Wielding the Scalpel: New Strategies to Maintain Control of Operating Expenses

It might seem as if property managers ran through their entire bag of cost-cutting tricks during the past couple of years, but property managers are turning to alternative means of saving dollars, including energy audits, renegotiation of contracts and tax savings.

It might seem as if property managers ran through their entire bag of cost-cutting tricks during the past couple of years. In the quest to keep assets in the black, managers renegotiated vendor contracts, reduced staffing levels, trimmed outlays for landscaping and maintenance, and switched out conventional light fixtures for low-usage new bulbs.

“I think most companies have done the easy tightening of the belt already,” said Barry Saywitz, president of the Saywitz Co., a diversified investment and service firm based in Newport Beach, Calif. Many of these cost-cutting methods have become standard during the past several years, which only raises expectations that managers will find ways to reduce costs or keep them flat.

In that regard, there is good news on several fronts. Given the slow pace of the economic recovery, big price jumps for most categories of operating costs appear unlikely. Some categories of expenses call for specialattention.

“The place where I would keep a close watch is energy,” said Tony Long, president of asset services for CBRE Group Inc. Even so, bargaining with utilities continues to yield savings. Brookfield Real Estate Opportunity Fund engineered a $150,000 annual cost savings at Convergence, a 650,000-squarefoot, five-building office campus located in the New York City suburb of Whippany, N.J. An affiliate of Brookfield Asset Management Inc., the fund negotiated a new utility contract after acquiring the campus from JPMorgan Chase in early 2010 as part of a 16-asset, 2.9 million-square-foot sale-leaseback deal. A new contract negotiated with the campus’ electric utility trims costs 75 cents per square foot, which translates into a $150,000 savings annually.

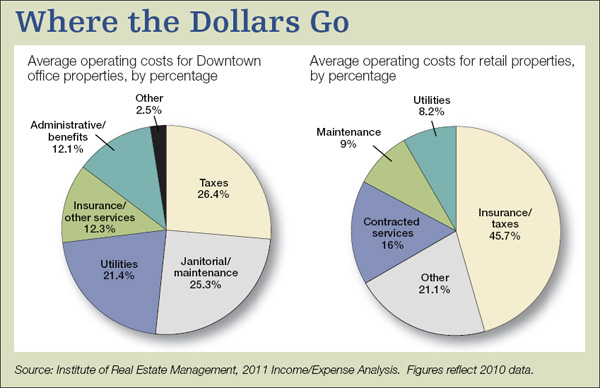

On the positive side, many cost trends appear to favor owners. Competition among vendors kept the lid on pricing during the recession, and the trend may continue during the slow-paced recovery. In the retail sector, for instance, average operating costs declined from $5.36 per square foot in 2009 to $4.38 per square foot in 2010, according to the Institute of Real Estate Management’s most recent annual survey. Although due to the exhaustive nature of research there is a year’s lag time in reporting these findings, the results are suggestive of overall trends in a relatively slow-changing climate.

Among retail operating costs, insurance and taxes accounted for 45.7 percent of overall expenses in 2010, followed by contracted services like security, landscaping and trash hauling, which made up 16 percent of expenses. Maintenance and repairs were 9 percent of the total, according to IREM’s research, trailed by utilities at 8.2 percent. On a regional basis, operating costs were twice as high in the Northeast and Mid-Atlantic regions ($6.99 per square foot) as they were in the Southeast ($3.11 per square foot).

Operating expenses have also been declining lately for most categories of multi-family properties. Between 2009 and 2010, expenses slipped 1.3 percent for high-rise elevator complexes, 1.7 percent for garden apartments and 1 percent for low-rise buildings with 25 units or more, according to IREM. Only among low-rise complexes with between 12 and 24 units was there an increase. Condominium properties registered an even steeper decline over the same span—9.6 percent, to $2,569 per unit.

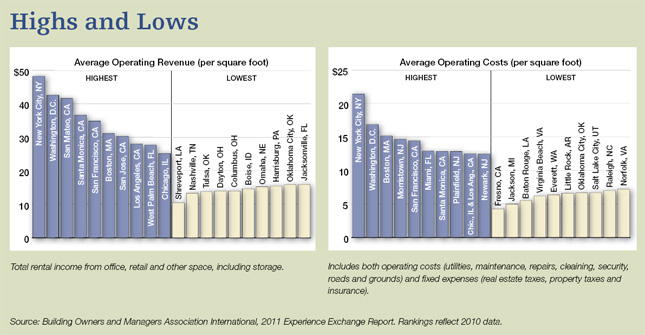

The office sector is showing a distinct split between city and suburbs. Operating costs for downtown properties edged up 0.5 percent to $10.14 per square foot. Behind the uptick was a 4.7 percent bump in taxes and a 1.4 percent increase in utility prices that offset flat or declining costs for maintenance, insurance, administration and other areas. The suburbs have told a different story. In 2010, the average cost of running office properties was 17.4 percent lower than in the nation’s Downtown markets, and operating costs dropped 4.8 percent, to $8.38 per square foot. Although such statistics reflect a wide range of geographic markets, they convey a sense of broader trends. Across all categories, operating costs were higher in regions where revenues were higher.

