Will CRE Market Conditions Improve?

Find out what NAIOP members expect, according to the organization’s latest survey.

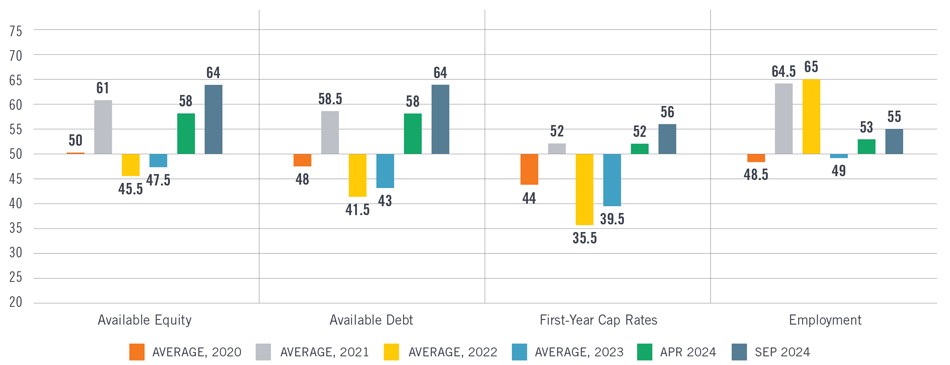

The outlook for debt availability and equity availability tied for the largest improvement among several categories in NAIOP’s CRE Sentiment Index, which measures industry expectations for commercial real estate market conditions over the next 12 months.

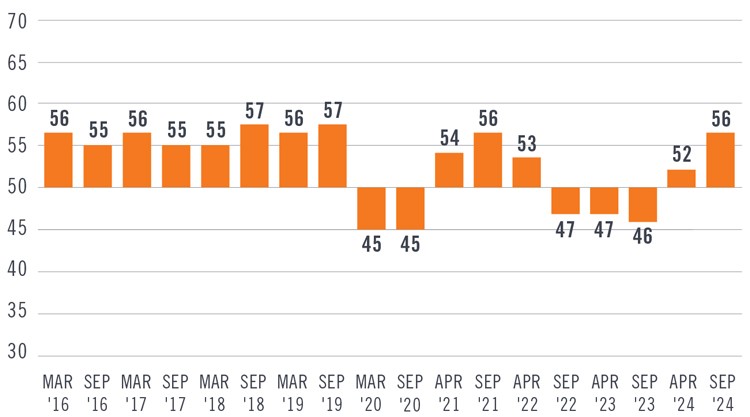

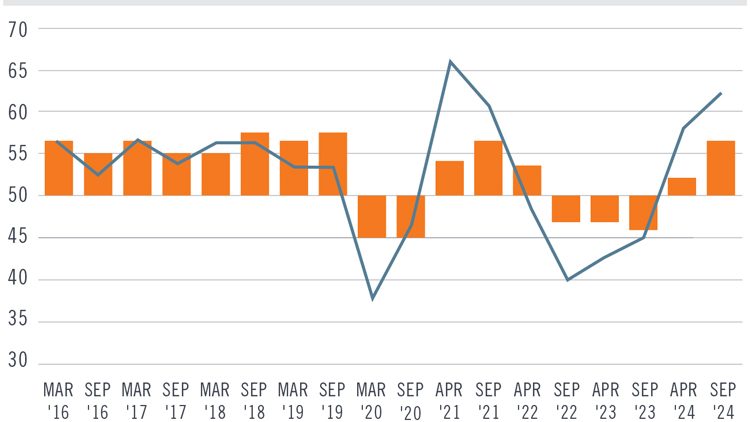

Overall, the index rose to 56 out of 100, up since the spring survey. A reading over 50 indicates favorable conditions. It’s the second consecutive index to score above 50, with the April survey reflecting an index of 52 after two years of ratings below 50.

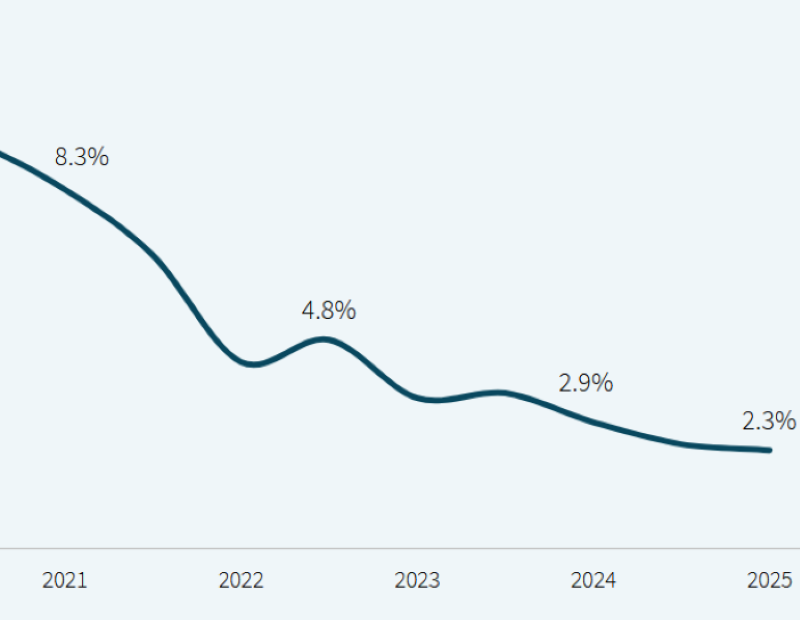

“Improving expectations related to debt and equity markets are likely driven by a consensus that interest rates will decline,” according to the NAIOP report.

