Why C-PACE Loans Are at a Record High

In light of the current finance environment, originations and available capital are soaring.

READ ALSO: CRE Experts See Opportunities Ahead

NGC also saw the average C-PACE loan size jump nearly threefold, Bailey said, in part because projects overall were larger, and NGC was able to fill larger pieces of borrowers’ construction budgets due to its ability to raise capital quickly.

C-PACE is a green financing mechanism enabled by state policy that provides fixed-rate, long-term, non-recourse, non-dilutive loans for up to 30 years for any aspect of construction that improves building energy or water conservation.

It is structured so the assessment is attached to the parcel of real estate rather than to the sponsor of the property and so does not require the sponsor to put up the collateral. And since the debt is collected on the property tax bill, some owners can pass on the cost of financing as common area maintenance charges to tenants, who are enjoying the benefits of improvements, Bailey suggested.

A most ‘favorable’ option

Last August, Bay Area developer TMG Partners did the biggest C-PACE office deal ever, securing a $172-million C-PACE loan from San Francisco-based GreenRock Capital and Cleveland-based KeyBanc Capital Markets for sustainability upgrades at 300 Lakeside Drive in Oakland, Calif.

C-PACE financed upgrading or replacing fire protection, electrical, plumbing, and mechanical systems with high-efficiency equipment and materials; sealing of the building envelope for energy efficiency; a complete seismic retrofit; and energy-efficient lighting throughout workspace in preparation for new tenant Pacific Gas & Electric Co.

PG&E is moving its headquarters here from San Francisco, inking a 35-year lease for the iconic, mid-century, 28-story office tower that anchors the city’s thriving Uptown Area on Lake Merritt. PG&E, however, has announced plans to exercise an option to acquire this LEED Platinum-certified office building for nearly $900 million, with closing sometime in 2025.

The largest C-PACE office loan ever was completed this summer for sustainability upgrades at 300 Lakeside Drive in Oakland, Calif.

“This was the first time we have used C-PACE, and it was efficient for large, single-tenant office financing in the current (interest) environment, where that type of financing has been very challenging,” reported Matt Field, TMG Partners’ Co-CEO. He noted that, since C-PACE loans are transferrable to a new owner, PG&E can either assume the loan balance or pay it off when it closes on the building.

“C-PACE continues to be an increasingly attractive option from an investment point of view because it’s relatively low-levered; financing sustainability that is critical for developing or redeveloping in today’s buildings; and a very secure financial instrument,” said Joe Euphrat, GreenRock managing principal. “In competing with other financial sources, C-PACE is not only more favorable now, but one of the most favorable options,” he contends.

Public-private benefit

C-PACE lenders can offer such favorable terms because it is a public-private partnership that leverages private capital but utilizes the public-benefit funding mechanism typically used to finance public infrastructure, Bailey explained.

The program allows debt to be repaid as a benefit assessment on the property tax bill over a term that matches the useful life of improvements and/or new construction infrastructure (typically 20 – 30 years) and can be transferred to new owners as a property lien.

This type of financing, which can fund up to 40 percent of a project’s total cost, is available for all types of commercial real estate assets, requires no equity investment, and can be used to upgrade or install sustainability features in existing buildings or ground-up construction that reduces energy consumption or conserves water, as well as the related labor costs. It also finances seismic, storm, fire and flooding resiliency infrastructure upgrades in markets subject to earthquakes, hurricanes and flooding, like California and Florida.

Jason Schwartzberg, president and co-founder of MD Energy Advisors, cites other advantages for developers. “If a project starts to go over budget or isn’t leasing up as fast as predicted in the proforma, we can retroactively finance the deal as long as a certificate of occupancy had been issued within 36 months,” he explains, noting that C-PACE also can eliminate high-cost, mezzanine financing to fill funding gaps.

The matches that lit the fire

The upswing in C-PACE loans can be attributed to several factors. “The extreme volatility we saw in the capital markets left more traditional commercial real estate lenders on the sidelines and created gaps in capital stacks that C-PACE was strategically positioned to fill,” Bailey said “And for the first time since I’ve been doing C-PACE lending, we were often able to price inside a senior mortgage.” C-PACE already had several structural benefits attractive to developers, Bailey noted. “When we paired the structural advantage with a pricing advantage, we saw originations tick up quickly.”

C-PACE deals increased over the last year in step with rate increases by the Fed, which slowed the pace of lending by commercial banks, according to Schwartzberg. With the highest Fed rate in decades, capital lenders tightened lending terms and policies and increased equity requirements. His firm did four C-PACE deals in the last quarter of 2023 alone.

As a result of the Fed’s moves, PACE rates are now lower or on par with the “go-to lenders” for construction loans, he adds, noting that previously bank rates were often lower. C-PACE loans range from 7.5 percent to 8 percent, compared to bank construction financing at 10 percent to 15 percent, depending on the length of the loan, location, property type, and the sponsor’s credit rating, according to Commercial Loan Direct.

