Will Financing Flow More Freely Now? The CPE 100 Weigh In

Industry leaders share insights on the capital markets outlook and other key issues in the year’s first Sentiment Survey.

Capital for commercial real estate borrowers will be plentiful in 2021, but many of the challenges to securing it that emerged last year will remain in place.

Capital for commercial real estate borrowers will be plentiful in 2021, but many of the challenges to securing it that emerged last year will remain in place.

That is a key expectation of the CPE 100 an invited group of commercial real estate leaders. Conducted in early February, the most recent Quarterly Sentiment Survey addresses a variety of capital markets issues, along with general industry conditions.

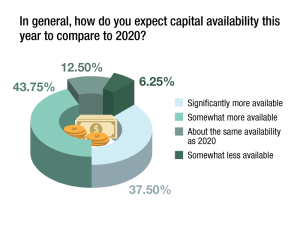

Reflecting a growing spirit of optimism about prospects for the year, the CPE 100 appear to see the stifling effects of the pandemic beginning to lift from the capital markets. An overwhelming majority of survey participants—81 percent—predict that capital will be much more or somewhat more available this year than it was in 2020. Only 6 percent feel that capital will be less available to the industry.

READ ALSO: CBRE Reports Q4 CRE Lending Surge

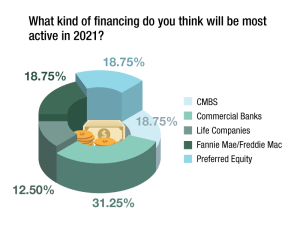

A consensus about debt providers is notably harder to come by. No single category emerged as the clear favorite. Only one category, commercial banks, was named by as many as one third of respondents as the likely most active source of capital this year. The remaining results were scattered among life companies, CMBS, preferred equity, Fannie Mae and Freddie Mac. While hopes for bank lending may be relatively high, the results suggest that a diversified slate of lenders is expected to provide capital.

A consensus about debt providers is notably harder to come by. No single category emerged as the clear favorite. Only one category, commercial banks, was named by as many as one third of respondents as the likely most active source of capital this year. The remaining results were scattered among life companies, CMBS, preferred equity, Fannie Mae and Freddie Mac. While hopes for bank lending may be relatively high, the results suggest that a diversified slate of lenders is expected to provide capital.

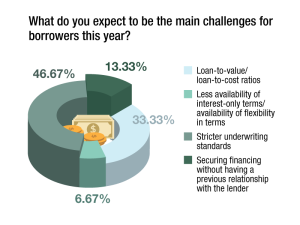

Nevertheless, the CPE 100 see more hurdles to securing debt than they might have only a year ago. Underwriting, which emerged as an issue last year amid lender pullbacks, continues to be the top concern; 47 percent of respondents, more than for any other category, cited the higher standards as a hurdle. Higher hurdles of a different kind also factored into the CPE 100’s responses. The second-highest share of survey participants, about one third, named loan-to-value and loan-to-cost ratios as the key challenge.

Nevertheless, the CPE 100 see more hurdles to securing debt than they might have only a year ago. Underwriting, which emerged as an issue last year amid lender pullbacks, continues to be the top concern; 47 percent of respondents, more than for any other category, cited the higher standards as a hurdle. Higher hurdles of a different kind also factored into the CPE 100’s responses. The second-highest share of survey participants, about one third, named loan-to-value and loan-to-cost ratios as the key challenge.

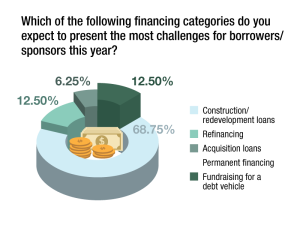

In another sign of the times, current conditions also make the availability of debt for construction and redevelopment a worry. More than two-thirds of respondents—69 percent—expect that to be the most challenging category this year. That was more than the combined total for refinancing, permanent financing and raising capital for a debt vehicle. The result reflects the uncertainty about demand for new product, particularly retail, office and hotel properties.

In another sign of the times, current conditions also make the availability of debt for construction and redevelopment a worry. More than two-thirds of respondents—69 percent—expect that to be the most challenging category this year. That was more than the combined total for refinancing, permanent financing and raising capital for a debt vehicle. The result reflects the uncertainty about demand for new product, particularly retail, office and hotel properties.

When it comes to the broader outlook for the industry’s performance, the recent decline in the COVID-19 infection rate, and the deployment of vaccines, may be contributing to a marked uptick in confidence. Last July, 63 percent of the CPE 100 predicted that the economy would be much better or somewhat better in six months. In the most recent survey, that number has risen to 88 percent.

When it comes to the broader outlook for the industry’s performance, the recent decline in the COVID-19 infection rate, and the deployment of vaccines, may be contributing to a marked uptick in confidence. Last July, 63 percent of the CPE 100 predicted that the economy would be much better or somewhat better in six months. In the most recent survey, that number has risen to 88 percent.

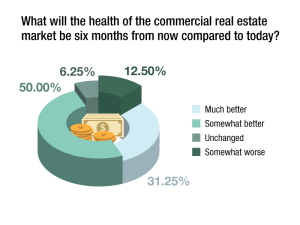

Also on the rise are expectations for the health of the commercial real estate sector and company performance. In the most recent survey, 81 percent of respondents said that they expect the industry to be in better shape six months from now. That result is a marked contrast from last summer, when only six out of ten survey participants responded affirmatively, and 25 percent said they expected the industry to be less healthy.

Also on the rise are expectations for the health of the commercial real estate sector and company performance. In the most recent survey, 81 percent of respondents said that they expect the industry to be in better shape six months from now. That result is a marked contrast from last summer, when only six out of ten survey participants responded affirmatively, and 25 percent said they expected the industry to be less healthy.

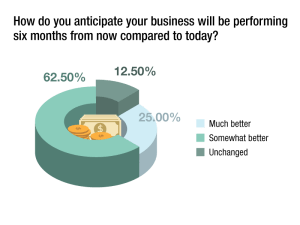

The CPE 100 are also more confident about their own businesses than they were last year. Since the midyear 2020 survey, the share of respondents who believe that their companies will be doing better in six months has jumped 20 points, to 88 percent.

The CPE 100 are also more confident about their own businesses than they were last year. Since the midyear 2020 survey, the share of respondents who believe that their companies will be doing better in six months has jumped 20 points, to 88 percent.

You must be logged in to post a comment.