Why Industrial Space Demand Exceeds Expectations

NAIOP’s new report offers predictions for supply and demand over the next several years.

The latest NAIOP Industrial Demand Forecast notes that nearly 100 million square feet of new industrial space has been completed so far this year, and it’s still not enough to meet the demand.

According to the report, 450 million square feet is under construction and another 450 million square feet is planned. Nevertheless, the robust demand for space—driven by sustained growth in e-commerce and an improving economy—led NAIOP’s authors to project increasing net absorption for the second half of this year and 2022.

Dr. Hany Guirguis of Manhattan College and Dr. Michael Seiler of the College of William & Mary forecast total net absorption in the second half of 2021 to be 162.6 million square feet, with a quarterly average of 81.3 million square feet. The team projected net absorption of 334.6 million square feet for 2022 with a quarterly average of 83.6 million square feet.

In their first quarter 2021 NAIOP report, Guirguis and Seiler forecast a quarterly average net absorption of 78.7 million square feet. They also previously projected net absorption of 231.6 million square feet for 2022, with a quarterly average of 57.9 million square feet.

An improved economic outlook for 2021 and 2022, Guirguis and Seiler said, prompted the increase in the third quarter 2021 forecast. One factor cited is the real GDP growth rate that is now projected to be 7 percent for 2021 rather than the previous forecast of 5 percent growth. The report notes, however, that economic growth is projected to revert to long-term growth rates in 2023 leading them to project net absorption in the first half of 2023 to be 160.5 million, with a quarterly average of 80.2 million square feet.

“Even though the increases in COVID-19 cases that we are seeing now threaten once again to disrupt a stable overall economic rebound, industrial real estate has been and remains a bright spot in the commercial real estate industry,” Thomas Bisacquino, NAIOP president & CEO, said in a prepared statement. “Lower unemployment rates and increased consumer demand should continue through the end of the year, sustaining the growth need for warehouse and distribution facilities.”

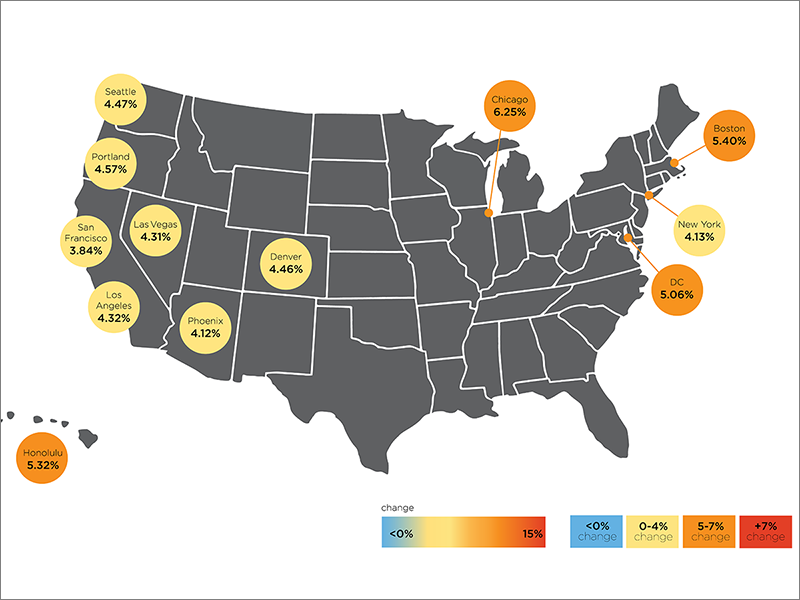

Rents, sale prices up

The report notes that even as the supply increases, vacancy rates remain low, leases are being signed at higher rates and industrial transaction prices per square foot are increasing, particularly for properties in coastal port cities. In addition to the continuing long-term trend toward e-commerce, the NAIOP forecast stated a continued surge in imports for retailers that need to restock depleted inventories has exacerbated the shortage of warehouse space near major logistics hubs.

Other factors that are leading to more construction and higher transaction prices include the continued need for more last-mile industrial space and cold-storage facilities and increased interest by investors drawn to the strong returns on industrial real estate. While the demand has increased, the report does note that the rising cost of building materials and construction worker shortages could delay industrial completions.

Taking a look at more economic trends, Guirguis and Seiler note unemployment rates have fallen and school reopenings are expected to lead to more people rejoining the workforce. Consumers, who had been saving during the pandemic, are spending more on goods and services. While the Delta variant of COVID-19 has renewed concerns about the pandemic’s impact on the economy, the report notes it could mean people shift more of their purchases back to e-commerce, which would support more demand for industrial real estate.

In October, NAIOP released a research report, “The Evolution of the Warehouse: Trends in Technology, Design, Development and Delivery,” that looked at supply chain patterns driven by the rise of e-commerce and changes in the industrial sector. The report examined the growing use of automation, data analytics and artificial intelligence from mega-warehouses to smaller, last-mile distribution providers and also predicted increasing demand will lead to more retail locations being used for distribution sites.

You must be logged in to post a comment.