A total of 496 respondents from 374 distinct companies participated. The survey respondents are NAIOP members in the U.S. who are developers, building owners, building managers, brokers, analysts, consultants, lenders and investors in commercial real estate. Out of the total number of participants, eight took the survey after the Federal Reserve announced a 50-basis-point rate cut on Sept. 18.

Among the additional key findings:

- Respondents are optimistic about all index components except for construction labor costs.

- Respondents anticipate increased demand and rising valuations in commercial real estate.

- Much of the improvement is likely driven by expectations of declining interest rates.

- Increased optimism about market conditions is prompting developers and building owners to anticipate growth in their deal volume over the coming year.

- Most respondents expect to be most active in industrial or multifamily real estate during the next 12 months.

More reasons for optimism

Industry observers, including those who did not participate in NAIOP’s survey, found those and other reasons for optimism.

Lisa Nickerson, founder & CEO of Nickerson Cos., told Commercial Property Executive that she sees “bullish investors buying at significant discounts to pre-COVID sales prices.” This puts the industry in ‘pre-season training’ for a true return-to-office ‘game time.’ “But, because you bought it cheap, will they come?”

Nickerson said tenant needs have changed, and most successful companies have adapted to employee desires and behavior changes.

“Even well-located, Class A assets can’t just dust off their pre-Covid playbook,” she said. “Tenants are driven by employee sentiment, and employees care about who you are and what you stand for more than ever.”

READ ALSO: Why Worry About Rates? We’ve Been Here Before

According to Nickerson, employees consider sustainability, technology, health and wellness, and convenience important parts of the overall work experience. “Only owners and investors with a critical eye for asset positioning, amenity offerings and thoughtful leasing strategies will win the day,” she added.

PEBB confident about the next few months

Bret Fischer, director of asset management at PEBB Enterprises, told CPE that the commercial real estate industry has experienced considerable volatility and uncertainty since the Federal Reserve started increasing interest rates in March 2022.

“As inflation has lowered, rates have steadied, employment remains strong and the U.S. economy continues to expand, PEBB is confident in the commercial real estate development conditions over the next few months,” Fischer said.

He added that while the days of 0.1 percent SOFR are gone, rates seem to have settled into a more realistic and predictable range.

“Capital Markets will still be a challenge based on product type, but the past few years have proven that tenants want to occupy Class A projects. Well-located real estate projects with diligent capital sources will continue to be successful,” Fischer anticipates.

Many loans soon to mature

Pierre Debbas, Esq., co-founder of Romer Debbas LLP, said billions of dollars of capital are on the sidelines, waiting to be deployed once rates come down and the economics make sense to acquire properties.

“We have experienced a historic decline in transaction activity, and the rebound in 2025 should be significant, assuming the Fed is actually committed to substantial rate cuts,” Debbas said.

“There is a record level of loan maturities coming up next year, and this will force many owners to sell their assets if they struggle to refinance their properties. This will add supply to the market and provide opportunities for investors waiting patiently.”

Retail sales growth needed for a ‘soft landing’

Recent growth in retail sales provides a rational basis for an overall soft landing, according to Noel Liston, managing broker, Core Industrial Realty – Chicago. He told CPE that unemployment has ticked up lately but remains within a healthy and supportive range.

“Combining these factors with the FOMC’s recent half-point September rate cut, commercial real estate, particularly industrial real estate, seems positioned to perform well in the new post-pandemic normal,” Liston said.

According to Liston, an employed and healthy consumer is key to sustaining strong occupancy levels in commercial real estate, given the overweight domestic nature of the U.S. economy. “Productivity gains relative to other competing international economies and the impact of technology are also critical factors shaping occupancy levels for commercial real estate,” he said.

Liston added that further rate cuts by the FOMC could translate into lower capital costs for consumers.

While the residential real estate market has been stuck in neutral for the past few years, a lowering of interest rates could unleash pent-up demand in the sector, and that would provide ancillary benefits to the commercial markets through increased purchasing of durable goods, increased construction activity (both new starts and remodeling) and increased employment in the sector, Liston predicts.

“While there remains uncertainty about the course of future capital costs as well as geopolitical issues and a U.S. election around the corner, many in commercial real estate can see a growth path based on the resiliency demonstrated by the U.S. consumer,” Liston commented.