Given the trend among service costs, some property managers are taking a fresh look at their vendor procurement this year with an eye toward obtaining further savings through efficiencies of scale. In a climate where vendors remain hungry for work, property managers report that landscaping, maintenance and other contracted services offer continued potential for savings.

Raising the Bar

Some managers are even challenging longtime, trusted vendors to compete with one another. Western National Property Management is requesting proposals from the vendors that currently serve the company’s 24,000-unit multi-property portfolio in the West. “We’re not looking to gouge our vendor partners,” some of which have been providing services to the company for a quarter century, explained Laura Khouri, the company’s president. “We’re going to them and saying, ‘Let’s agree on a price.’ ”

Wherever possible, Western National wants to identify cost savings through economies of scale. The firm currently retains about 20 painting contractors throughout its portfolio. The proposal process could trim that number to as few as four or five, Khouri explained. Those vendors that are selected to stay on will most likely be rewarded with more lucrative new contracts.

Like vendor and utility contract renegotiations, property tax appeals are an established part of cost-containment methods. The volume and degree of those appeals varies widely, but dramatic declines in property values continue to encourage owners to challenge assessments.

A decision last summer by a state board is giving property owners in Philadelphia the chance for massive tax relief. Pennsylvania state commissioners threw out the formula used by the city, which calculates tax bills on 32 percent of an asset’s market value, and cut that baseline to 18.1 percent. Under that mandate, in January Philadelphia officials began hearing a fl ood of appeals expected to involve as many as 1,000 commercial properties. Those appeals could trim owners’ collective tax liability by as much as $80 million, which would admittedly open a deep funding gap for city schools and services. The city’s long-term proposal is to base future calculations on 100 percent of a property’s market value but cut the tax rate.

Challenging property taxes is an attractive strategy around the country, yet veterans warn that it also has a longer lead time for returns than other categories of cost-cutting. “There’s money to be had—it’s just not a quick fix,” noted Saywitz. “The problem is, you have to appeal it every year.” In early 2011, Saywitz challenged the previous year’s assessment on a property the company owns in a San Bernardino County submarket where values have dropped drastically and many properties are underwater. Saywitz expects to wait until mid-2012 for the effort to bear fruit—more than a year after filing the initialappeal. While waiting for the refund, Saywitz has already filed an appeal for 2011 property taxes.

Another cost-control strategy that deserves attention is to selectively pass along costs that are the responsibility of the tenant or the multi-family resident. Rather than automatically footing the bill for plumbing repairs at its apartment communities, for example, Saywitz now bills residents in some cases. “The sophisticated tenant will understand that they’re being billed back for something that is not unreasonable,” Saywitz said. And he warns that persistence is a must, even though pursuing these payables requires an investment of staff time: “You can’t just not bill them because it’s more effort to collect the money.”

In addition, property managers are exploring fresh opportunities to save operating costs through sustainable practices. One avenue that has potential is recycling in municipalities that offer incentives for diverting waste from landfills. Miami-based Adler Group Inc. is rolling out a pilot program in the South Florida portion of its portfolio that willaim to separate 100 percent of recyclable materials from trash, reported Van Antle, the company’s director of operations. That initiative could save 20 percent of waste-hauling costs in the company’s portfolio. The near-term savings would result from a city incentive program that reduces the company’s franchise fee. Adler hopes to implement the program more widely throughout its 6 million-square-foot portfolio, which also includes retail, industrialand office properties in Virginia, Maryland, Tennessee and Texas.

Consultants also recommend renewed attention to detail that can uncover opportunities to trim spending. “People want to look for revenues in different areas,” explained Jeffrey Strauss, managing director for FTI’s Real Estate Solutions group. “Now they’re doing that deep dive in terms of, ‘Have we left any money on the table?’ ” He suggests conducting systematic lease reviews, which determine the full extent of the tenant’s obligations and help prevent the owner from picking up costs unnecessarily. Also helpfulare software programs that track maintenance jobs so that tenants can be billed for any costs that are their responsibility under the lease, Strauss added.

Structuring leases carefully comes into play in a redevelopment that adds a new property type. Strauss cited the example of a client who is seeking additional revenue from a 500,000-square-foot suburban retail center by adding approximately 150,000 square feet of office space on a second level. The lease documents for the new space should reflect the differing formulas for allocating costs to tenants, Strauss noted.

You must be logged in to post a comment.