Why Office Loans Are Few and Far Between

Investors and developers looking to build or buy office assets can expect to pay more for their loans–if they can get them.

Lending for new office construction and acquisition deals has all but disappeared in recent months. Financings that are getting done are often for newer build properties in high-growth markets or submarkets. And those fortunate enough to receive financing should expect tighter underwriting and a higher cost of debt.

Brad Zampa

“The appetite and desire to finance office as a product type is a 180-degree change since Q2 2022,” said Brad Zampa, an executive vice president on CBRE’s San Francisco Capital Markets team specializing in Debt & Structured Finance. “The uncertainty around return to office, interest rate increases, lack of tenant demand and massive negative absorption has ultimately caused liquidity to dry up almost completely.”

During the first half of the year, CBRE was financing value-add and stable office assets and portfolios, but the market is almost non-existent now.

“We did market a vacant office financing in Q3 and received only three bids with spreads two to three times higher than similar deals six months prior,” he said.

Lenders are backing down leverage across the board, and rising interest rates have stressed underwriting, particularly as it relates to exit debt service criteria, which can further reduce leverage, Zampa said: “Lenders are equally as focused on funding a lower overall last-dollar basis and reducing interest only periods, preferring amortization to accelerate paydowns.”

The Exchange Raleigh in Raleigh, N.C., where DeWitt Carolinas, Inc., recently received financing for 1000 Social, the first office tower. Rendering courtesy of DeWitt Carolinas Inc.

Beyond the Economics

All property types are experiencing some disruption in liquidity due to the impacts of macroeconomic conditions on the financial markets. But the problem for office is more extensive and potentially more long-lasting, according to Justin Kennedy, co-founder & managing partner of 3650 REIT.

Justin Kennedy

“We’re definitely not dealing with an excess of new supply constructed in recent years, which has been the fundamental problem in past crises. said Kennedy, whose Miami-based investment firm originates and services portfolio loans for relationship borrowers. “This is clearly a ‘demand shock’ and it’s one that is not even close to played out yet.”

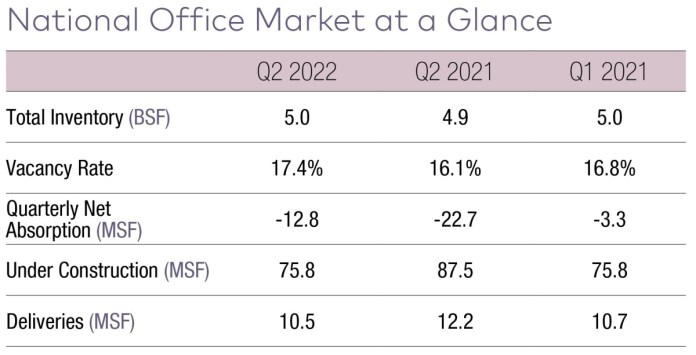

According to Newmark’s Q2 2022 National Office Market report, there were 10.5 million square feet of new office deliveries in the second quarter compared to 12 million square feet in Q2 2021. Office space under construction also dropped year-over-year going from 87.5 million square feet in Q2 2021 to 75.8 million square feet in Q2 2022.

In recessionary periods, office and retail tenants are reluctant to make new office leasing commitments. But there is another force at play in the office market.

“Today we’re seeing pullback because people just don’t want to go to the office anymore,” he said.

For the first 12 months after the pandemic through the summer of 2021, there was decent financing available for good office assets, noted Keith Largay, senior managing director, co-lead, Midwest Capital Markets at JLL.

Jamie Woodwell

“What started to change in the second half of last year, and really took hold in 2022, is that there’s just huge uncertainty over demand and what demand characteristics are going to look like in the office sector,” Largay said.

Second-quarter originations for office properties were down 11 percent year-over-year compared to a 24 percent increase for multifamily and a 3 percent increase for industrial, according to Jamie Woodwell, vice president of research at the Mortgage Bankers Association. Lending for retail and hotel had bounced back from low levels while office continued to lag.

The MBA updated its baseline forecast in late July to reflect an anticipated slowdown in overall lending in the second half of the year. MBA expects total commercial and multifamily mortgage borrowing and lending to fall to $733 billion in 2022, down 18 percent from $891 billion in 2021.

Woodwell did not have estimates for office-only lending. Should the economy enter a recession, however, commercial and multifamily borrowing and lending would likely be further constrained in 2023, he said.