Fed delivered a ‘jolt’ of positivity

“As we all expected, the commercial real estate market would respond positively to any interest rate cut by the Fed,” said Michael Romer, Esq., co-managing partner at Romer Debbas. “Although smaller than most feel is needed, the recent reduction provided a jolt of positivity in the market.”

READ ALSO: What the 2024 Presidential Election Means for CRE

According to Romer, the commercial real estate market needs rate stability, lower inflation and commercial banks to lend again. Seeds of positivity have been planted, and the commercial real estate world is hopeful of real growth in 2025, he predicts.

“However, the election remains the elephant in the room. The two candidates have significantly different economic policies. The path forward will become much clearer in just a few weeks,” Romer said.

Transaction volume is starting to increase

According to Kip Sowden, CEO of RREAF Holdings, investor confidence remains relatively cautious despite the Fed’s recent action, as much of the rate drop was already priced in several months prior.

“Transaction volume is starting to increase, though this momentum remains moderate as broader economic uncertainties persist,” Sowden said. The slight increase in investor activity can be attributed to more favorable borrowing conditions and the expectation of stabilized economic growth.

“A rate reduction typically leads to lower capital costs, which enhances the attractiveness of CRE investments. Lower interest rates contribute to cap rate compression and higher asset valuations, spurring investment activity in high-demand sectors such as multifamily and industrial,” he observed.

Capital markets have proven resilient

“Life companies continue to meet or exceed their origination goals while growing allocations with little to no delinquencies in their portfolios,” said J.D. Blashaw, vice president at MetroGroup Realty Finance.

According to Blashaw, CMBS is facing challenges due to exposure to the office market. “Still, originations through the third quarter totaled $74 billion, more than $40 billion issued in 2023, as spreads have tightened for most asset classes, signaling strong demand from bond buyers,” he observed.

Blashaw added that banks and thrifts are historically the largest originators and holders of commercial real estate loans.

“They should benefit from the recent and anticipated interest rate cuts, reducing their cost of funds and allowing for more competitive pricing,” he said. “Development should be spurred on with short-term rates declining with most construction loans tied to SOFR, which moves mostly in lockstep with the Fed funds rate.

As capital markets have proven resilient in 2024 to the headwinds and uncertainties in the economy, Blashaw anticipates continued positive momentum heading into 2025.

Skilled labor remains a concern

Brian Gallagher, vice president, Corporate Development, Graycor, told CPE that higher interest rates remain a significant headwind.

“Developers will likely continue to face scrutiny from investors, which could slow some projects,” he said. “While we’ve seen some stabilization in construction costs, the availability of skilled labor remains a concern, particularly in specialized trades. Overall, commercial real estate fundamentals remain strong in some sectors where demand continues to outpace supply.”

Optimism increasing in ‘Wall Street South’

Jake Geleerd, co-founder & CEO of Tortoise Properties told CPE that sentiment for 2025 is more optimistic than earlier this year.

“We’re still seeing positive trends in job growth, construction costs and new development starts,” Geleerd said. “In South Florida, especially Palm Beach County, we anticipate continued double-digit job growth, driven by ongoing migration from the Northeast, solidifying us as ‘Wall Street South.’”

“Additionally, the substantial wealth transfer to South Florida, particularly Palm Beach County, is fueling the rise of ‘Silicon Valley South,’ attracting tech companies and a high-tech workforce.” He added that a key focus for 2025 will be the return to the office.

“Major employers like Amazon, JP Morgan Chase and Goldman Sachs require employees to return,” Geleerd mentioned. “Senior partners in law firms and private equity firms are urging junior colleagues back to stay involved in deals or risk losing opportunities, signaling a shift toward re-establishing in-office collaboration.”

Geleerd observed that favorable municipal financing and tax incentives, especially for affordable housing, support much of the new development activity.

“I expect this trend to continue into 2025,” he said. “However, construction costs may flatten or decrease slightly as development slows from the post-pandemic boom. While growth continues, it’s slower than in 2022-2023, leading to more competitive bidding and lower costs.”

Uptick in return-to-office trend

Brian Haines, chief strategy officer for FM:Systems, said that many organizations are successfully implementing return-to-office policies, and interest rates are starting to ease, so it’s no surprise that optimism is growing.

“We’re hearing the same from our client partners, both those who have returned to full-time office models and those with hybrid arrangements,” Haines said. “After years of pandemic-driven uncertainty, we’re finally approaching a new sense of normalcy. However, with commercial real estate being the second-largest expense for most employers, real estate decisions aren’t made on anecdotes or gut feelings alone.”

READ ALSO: Here’s a Surprising Shift in Remote Work’s Appeal

According to Haines, organizations using workplace management solutions to gather data over the past few years are better equipped to align their real estate strategies with how their people use—and plan to use—their spaces, as this positions them well for making more informed real estate choices, whether optimizing existing spaces or expanding their real estate footprint.

You must be logged in to post a comment.