Will CRE Conditions Become More Challenging?

For better or worse, a survey of more than 500 NAIOP members found similar sentiments as six months earlier.

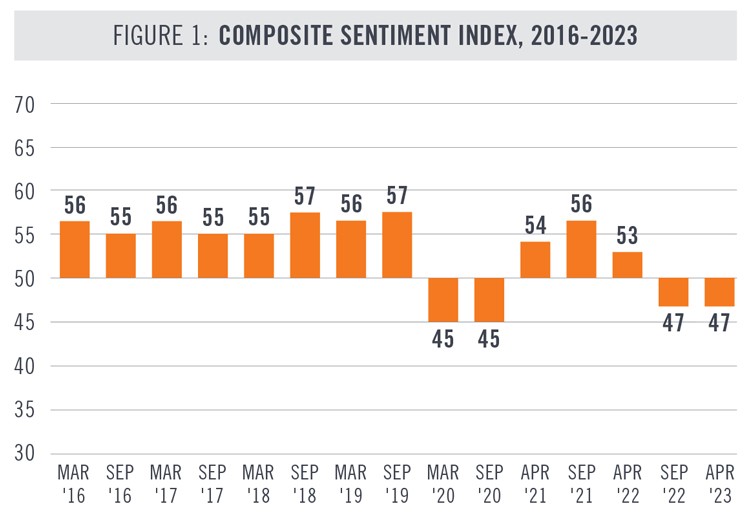

For the second time in a row, the semiannual NAIOP CRE Sentiment Index is 47, indicating a modest level of pessimism about conditions for commercial real estate over the next 12 months.

For context, this is almost as low as the Index has been since its inception in spring 2016; the Index was at 45 in both spring and fall of 2020.

The survey of NAIOP members, 523 of whom responded this time, is structured to reflect their expectations of CRE conditions over the coming 12 months. A score of 50 means no change, while scores of above and below 50 indicate favorable and unfavorable conditions are expected, respectively.

Overall, the association reports, developers and building owners “predict that economic conditions will be slightly less favorable in the markets in which they are active, suggesting a more challenging operating environment.”

READ ALSO: Today’s Most-Desired Office Amenities

Bolstering last September’s survey, respondents expect that debt and equity will be less available in the near future and that cap rates will rise.

More significantly perhaps, CRE practitioners predict a decline in occupancy rates along with a slight decline in effective rents.

Alongside that, developers and building owners generally expect to initiate fewer new projects and acquisitions over the next 12 months.

Over the next year, a slight majority of respondents, 54.3 percent, expect to be most active in projects or transactions involving industrial properties. Multifamily properties are in a rather distant second place, at 31.7 percent, followed by office (7.5 percent) and retail properties (6.5 percent).

One bright spot is construction costs, which seem to be moderating, NAIOP President & CEO Marc Selvitelli said in a prepared statement. However, members remain wary of the strength of the overall economy, Selvitelli added.

From the front lines

Two unidentified survey participants made especially cogent comments about conditions this year. One wrote that continued cap rate decompression is expected, along with a widening gap between seller and buyer expectations, and a more restrictive lending environment while CRE professionals and investors adjust to higher interest rates.

The second commented that the biggest issue is that construction costs are still elevated (though finally stable), but the cost of debt has more than doubled while rents are either flat or increased slightly. As a result, excellent deals are harder to pencil and marginal deals don’t pencil at all, as the NOI limits the amount of debt, requiring higher equity contributions.

You must be logged in to post a comment.