasing

Many of these companies in the Bay Area opt for plug-and-play models.

AI companies in the San Francisco Bay Area are taking a more cautious approach to office leasing than startups in previous cycles, according to Newmark’s latest report.

These firms are delaying commitments while gradually expanding their footprints, to avoid significant swings in rapid expansions and subsequent downsizings.

Since the beginning of 2023, AI companies accounted for 20 percent of all leases signed in the Greater Bay Area and, together with other tech sectors, nearly 44 percent of all leasing activity.

AI firms’ lease terms generally lean toward three years rather than the average of approximately five years or more for non-AI tenants. Since the start of 2023, most AI leases (61 percent) in San Francisco were signed for sublease space. In Silicon Valley, 25 percent were subleases.

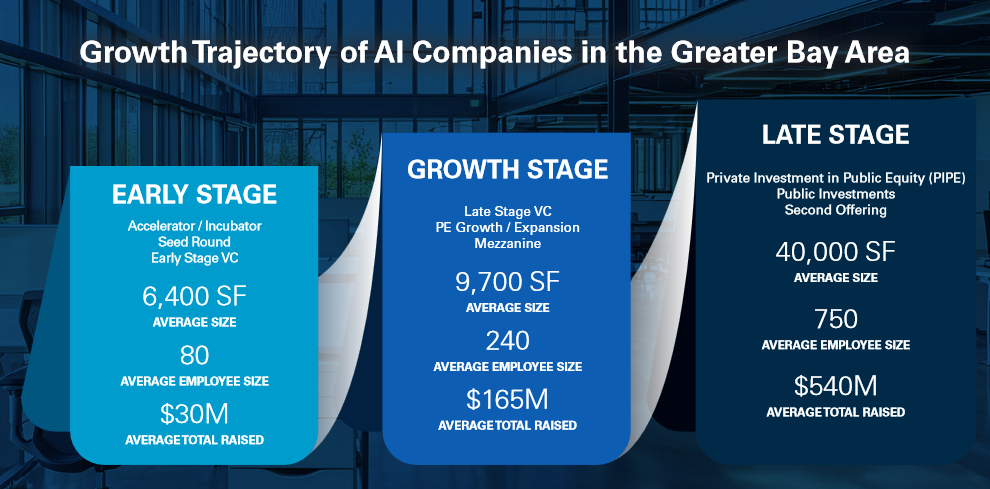

Newmark also reported that since the beginning of 2023, San Francisco AI firms signed on for an average of 4,700 square feet in the early stage, increasing to 9,200 square feet during their growth phase. As these companies hired more employees, their space needs jumped to an average of 28,500 square feet.

However, earlier this month, AI-powered company Notion signed a 105,000-square-foot, 10-year lease at The Monadnock Building. The 204,625-square-foot office building in San Francisco’s South Financial District submarket is owned by Brookfield Properties. Notion will occupy five floors at the 10-story property, with the option to expand.

Tech firms coming and going

San Francisco has now experienced flat or declining rents for eight consecutive quarters, Moody’s Data Scientist David Caputo told Commercial Property Executive. Among the 15 traditional tech markets, rents only declined in San Francisco (by 0.3 percent), according to Moody’s third-quarter data.

X’s San Francisco headquarters is relocating to Austin, Texas. Legal and financial disputes have surfaced, including a lawsuit against X for unpaid rent on its San Francisco headquarters and controversy over unauthorized modifications to its office space, Caputo said.

“This departure exemplifies a broader trend of tech companies scaling back their presence in downtown San Francisco,” Caputo added. “However, there is optimism for reversing this trend, fueled by the number of AI companies in the Bay Area.”

READ ALSO: Return-to-Office Traffic Reaches Record Level

These entities attract significant venture capital investment and show a marked preference for maintaining office-based work environments, according to Caputo. “Consequently, leasing activity has witnessed a 40 percent increase, with tenant demand surging. Over 25 AI companies have sought 1 million square feet of office space this year alone.”

He added that efforts by local officials and community organizations to revitalize downtown areas are noteworthy. Initiatives such as cultural events and pop-ups aim to rebuild office demand. These measures, with the growth of AI companies, are anticipated to reduce San Francisco’s vacancy rate by 2025.

The capital of AI

Not only have AI companies been responsible for leasing larger blocks of space in San Francisco over the past couple of years, but their rapid growth means that this activity has translated into positive absorption and occupancy growth, according to Robert Sammons, Cushman & Wakefield’s research director in Northern California.

San Francisco and the Bay Area have become the “capital of AI” not only because of the number of companies located there (730 at last count at the end of the third quarter of 2024 in the Bay Area, with 440 of those residing in San Francisco—out of 3,344 globally) but also because of the venture capital being pumped into them.

According to PitchBook, through the third quarter of this year, Bay Area companies have absorbed 67.8 percent of global generative AI funding and 31 percent of global funding into San Francisco-based companies alone. Over that time, 23 of the top 50 VC funding transactions went into Bay Area companies, with 10 in San Francisco proper.

“Something to be aware of going forward—there will undoubtedly be M&A activity among some of these AI companies, which could either create further expansion among the winners or a decline in leasing and hiring as well; it’s just too soon to tell,” Sammons said.

AI talent is concentrated in the Bay Area

AI companies have nearly doubled their footprint since 2021, occupying close to 11.6 million square feet in the Bay Area, according to Chris Pham, senior research analyst for JLL.

“AI talent is primarily concentrated in the Bay Area, which will remain an AI superhub,” Pham said.

AI companies have been growing at roughly 37 percent on a compound annual growth rate since 2013, Pham added. The Bay Area AI footprint this year stands at 1.1 million square feet in the East Bay, 1.9 million square feet in the Mid-Peninsula, 3.8 million square feet in Silicon Valley and 4.8 million square feet in San Francisco.

READ ALSO: Are Coworking Networks the Future of Office?

New-to-market AI deals, primarily from new startups, make up close to 40 percent of the AI count this year in the Bay Area, Pham said.

OpenAI, Notion, Anthropic and many other AI firms generated leasing activity of well over 1 million square feet in 2024 alone, according to Markus Shayeb, senior vice president & San Francisco managing director of TRI Commercial Real Estate Services/CORFAC International.

“Numerous AI-related companies are searching for spaces exceeding 50,000 square feet, making up the majority of predicted office leasing activity in 2025 in San Francisco alone,” Shayeb said. “As many as 100 companies with less than 50 employees are searching for space.”

A struggle with gentrification and displacement

The Bay Area had seen a significant drop in office space occupancy since COVID-19, but now we’re seeing a surge in demand, particularly from companies focused on AI, said Mahalakshmi Balachandran, senior associate in the Northern California Office of McCullough Landscape Architecture.

This shift is driving a need for different types of spaces, such as those with a larger footprint for data centers. “At the same time, there’s a growing preference for sustainable building practices and adaptive reuse of existing structures. However, while AI brings new opportunities, it raises concerns about equity and accessibility.”

The Bay Area real estate market has long struggled with gentrification and displacement, Balachandran added. “Without careful oversight, AI could worsen these issues, making it harder for low-income and marginalized communities to own homes. When working with existing data, AI tools can reinforce existing patterns of exclusion within neighborhoods. There needs to be a cautious integration and approach to inferring the results of such analysis.”

You must be logged in to post a comment.