Closing a deal

Despite the volatile debt markets, in late September, DeWitt Carolinas secured a $139 million construction loan from alternative lender ACORE Capital for “1000 Social,” the first office tower at The Exchange Raleigh, a $1 billion, 40-acre mixed-use project in Raleigh, N.C. Avison Young arranged the financing. The project will eventually comprise two 12-story office towers totaling 330,000 square feet of Class A office space.

Ed Soccorso

“Although there are fewer lenders who are willing to finance new projects right now, we’ve got strong relationships and a great track record, which always makes things easier on the financing side,” Soccorso said.

He also cited three other factors in the firm’s favor: 1000 Social is part of The Exchange Raleigh master-planned, mixed-use community that has garnered a lot of interest; Raleigh continues to be an incredibly attractive market: and DeWitt Carolinas has a significant equity commitment in the project. Upon buildout, the project will include 790,000 square feet of Class A office space; 1,275 residential units; 300 hotel rooms; and 125,000 square feet of retail and dining.

Mixed-use developments also help mitigate a lender’s exposure with diversified product and diversified income streams. For office-only projects, the flight to quality is a reality and the newer the building the better chance a borrower has of getting either construction or acquisition financing.

For the few office construction deals that are being done, credit tenant preleasing is the starting point for lenders, Kennedy noted.

Source: Newmark 2Q22 National Office Market Report

“Going from there it becomes just how special is the story of your location and amenities,” Kennedy said. “Would there have to be a recourse component? If we were dealing with a bank, yes. A debt fund? If the story is good enough, I think probably not. It’s all going to be about how clearly the ‘specialness’ can be defined as driving demand for the space in that particular area.”

3650 REIT hasn’t done an office construction loan since last year when it financed a property in Houston’s River Oaks district, Kennedy said. The firm recently bid on a Miami office construction deal, but its pricing wasn’t sufficiently aggressive to get the deal. The sponsors are still in the market for the right deal.

“If somebody showed up with a building that had a credit tenant, was in a special location and we had good confidence about a lease up for the rest of the space, I think we would still look at it,” Kennedy said. “It certainly would be a lot pricier than last year, but we would still look at it.”

Sell or hold?

Investors hitting the end of their business plans must decide whether they will sell or hold their assets longer. Largay expects a good number will sell because, even though the cost of capital will hurt their pricing, they know that is not going to change over the next 12 to 18 months or 24 months and, if they wait, they will also have a lower average lease term. Meanwhile, closed-end funds may sell if they don’t have extensions left on their fund.

Keith Largay

JLL closed an office building sale in the Dallas market in September for a four-year old, Class A building that was 80 percent leased. While the owner of 3400 at CityLine in Richardson, Texas, could have held on to the asset for another year or two, adding more value and selling at a better time in the market, they decided it was the right time from a portfolio standpoint to sell.

Largay said the buyer, who used a debt fund to finance the acquisition, was willing to accept the risk to continue leasing up the building because it was a high-quality building purchased at below-replacement cost with a good weighted average lease term in a growth market and a good submarket.

He said many debt funds are willing to lend on office if there are quality property demand fundamentals.

“Where they’re challenged is all of those debt funds leverage themselves,” Largay said. “Historically the primary source of leverage has been the money center banks. The money center banks have pulled back significantly on real estate lending due to regulatory requirements.”

With banks reducing their leverage on all property types, many debt funds are having to finance their positions with smaller regional banks. Lower internal leverage is driving up their cost of capital, which they are passing on to borrowers with higher spreads.

Insurance companies and office

Tony Kaufman

Tony Kaufmann, a director in the San Francisco office of Gantry, Inc., the largest independent commercial mortgage banking firm in the U.S., said life companies are still considering office deals, particularly those with high-quality properties and strong market fundamentals, but the leverage will be lower and the rates will be higher. For Gantry, life companies provided both the most loan volume and loan values so far this year.

“I think one of the things that life companies benefit from and why they’re still looking at office assets selectively is that they are inherently conservative lenders,” Kaufman said. “They are predominantly all non-recourse lenders.”

CMBS is still a good source of liquidity for office assets, Largay said, but activity has fallen due to the pricing, which was at 6 percent in September and could go higher depending on where interest rates go. For borrowers willing to pay CMBS rates, the market is functional, and debt is available.

In addition to CMBS lenders and select life companies, experts report some regional banks, credit unions and select un-levered debt funds are still active in stabilized office deals, but underwriting will be conservative due to interest rate increases and continued leverage.

“It’s not fully predictable where we’re heading,” Largay said. “As there continues to hopefully be upward momentum on cap rates, there will be a little more success with deals penciling in better.”

You must be logged in to post a comment.