Why CRE Investors Are Rethinking Refinancing

Interest rates are still historically low, but lenders and investors are more conservative since the Fed began its aggressive tightening.

Rising interest rates, growing inflation, fear of recession and a war in Europe give commercial property players ample reason to put extra thought into whether and when to refinance their current debt.

Last month, the Federal Reserve raised the federal funds rate 75 basis points to a target range of 1.5 percent to 1.75 percent in order to control runaway inflation. Meanwhile, the 10-year Treasury yield had doubled from 1.6 percent at the beginning of the year, and the short-term Secured Overnight Financing Rate had climbed some150 basis points from near zero.

During the first quarter, investors were eager to refinance in order to take advantage of high valuations and to get in the market before the Fed started hiking its benchmark interest rate to ease inflation. Now, many are hesitant to tap the debt markets because interest rates have risen so rapidly since March, and lender underwriting is reflecting economic uncertainty and increased risk. There is even talk of “negative leverage” for some properties if the cost of capital is higher than a property’s cap rate.

Read Also: What Rising Interest Rates Mean for Net Lease Investors

”The hurry-up concept has passed, as most of our clients are now considering holding or waiting to access the market, thinking there will be an opportunity to see lower yields in the future and spread compression as the market settles,” pointed out John Alascio, vice chairman at Cushman & Wakefield.

Nipul Patel, head of real estate banking at Wells Fargo, was even more emphatic: “Broad brush, borrowers are waiting till their maturities come up. … They’re sticking with their current instruments.”

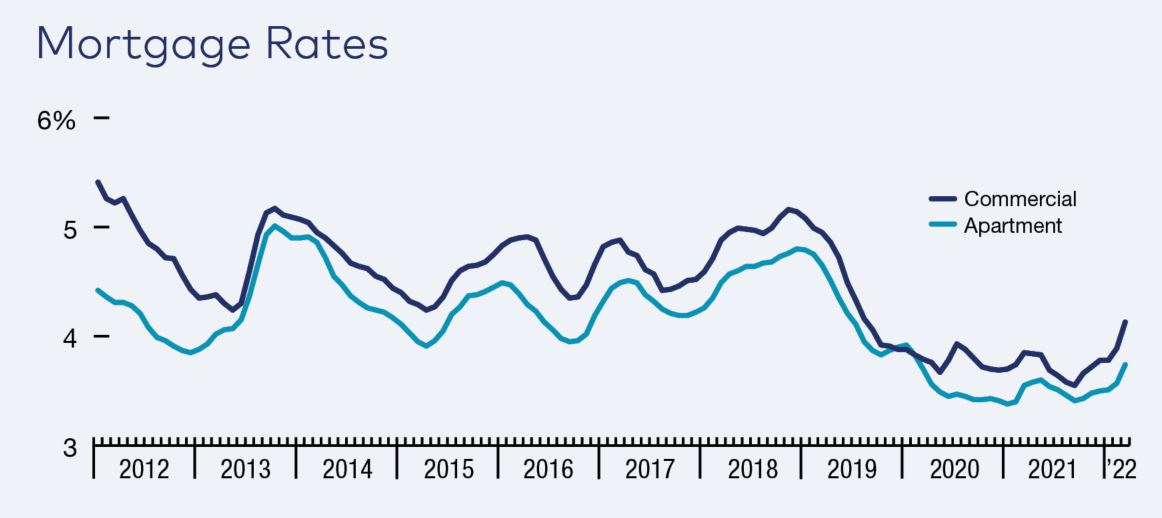

Mortgage Rates Are Still Low

Despite the increase in borrowing costs, interest rates are still historically low and many financing executives believe there’s still time to secure terms that will gird properties and portfolios for whatever lies ahead economically.

“The Fed is going to hike rates till it hurts,” said Jay Maddox, principal in capital markets at Avison Young, noting it started raising rates too late and will probably overcorrect the U.S. into recession. The Fed, however, is still hoping to bring inflation back down to 2 percent without tanking the economy.

Under current circumstances, Maddox advises clients to get the longest-term, fixed-rate loans they can get, and he’s also trying to put his borrowers into balance-sheet loans.

One of Maddox’s clients, a lower-leveraged owner-developer that currently focuses on NNN, single-tenant leases with investment-grade tenants, is using refinancing as a way to build a war chest to make some opportunistic acquisitions in the office sector.

Borrowers entering the debt markets for refinancing, however, will find a different environment than earlier this year.

“Much of the current market has priced in the projected inflation and rate increases,” Alascio added. “Rates are higher across the board, and lenders are more critical of underwriting and rent projections.”

Proceeds are being constrained as a result of Fitch underwriting models and stressed DSCR standards. And lenders are cutting back on leverage to meet their coverage tests.

For example, Van Leer noted, a lender that wants to see a 1.3x coverage isn’t offering the same loan amount today as six months ago, if its rate is now 150 basis points wider.

“As a result, we’re seeing a trend where debt funds and sub-debt providers are playing a larger role in the capital stack,” he remarked.

The rate increases make alternative sources of debt no longer contingent on the public markets for leverage or securitization, as well as more competitive and dependable, Alascio added.

Meanwhile, the rise in rates has created opportunity, according to Van Leer. “Prepayments based on defeasance/yield maintenance are now cheaper, which gives a borrower more flexibility for exit to sale or refinance ahead of their maturity,” he said.

JLL arranged a $215 million refi for a 30-property portfolio—retail, medical and traditional office space—for Paramount Realty. “We locked rate earlier this year, and as we worked towards a closing, Treasuries continued to rise, thus reducing our prepayment penalty,” said Van Leer, noting JLL’s debt transaction volume was up 61 percent in the first quarter of 2022 vs. the first quarter of 2021.

Defeasance costs on CMBS loans have also come way down, Maddox noted.

Refinancing for the Remainder of the Year

The Fed is forecasting a 3.25 to 3.5 percent fed funds rate by year-end, but it could be higher if necessary, and 10-year Treasury yields will remain around 3 percent, according to Nuveen.

“Continued recession discussions will put further strain on capital markets’ debt,” he added. “Banks and other providers of debt will be even more conservative.”

But most lenders are not retreating from the market. Commercial real estate has proven to be a secure investment during inflationary times, and banks are encouraged by consistent and increasing equity investment as well as strong rents, occupancies and overall fundamentals.

“(Lenders) like the market they’re in,” Van Leer said. “They have ample liquidity, and they’re able to gain a higher yield at a much lower leverage point.”

For borrowers, the choice of whether or not to refinance depends mostly on their view of where we are and where we’re headed, Van Leer said: “If you take the approach that rates are not compressing over the next six to 18 months, and there’s a chance we go into a recession in a couple years, one might pursue a five- or seven-year fixed-rate financing with some flexible prepay option vs. locking in a 10-plus-year loan.”

You must be logged in to post a comment.