Yardi Matrix: Charlotte, A Hotspot for Deals

Charlotte’s multifamily market is thriving as a result of healthy demand, which has produced above-trend increases in rents and accelerated transaction volume and values.

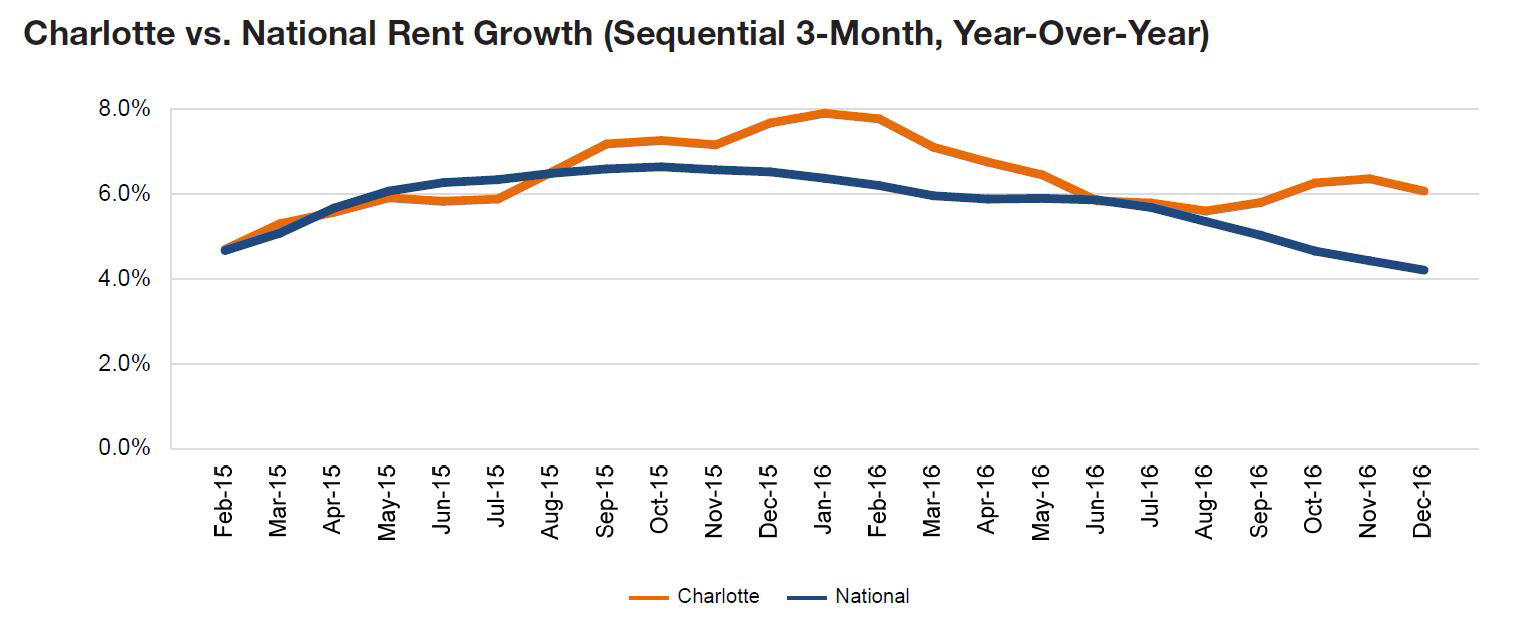

Charlotte rent evolution, click to enlarge

Charlotte’s multifamily market is thriving as a result of healthy demand, which has produced above-trend increases in rents and accelerated transaction volume and values. Though the outlook points to continued gains in employment and population, the outpouring of new supply and issues with affordability could prompt a slowdown in rent growth.

Charlotte’s strategic location within the Piedmont-Atlantic Megaregion helps fuel the metro’s economy, with employment led by transportation and distribution. The city is also known for its banking industry, though tech startups have begun making inroads. Young workers are attracted to the live-work-play environment, as evidenced by the amount of new supply concentrated in the Uptown submarket. The cranes stretch beyond Uptown, as Charlotte Douglas International Airport undergoes a $2.5 billion expansion.

A low cost of living has bolstered population growth, but most of the upcoming supply is aimed at high-end renters and buyers. Affordability is starting to become a problem, though rents rest below the national average at $918. Signs of decelerating rent growth align with national trends. Due to robust investor demand, transaction activity reached $1.7 billion in 2016, a new high in the current cycle, while prices also hit highs for the current cycle.

Read the full Yardi Matrix report.

You must be logged in to post a comment.