You Bought an Office Building. Now What?

Today's investors are both opportunistic and optimistic when you consider the sector's challenges.

The past several months have witnessed a surge in office building sales, with investors mostly snapping up distressed assets, often at or near the value of the land they occupy. Much of the office product trading at deep discounts consists of lower-tier and substantially vacant buildings. But there also are some institutional-grade assets in desirable locations changing hands at lower-than-expected prices.

Everybody loves a bargain, but in a property type where there is excess supply and uncertainty about future demand, what are investors going to do with these buildings? Experts contend there is ample opportunity for the properties, but when it comes to strategies, one size does not fit all.

READ ALSO: Investors Find Bargains

Distressed office properties were a key driver of building sales in the first half of the year. In Manhattan, for example, where H1 office sales totaled $1.3 billion—up 30 percent from H1 2023, according to a report from Ariel Property Advisors—the activity included 18 “forced sales” by Class B and C office building owners facing mortgage maturities. Some transactions were deeds in lieu of foreclosure.

These included 1740 Broadway, a mostly vacant office building that Yellowstone purchased from Blackstone for $185 million in a deed in lieu with a special servicer, noted Shimon Shkury, president & founder of Ariel Property Advisors. The property, which sold for $300 per square foot (a 69 percent discount from its previous sale in 2014), is reportedly destined for residential conversion.

What’s driving office sales

“Most investors feel the office sector has hit (its) nadir, or very close to it,” said Mike McDonald, co-lead for JLL Capital Markets’ office group, “and now is the time to deploy capital into the sector in order to get outsize alpha returns. The market is at the intersection of FOMO—fear of missing out—and FOMAM—fear of making a mistake—but we are seeing more investors on the FOMO expressway, especially compared to this time last year.”

For McDonald’s group, the office sector “sentiment pendulum” has swung too far negative. There exists a “plethora of opportunities” to invest capital wisely into the sector, McDonald said, and there are approximately 18 months of “true arbitrage” before a strong wave of institutional capital returns to the sector.

Investors appear confident that the office market will eventually recover, and many leasing brokers agree. “We believe that tenant contractions planned during the recent post-COVID years were overdone,” said David Camins, principal at Xroads Real Estate Advisors. He expects to see an uptick in demand as tenants that downsized correct and recover space they gave up, especially in financial services, law and tech.

Lenders are also generally willing to finance acquisition of distressed buildings they are selling, according to Daniel Littman, senior manager of research at JLL Research. “We are seeing examples of existing lenders (sellers) on assets offering below-market-rate financing to the new equity/buyer,” he said.

If the building has a value-add/opportunistic profile, Littman said, the lender often will fund future leasing costs if they believe in the sponsor and the business plan. “This is a part of the sector that is accelerating, and we expect both seller financing and existing lender financing to be a major thesis for the balance of 2024 and all of 2025,” he said.

When seller financing is offered, more bidders come to the table, and there is some improvement in the ultimate pricing, noted Revathi Greenwood, head of real estate optimization for the Americas at Cushman & Wakefield. But if the transaction is under $50 million, there are all-cash buyers in play who often win the bid, she said.

“Most of the buyers in the market are high-net-worth individuals, although some institutional interest has been coming back in the past couple of months,” Greenwood said.

Recycling office buildings

Opportunities for office investors who acquire these properties include upgrading the A- and B+ buildings to A and A+ status or converting to other uses. Alternative uses could be residential, hospitality, medical/biomedical lab space, medical office, data centers and warehouses. What is possible, experts say, depends primarily on specific office market demand and dynamics, submarket location, building design, structure and infrastructure, construction costs, surrounding amenities and government incentives.

In Manhattan’s competitive office market, where employers are now mandating at least some office time for their workers, opportunistic, value-add office investors are buying into Class A, A- and B+ assets because there is tenant demand for all three levels of office space. Class A rents command north of $100 per square foot, and A- and B+ assets rent for $60 to $90 per square foot.

