Why Foreign Investment in the US Looks Different

The country still attracts billions in cross-border capital but the players and strategies have changed, a panel at the 2019 CREW Network Convention reveals.

Three years ago, Chinese investment in U.S. real estate hit a peak of $46.5 billion. The country’s biggest players—Anbang and Wanda Group—plunked down billions of dollars for high-profile properties in core markets of the country, including New York City. But now, with an investing atmosphere shaken by trade wars, uncertainty surrounding the stability of the U.S. government and the ever-looming threat of a recession, what foreign investment looks like in the U.S. has experienced a significant shift.

“It’s changing, but it’s not the end of the world,” said Jim Costello, Senior Vice President at Real Capital Analytics, at a panel on foreign investment at the 2019 CREW Network Convention in Orlando, Fla., on Sept. 26. Costello noted that for the first time in seven years, cross-border investors are selling more than they are buying.

READ ALSO: Capital, Interest Rates Battle as Properties Obsolesce Faster

“Don’t panic,” said Costello. “There are a lot of negative things in the news these days, but if you look at some of the fundamentals in the U.S. economy, there’s still a lot of good reasons to be in U.S. real estate.”

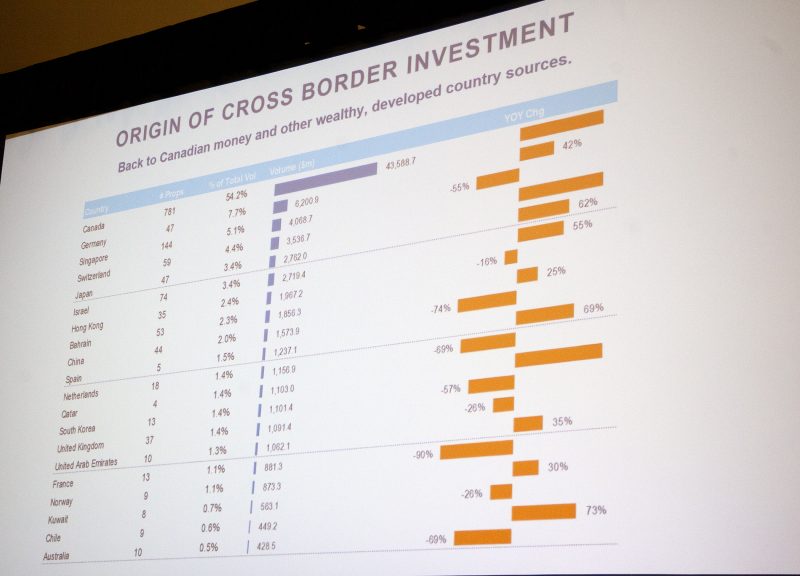

While Chinese investment has pulled back dramatically, other countries have filled in the gap. Canada is the top foreign investor of American real estate, with 54.2 percent of cross-border investment, followed by Germany with 7.7 percent, according to data from Real Capital Analytics.

Looking at new markets

Foreign investors aren’t just looking to acquire office properties—retail, industrial and senior housing and care assets are attracting more capital. The interest in new sectors can be attributed at least in part to wariness in investing in primary markets and sectors due to cap rate compression.

“We’ve talked to a lot of groups about importance of Seattle and Chicago,” said Maggie Coleman, a managing director in international capital at JLL. “In some ways those are acting more like primary markets. We’re working on education around secondary market exposure.”

In the multifamily sector, Canada has emerged as one of the biggest investors in the U.S., picking up large portfolios in the southeast and southwest regions, where the development of workforce housing has flourished.

“They saw workforce housing before it became the darling of multifamily,” said Coleman. “They really identified that this is where middle America rents and works and this part of America is not going anywhere.”

What lies ahead

Despite the higher cost to investors, medical office and senior housing properties are getting more attention, as the demographic wave of aging Baby Boomers is leading to an uptick in demand for these kinds of properties.

Investor concerns over regulatory issues such as rent control could indirectly give secondary markets a boost, as most of the regulations that have been implemented have been affecting coastal cities.

“They’re pausing when they look at states and cities where they implemented or are having some kind of regulatory conversation and may implement in future,” said Coleman.

Analysts are also anticipating a big influx of investor money coming in from Japan, where $8 trillion in pent-up capital is yet to be deployed, with a large amount needing to go into real estate.

“We’ve been courting Japanese investors for a while,” said Coleman. “But then we saw an influx from Singapore. We saw their REITs and pension come out with capital in a very meaningful way. That has really supplemented the Japanese capital, which we’re still waiting for.”

You must be logged in to post a comment.