Yardi Matrix: Fever Pitch—Atlanta Demand Heats Up

Atlanta’s multifamily market benefits from a diversified economy, a healthy development pipeline and high investor demand.

By Robert Demeter

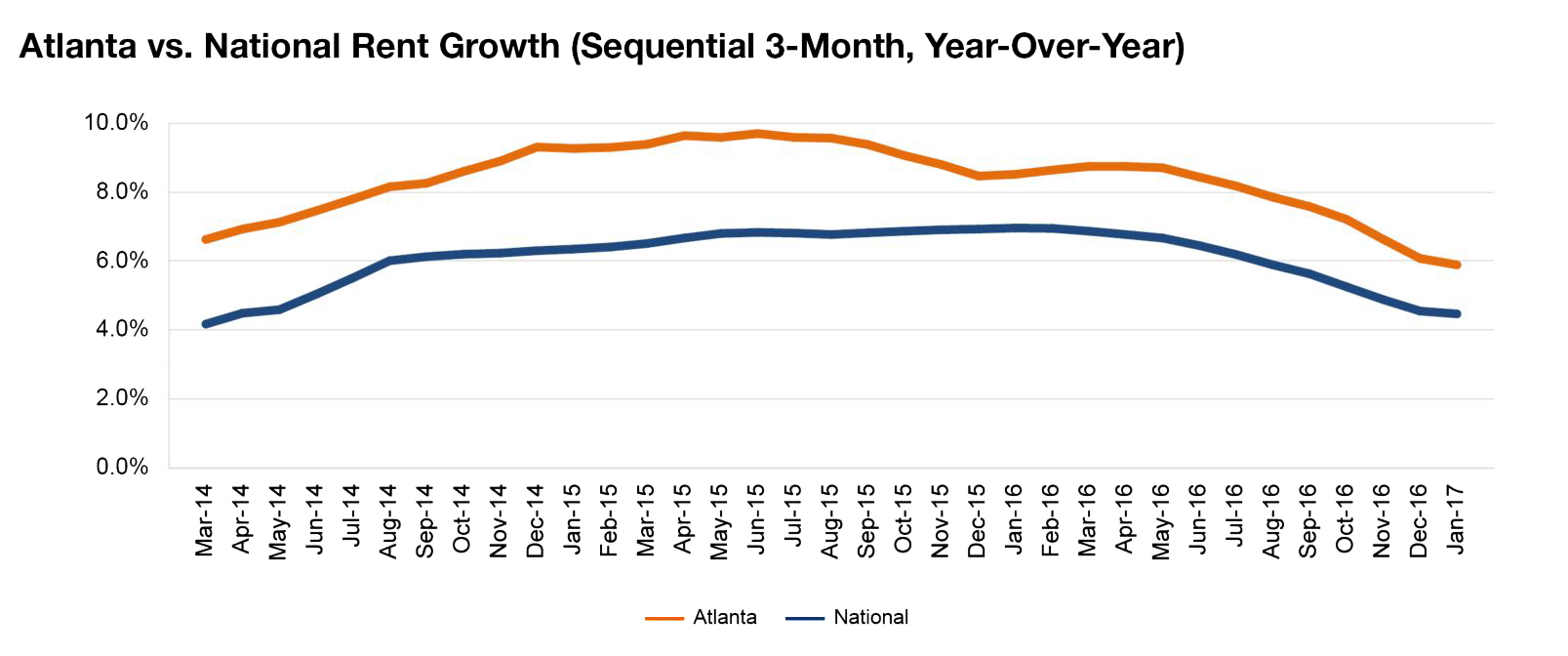

Atlanta rent evolution, click to enlarge

Atlanta’s multifamily market benefits from a diversified economy, a healthy development pipeline and high investor demand. The population is growing, due to an influx of young professionals drawn to the 18-hour lifestyle. Strong rent gains and increased demand for housing have created concerns about affordability, congestion and overdevelopment.

Atlanta’s favorable tax structure and business relocation costs attract jobs in fields such as health care, media, technology, tourism and film. Traffic congestion has become a major issue, although a recent legislation change will provide an increased and steady source of state funding for a range of transportation improvements, including Georgia’s $10 billion roads bill. Infrastructure improvements will play a role in growth going forward.

In order to meet demand, the metro has one of the most active development pipelines in the country, with more than 60,000 units. Most of the upcoming supply is geared toward the high-end part of the spectrum, while demand is strong for both affordable and market-rate units. Rental rates hit a record high of $1,137, trailing the national average, and occupancy rates for stabilized properties are steady at 95 percent. We expect rent growth to maintain its healthy level: 8.3 percent in 2017.

Read the full Yardi Matrix report.

You must be logged in to post a comment.