Those building classes will continue serving office users but are likely to be upgraded, with hotel-like amenities in common areas and modern infrastructure to improve Wi-Fi accessibility, cell phone reception and digital building access.

In Chicago, Camins’ company upgraded the lobby experiences and infrastructure at some of the assets it manages, including 540 W. Madison, 300 S. Riverside and 161 N. Clark. Improvements include dynamic lobbies with agile seating arrangements and art exhibits that are updated and rearranged with the changing seasons. Infrastructure has been upgraded to improve Wi-Fi and cell phone reception, and propriety software was leveraged to provide tenants with digital building access controls using their cell phones without data collection by the technology providers.

San Francisco has also experienced a flurry of transactions, typically in the $200 to $300 per-square-foot range—close to land value—over the last 12 months, an indication that the market is at bottom, said Littman, citing 60 Spear St. as a recent example of a distressed office building being upgraded with best-in-class amenities to attract tenants.

“The leasing market remains highly bifurcated by product quality and location,” Littman said. “While overall market vacancy and rents remain weak by historic standards in the majority of markets we track, the top-quality product and good-quality product in top micro-locations continues to outperform and attract tenants.”

READ ALSO: What Makes a Distressed Office Property a Good Investment?

He cited the Grand Central submarket in Manhattan as a prime example of a supply-constrained micro-market but noted that markets nationwide are experiencing this dynamic. Other examples can be found in Chicago (Fulton Market versus the Central Loop), Dallas (Uptown versus the CBD) and Boston (East Cambridge versus the downtown market).

Manhattan office owners have invested millions of dollars to modernize building infrastructure and appearance and create high-quality amenities in common areas that benefit occupants and often appeal to the general public, like restaurants with celebrity chefs that generate business seven days a week.

Office building investments in markets where high-quality tenants are moving to new or highly renovated office projects with an array of amenities are obviously less risky, observed Brett Shannon, a senior vice president in CBRE’s New York City agency group focused on landlord representation. Success, however, comes at the expense of another building.

In Manhattan, where there is ongoing “flight to quality,” this approach has proved successful because newly built projects, like Hudson Yards, are fully leased and high construction costs and interest rates have brought ground-up office development to a standstill, Shannon noted.

From an occupier standpoint, David Smith, head of Americas insights at Cushman & Wakefield, noted that most companies are more focused on optimizing employee productivity and experience than in-office attendance, and are creating purpose-built office space that provides amenities employees want and spaces that spark inspiration, energize employees and foster a sense of belonging.

He noted that high-quality office space matters more than ever, as well as the location’s ease of commute and access to transportation options. “There is a higher focus on employee experience,” Smith remarked. “The office and its surrounding neighborhoods should be a place where employees want to be since it is hard for it to be a place they have to be. Given the new-construction pipeline is waning significantly, space that is renovated over the next few years will be at an advantage relative to the broader market.”

The case for conversion

Today’s office investor may have conversion in mind, but discounted pricing alone is often not enough to make these projects pencil. Conversions typically work best in urban markets, where there is a severe shortage of rental housing and not a lot of available land for new development, said Littman. Further, he noted, residential product created from office buildings is often inferior to purpose-built product and will not achieve the same level of rents. Finally, conversions require additional municipal, state or federal tax incentives to make the numbers work, Littman said.

Other issues come into play that drive up costs. For example, in California, seismic retrofit costs must be taken into account. Other factors influencing a project’s financial viability are the building’s structure, government incentives offered, transaction transfer costs and construction fees.

“Repurposing office buildings to residential requires a lot of stars to be aligned,” said Shkury, noting that the most important characteristics for developers are location, zoning, building structure, light, air and a path to vacancy. He also noted that, while investors are getting great deals on office buildings, the purchase price must be about $300 per square foot but never more than $400 per square foot to make the project feasible.