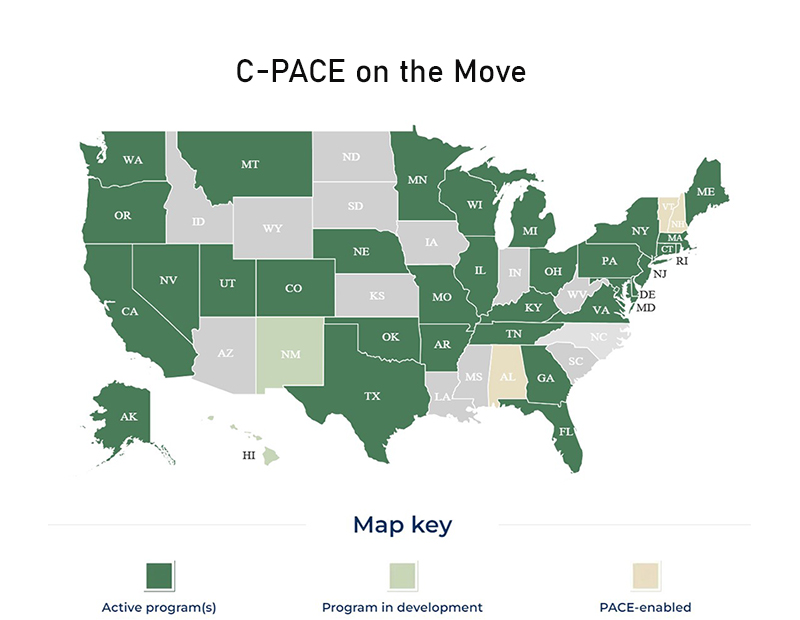

This financing tool, however, can only be accessed in states that have passed PACE-enabling legislation and in counties or local jurisdictions permitting it. For example, there are 10 local jurisdictions in California that permit PACE benefit assessment, property-tax financing. PACE-enabling legislation is now active in 38 states plus D.C. and launched and operating in 30 states and D.C. Additionally, three other states are considering PACE-enabling legislation, including Arizona, North Carolina and South Carolina, according to Schwartzberg.

Schwartzberg also suggests that the increase in C-PACE loan originations may be partially due to additional states adopting PACE-enabling legislation, the most recent being Alaska, Hawaii, Massachusetts, Nevada, Tennessee and Washington, and authorization by more local jurisdictions.

Sky’s the limit

There is no size cap for C-PACE loans. The loan amount is based on the project’s energy savings and is only limited by the sponsor’s credit rating and underwriting to ensure sufficient cashflow to service all debt. That’s why C-PACE loan amounts are hitting record highs. “PACE is increasingly becoming part of developers’ capital stacks, even for ‘Blue Chip’ or strong sponsors, and is being leveraged to fill equity gaps.” Schwartzberg said.

In addition, the PACE lending market is expanding. There currently are about 300 national, regional, and local mortgage lenders nationwide that offer PACE financing. But according to the Crittenden Report, other lenders, including major banks, are looking at acquiring PACE shops or taking steps to become approved PACE providers.

However, Schwartzberg cites the three hurdles to qualifying for C-PACE financing: (1) underwriting must demonstrate the project will generate enough cashflow to service both the primary mortgage and C-PACE loan, (2) it must pass a technical review, which uses permit plans, the schedule of values and COMcheck forms to quantify and confirm the project’s energy- and water-related content exceeds code, and (3) the borrower must ascertain written consent for a C-PACE loan from the primary mortgage lender.

Meanwhile, the amount of capital available to developers also is increasing, as more investors, including institutional investors, see C-PACE as an attractive, low-risk investment. According to PACENation, which promotes and supports growth in PACE market participants, capital investment in financing by private and institutional investors for commercial projects now exceeds $7.2 billion.

Last year, for example, NGC and parent company Nuveen launched a fund to provide insurers an opportunity to access a portfolio of investment-grade, clean-energy assets, following a survey in which 82 percent of insurers said they plan to consider impact investments in the next year and 55 percent of insurers In North America said they take climate strategy into account in their impact investing approaches.

As a result, six major insurance firms allocated a total of $525 million to the NCG fund to finance energy efficiency and sustainability projects. “As an investment product, C-PACE typically offers higher yields compared to similarly rated products, such as commercial mortgage-backed securities or municipal and corporate bonds,” noted Bailey. “The underlying security has proven to be a good fit for life insurers because it provides strong capital-efficient income, duration and diversification, and the opportunity for impact investment without sacrificing risk-adjusted return versus other fixed income products.”

You must be logged in to post a comment.