World’s Biggest Banks’ Uneven Ways in Project Financing

Between 2016 and 2018, 33 large U.S. and European banks provided more than $1.9 trillion to fossil fuel companies. Yet at least two leading lenders will stop funding such projects after 2019.

The board of the European Investment Bank has agreed upon a new energy lending policy which will align all financing activities with the goals of the Paris Agreement. The policy will start taking effect at the end of 2020 and will no longer consider new financing for unabated, fossil fuel energy projects, including gas, from the end of 2021 onward.

The decision, which marks one of the boldest measures taken against fossil fuels by a development bank to date, will strengthen the EU Bank’s support for clean energy. It might also put pressure on other financial institutions to follow suit. EIB’s new policy comprises five principles:

- Making energy efficiency a priority, which will support the new EU target under the EU Energy Efficiency Directive. The EU countries will have to achieve new energy savings of 0.8 percent each year of final energy consumption for the 2021-2030 period.

- Favoring energy decarbonization by increasing support for low- or zero-carbon technology. The goal is to meet a 32 percent renewable energy share throughout the EU by 2030.

- Increasing financing for decentralized energy production, innovative energy storage and e-mobility.

- Investing in grid development, essential for new, intermittent energy sources such as wind and solar, as well as updating and strengthening cross-border interconnections.

- Boosting the impact of investment to support energy transformation outside the EU.

The deadline set for 2021 allows enough time for projects underway to be completed. Moreover, money previously used on fossil fuel projects will be directed to promoting clean energy innovation, energy efficiency and renewables.

Since 2012, the European Investment Bank has provided 150 billion euros (approximately $164 billion) of finance supporting 550 billion euros (more than $605 billion) of investment in projects that reduce emissions and help countries adapt to climate change. The EIB has provided more than 65 billion euros (nearly $72 billion) of financing for renewable energy, energy efficiency and energy distribution over the last five years.

However, EIB is not the first large financial institution to commit to such a measure. Back in 2017, Word Bank Group announced at One Planet Summit in Paris that it would end its financial support for oil and gas exploration and extraction after 2019, in response to the growing threat posed by climate change.

The bigger picture

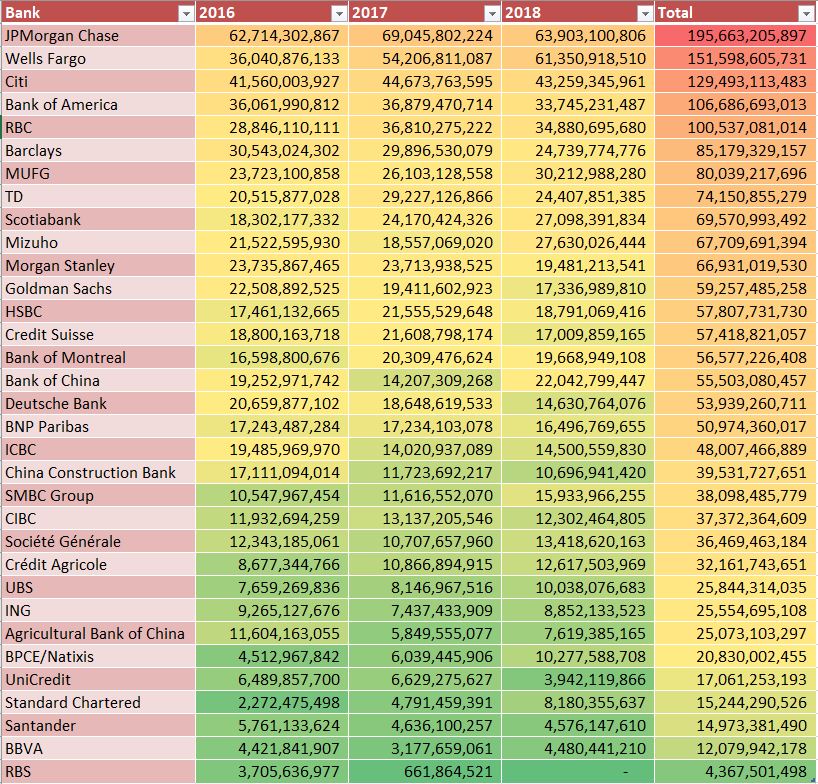

On the other hand, the Banking of Climate Change 2019 report found that between 2016 and 2018, 33 global banks financed more than $1.9 trillion to fossil fuel companies and increased total yearly funding to $654.1 billion in 2018, up from $611.9 billion in 2016. Moreover, the report shows that of the $1.9 billion total, $600 billion went to 100 companies that are most aggressively expanding fossil fuels projects.

The report was created with data from Bloomberg, energy research consultancy company Rystad Energy and Urgewald, a German environmental NGO. The sponsors of the report—BankTrack, Honor the Earth, Indigenous Environmental Network, Oil Change International, Rainforest Action Network and Sierra Club—advocate for the complete elimination of funding for such projects.

The study ranked U.S. banks as the largest lenders to fossil fuel projects, with JPMorgan Chase & Co. and Wells Fargo & Co. providing nearly $196 billion and nearly $152 billion, respectively, between 2016 and 2018. Citibank and Bank of America occupied the third and fourth positions. U.S. banks have also announced measures to tackle climate change—JPMorgan Chase has committed to $200 billion in clean energy financing through 2025, while Wells Fargo is planning to provide the same amount in financing sustainable businesses and projects by 2030.

Of all European banks, Barclays ranked sixth in the report, HSBC Holdings came 13th, followed by Credit Suisse Group on the 14th place, Deutsche Bank on the 17th position and BNP Paribas on the 18th spot.

There are also financial services entities that took a stand in combating global climate change. One such entity is French corporate and investment bank Natixis, which implemented the Green Weighting Factor, a mechanism that allocates capital to financing deals based on their climate impact. Specifically, the analytical risk-weighted assets are reduced by up to 50 percent for green deals, while facilities that have a negative environmental and climate impact see their analytical RWA increased by up to 24 percent.

Video courtesy of European Investment Bank

You must be logged in to post a comment.