In markets with severe housing shortages, local and state governments are providing tax incentives to encourage housing conversions. New York state’s newly adopted Affordable Neighborhoods for New Yorkers tax abatement program known as 485X provides a real property tax exemption for construction of new affordable housing projects with at least six units, including conversions. In addition, New York City’s “City of Yes” program calls for updating zoning to make it easier for developers to create affordable, sustainable housing projects.

READ ALSO: How Incentives Boost Conversions

According to Ariel Property Advisors, 25 percent of development sales citywide are slated for conversion, with the Pfizer Building at 210-235 E. 42nd St. the most prominent transaction for that purpose. The renovated property will provide 1,500 units.

California also has passed new laws to encourage conversion of office buildings to housing. AB 3068 will fast-track permits to convert vacant office spaces into apartments, and AB 529 streamlines office-to-residential conversions by modernizing the state’s building codes. In addition, the state has established a $400 million fund that provides developer grants of about $105 million to offset the cost of office-to-housing projects. And some California cities, including Long Beach and Los Angeles, already have established adaptive-reuse ordinances that have created thousands of affordable housing units over the past couple of years.

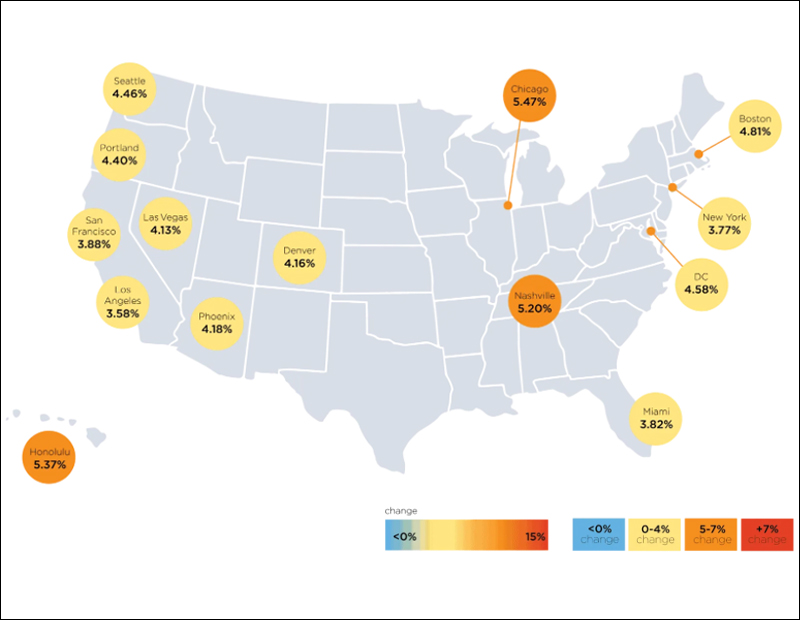

Washington state also passed a law to eliminate sales and use taxes for projects that convert existing structures to affordable housing. And other cities—such as Boston, San Francisco, Denver and Chicago—provide tax breaks for developers doing office-to-housing conversions, while still others, such as San Diego, Calif., and Seattle, offer incentives for conversions to housing, including zoning exclusions, increased FAR and fast-tracked permitting, as well as eliminated or reduced permit fees for creating affordable housing.

At the federal level, the White House has published a Commercial to Residential Conversions Guidebook that lists federal programs, loans, grants, guarantees and tax incentives available to support the conversions.

But while cities would like to see all obsolete office buildings converted to residential use, it is a difficult proposition for most properties. “The percentage of obsolete office stock suitable for conversion to residential or hospitality varies widely depending on location, demand in the market and other factors,” said Asif Virani, managing director and project development services city leader for the Washington, D.C., and Virginia region at Cushman & Wakefield. “Estimates vary, but our experience and research suggest that between 10 and 15 percent of the obsolete stock may be suitable for conversions.”

You must be logged in to post a comment.